UK deflation update

Most of the press coverage of the Bank of England’s inflation report centred around Mervyn King’s comments that the UK was in a ‘deep recession’. That’s hardly controversial any more – for me, more interesting was the fan chart depicting the Monetary Policy Committee’s best collective judgement of where inflation is heading in the next three years.

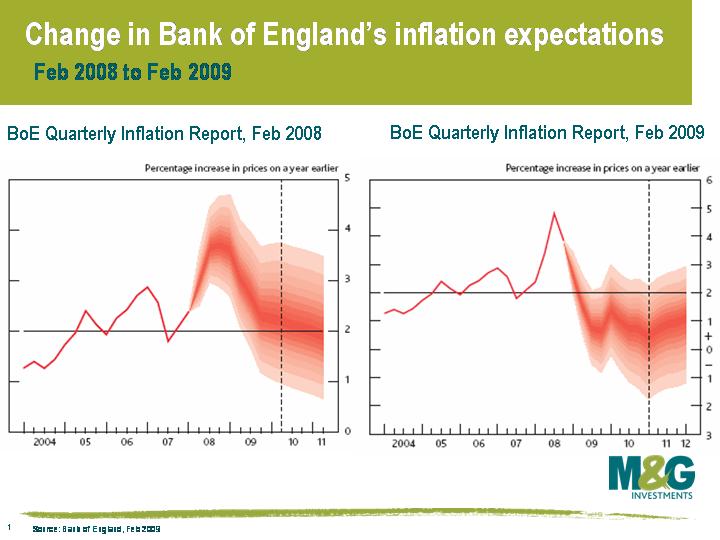

The attached chart shows how the BoE’s inflation expectations have changed from a year ago. Inflation expectations are displayed as a fan, where the MPC has 90% confidence that inflation will fall within the band. In February 2008, its central forecasts were for UK inflation to remain slightly above 2% target two years later, given the market’s interest rate expectations at the time (which was for UK interest rates to fall to about 4.5%). The MPC believed that there was a 5-10% chance that UK inflation would fall below its 1% lower limit by 2010.

Since the summer, the BoE has been steadily adjusting its inflation expectations downwards. While its core scenario is still for CPI inflation to remain above zero, it estimates that there is about a 1 in 5 chance of deflation in the UK – not just this year, but at the end of 2011. And this is taking the market’s current interest rate expectations, which are for UK rates to stay close to 1% for the next three years.

The MPC’s models have come in for some criticism lately, from three former MPC members no less (see here), but when the guys who actually set interest rates think there’s a very real risk of entrenched deflation (which is something that we’ve been arguing for over a year on this blog), you ‘d be foolish not to take note.

The MPC’s models have come in for some criticism lately, from three former MPC members no less (see here), but when the guys who actually set interest rates think there’s a very real risk of entrenched deflation (which is something that we’ve been arguing for over a year on this blog), you ‘d be foolish not to take note.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox