US in deflation for first time since 1955

Some interesting numbers came out of the US yesterday. US CPI was -0.1% in March, below expectations of +0.1%. This means that US CPI was -0.4% versus a year earlier, the first time there’s been a negative reading in over 50 years (see chart).

(It’s important to stress that I’m quoting the broad measure of CPI, which is including food and energy costs – the Federal Reserve, unlike the ECB and Bank of England, prefers to strip out the effects of food and energy from its inflation numbers. ‘Core CPI’ was +1.8% in the year to March. See an old blog from Richard here on whether central banks are targeting the correct inflation measures).

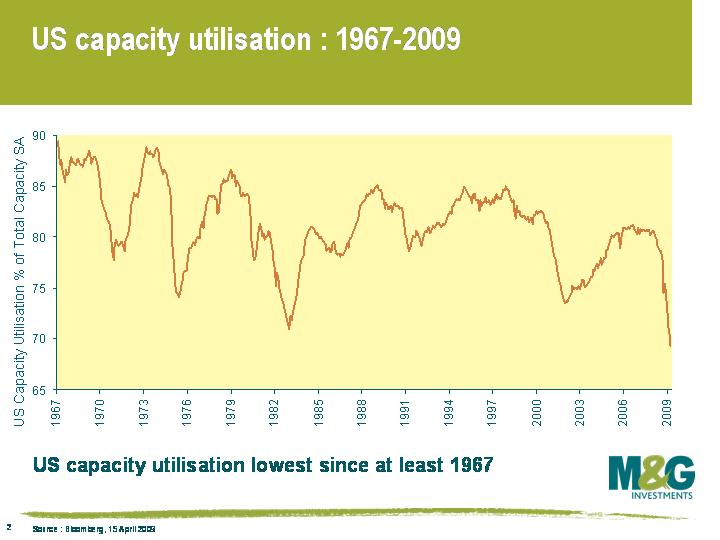

To understand why CPI has turned negative, and to understand why we think it’s likely that a number of other countries will experience deflation in the next few months, you need look no further than the ‘capacity utilisation rate’ for US, which was also released yesterday. A capacity utilisation rate of 69.3% for the end of March is the lowest figure recorded since the data series began in 1967 (see chart). See here for a comment that Jim wrote on relationship between the output gap and inflation.

So we now have US CPI negative on a year on year basis. In the UK, RPI is now zero year on year and likely to turn negative soon (although CPI is still at +3.2%). Spain, Portugal, Ireland, Switzerland, Japan, Thailand and Taiwan are already in deflation, while German and French inflation is only slightly above zero (the inflation rate for the Eurozone as a whole to the end of March was +1.2%).

The thing that all investors are trying to figure out is whether deflation proves temporary and relatively painless, or whether it develops into a deflationary debt spiral of death whereby investors delay making purchases as they can buy the same goods at a cheaper price in the future. Such behaviour would serve to exacerbate this already severe economic downturn.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox