What effect will the surge of government bond issuance have on government bond returns?

This is a question that numerous clients and members of the press have asked us so I thought it would be worth writing a brief comment here.

Focusing on the UK, in yesterday’s budget, chancellor Alistair Darling said that gross gilt issuance will be £220bn this financial year, which is easily a record. There is much speculation as to whether the market is able to digest this much issuance. If there is a lack of demand, or ‘indigestion’, then prices will have to fall and yields to rise until appetite for gilts returns.

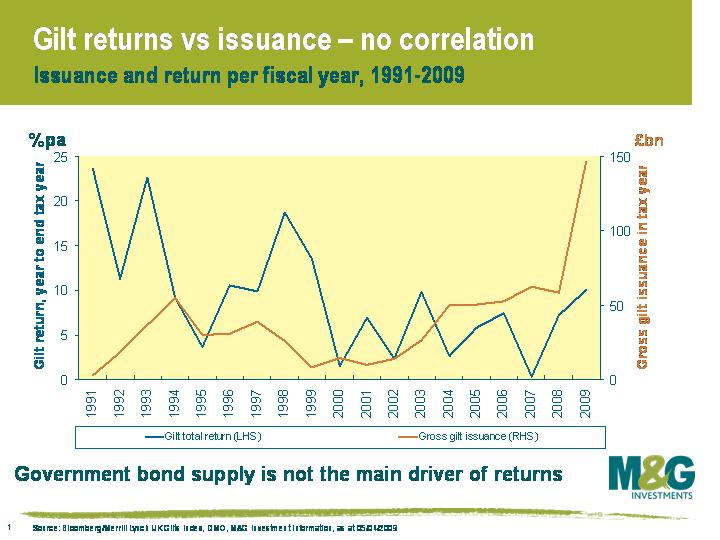

The chart shows the relationship between gross gilt issuance in each fiscal year since 1991 against the total return from gilts in that period. There is no relationship. It’s also a similar story if you measure gilt issuance as a percentage of GDP, or look at net gilt issuance rather than gross gilt issuance.

A lack of correlation is not to say that it doesn’t matter if the supply of government bonds is huge – clearly it does matter. The law of economics says that if the supply of something increases, then all else being equal, the price will fall. But with regards to government bond issuance, all else does not remain equal. When governments issue lots of bonds, it generally means that the economy is in trouble. And if the economy is in trouble, it means that spare capacity is probably being created because unemployment is going up and wages are stagnant (or perhaps even falling). These things all put downward pressure on inflation. If inflation falls and interest rates are low or falling, then locking into a high fixed interest rate (at least ‘high’ relative to cash interest rates) is very attractive, and demand for government bonds increases. Yields therefore fall and prices rise. This is exactly what happened last year in the UK – 2008 was the biggest year for gilt issuance but was still a very good year for gilt returns.

What will cause demand for gilts to rise over the next year to equal or exceed the supply of gilts? It depends on what happens to inflation and economic growth. In terms of inflation, Alistair Darling projects CPI to fall to 1% this year, and RPI to fall to -3% in September before rising to zero next year. In terms of growth, he expects -3.5% for 2009, +1.25% for 2010 and 3.5% for 2011.

Slightly ironically, gilt investors should be hoping that the chancellor has overestimated his growth forecasts, even though this will inevitably result in the budget’s numbers not adding up and even more gilts being issued than projected. Gilt investors should hope Alistair Darling is wrong because if the chancellor is correct about +3.5% growth in 2011, the economy will be booming at its strongest pace since 1999 and you can be pretty confident that government bond yields will be quite a bit higher.

Much can happen between now and 2011, and his growth projection is certainly possible, but at the moment our view is that it is unlikely that UK growth will be this strong. If UK economic growth does indeed fall short of his projections, then it’s also likely that inflation will fall short too. And if your core scenario is that sterling won’t collapse (which would put upwards pressure on inflation), then gilt yields are very capable of going lower.

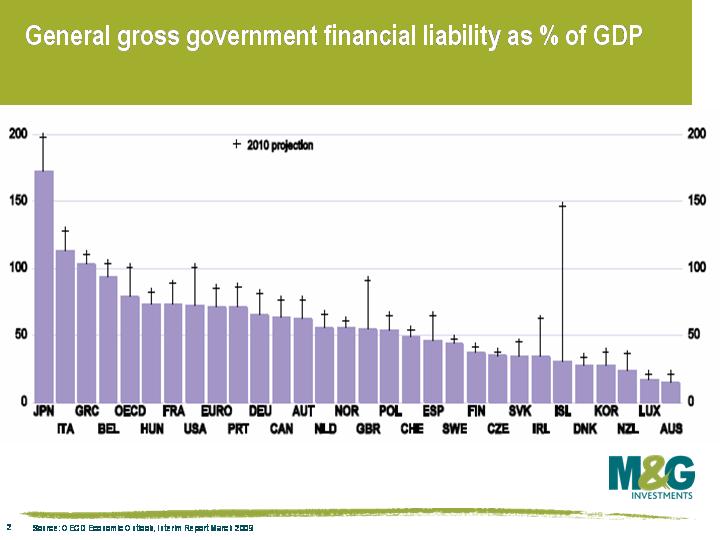

Finally, as we’ve mentioned previously on this blog, don’t forget what happened to Japan. There are of course many differences between the UK and Japanese economies, but an important lesson is that large issuance doesn’t mean government bond yields must rise. The OECD expects Japan’s ratio of public debt to GDP to rise to 197% next year, more than two times as much as for France, Germany and the UK (see chart). Japanese government debt has tripled since 1996. And yet today, 10 year Japanese government bonds yield 1.4%, and got as low as 0.4% in 2003.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox