Investment grade corporate bond returns – where's the pain been?

Conventional wisdom says that corporate bonds have performed terribly since the credit crunch broke in July 2007. Yes, BBB rated corporate bond spreads are now wider than they were in the Great Depression, but you may be surprised to know that thanks to falling government bond yields, the average industrial investment grade corporate bond has actually generated a positive total return over the past year and a half (‘industrials’ basically means anything that’s not a financial or utility – about a third of the euro investment grade market and a quarter of the sterling investment grade market).

The pain has been in the subordinated financials. We’ve been banging on about subordinated bank bonds for a while now – see Ben’s warning on the eve of the meltdown in September here, Richard’s comment at the beginning of October here, and most recently Jim’s comment on Wednesday re Deutsche Bank here.

I thought it would be worth updating the chart Ben first used, which demonstrate the massive disparity of returns in the investment grade universe. These two charts show just how spectacular the bank bond blow up has been (data as at end of yesterday, so includes the market’s reaction to Deutsche Bank not calling its LT2 bonds this week). The first chart shows the euro investment grade returns, breaking it down into industrials, Lower Tier 2 bank bonds (the most senior of the subordinated bank bonds), Upper Tier 2 (the next most subordinated) and Tier 1 bank bonds (super subordinated bank bonds). While industrials are up 0.3% since the beginning of July 2007, € Tier 1 (T1) bank bonds are down almost 40%.

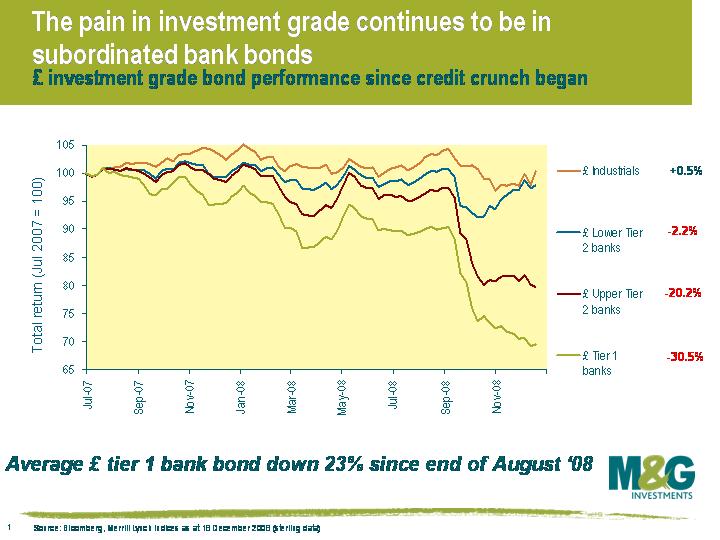

As this chart shows, it’s a similar story in the £ market. Industrials are up +0.5%, with T1 bank bonds down just over 30%. The reason that T1 bank bonds have behaved more like equities than bonds is because they ARE more like equities than bonds, usually ranking level with preference shares. A bank can stop paying coupons on T1 whenever it wants (although it can’t then pay dividends to equity holders) and that’s not an event of default – you have no rights to the company’s assets. In fact, although every bond varies, some banks aren’t allowed to pay coupons on T1 if they don’t make certain capital ratios. We have very little of this stuff, and we’d hate to be trying to sell it right now. Liquidity in T1 is poor – looking at a broker run from this morning, the bid-offer spread on Barclays € T1 is 33-37, which is an 11% spread – as a comparison, you’re looking at 92.3-93.5 on a France Telecom € 2015 bond right now, ie a 1.3% spread.

As this chart shows, it’s a similar story in the £ market. Industrials are up +0.5%, with T1 bank bonds down just over 30%. The reason that T1 bank bonds have behaved more like equities than bonds is because they ARE more like equities than bonds, usually ranking level with preference shares. A bank can stop paying coupons on T1 whenever it wants (although it can’t then pay dividends to equity holders) and that’s not an event of default – you have no rights to the company’s assets. In fact, although every bond varies, some banks aren’t allowed to pay coupons on T1 if they don’t make certain capital ratios. We have very little of this stuff, and we’d hate to be trying to sell it right now. Liquidity in T1 is poor – looking at a broker run from this morning, the bid-offer spread on Barclays € T1 is 33-37, which is an 11% spread – as a comparison, you’re looking at 92.3-93.5 on a France Telecom € 2015 bond right now, ie a 1.3% spread.

Finally, a reminder – it’s the last day to enter our XMAS quiz, where we have £175 worth of Amazon vouchers to give away.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox