Bank bailout schemes – are they really working?

Guest contributor – Tamara Burnell (Head of Financial Institutions, M&G Credit Analysis team)

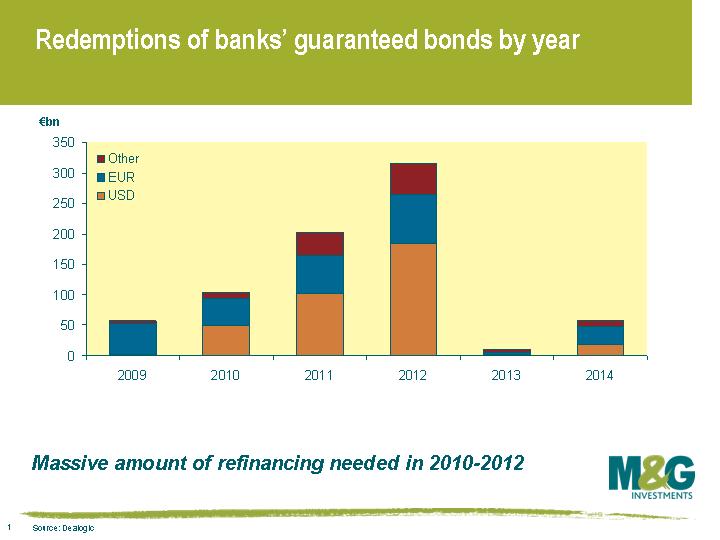

The Bank for International Settlements (BIS) has published a study of the ‘impacts’ of the bank rescue programmes used to date – see here for the full publication entitled ‘An assessment of financial sector rescue programmes’. It concludes, not surprisingly, that the schemes have so far failed to generate any perceptible easing of the supply of bank credit to the economy (which in fact continues to decline in the US, UK and EU). Moreover, the guarantee programmes have created some big refinancing risks of their own in 2010/2011/2012, as can be seen from the chart above. While there has been some tentative pick up in covered bond issuance in several countries, their cost remains prohibitive.

The Bank for International Settlements (BIS) has published a study of the ‘impacts’ of the bank rescue programmes used to date – see here for the full publication entitled ‘An assessment of financial sector rescue programmes’. It concludes, not surprisingly, that the schemes have so far failed to generate any perceptible easing of the supply of bank credit to the economy (which in fact continues to decline in the US, UK and EU). Moreover, the guarantee programmes have created some big refinancing risks of their own in 2010/2011/2012, as can be seen from the chart above. While there has been some tentative pick up in covered bond issuance in several countries, their cost remains prohibitive.

As well as the oft-discussed problem of crowding out of sovereign borrowing (especially in the UK), the data suggests that the guarantees are bailing out large complex/investment banks, rather than those banks most likely to lend to their domestic economies, so the subsidies are not reaching their intended beneficiaries. It also appears that the main investors in guaranteed bonds are a) other banks, ie investments in guaranteed bonds are crowding out bank lending, and b) more specifically, banks in the same country as the issuer – which in Europe is having the effect of breaking down the Euro area bond market back into its national constituents again and reducing liquidity.

With banks now addicted to government guaranteed issuance on both sides of the balance sheet (ie as issuer and investor), the BIS admits that “convincing the credit (risk seeker) investor base to resume investing in unsecured bank debt may turn out to be an expensive task, with potential adverse consequences for the real economy”.

However, some of their conclusions are flaky at best – eg they argue that weaker countries should be allowed to charge lower guarantee fees to the banks in their country, to give them access to bond markets on a level playing field with banks with higher rated sovereigns. [When you see that the report was prepared primarily by staff from the Bank of Italy, this starts to make sense!]. They also seem convinced that in order for governments to achieve a quick exit from the guarantee schemes, and wean banks and investors off these government guaranteed bonds, the solution is to recreate (ie subsidise) the securitisation market. However, they have no suggestions of how this could be done without releveraging the banks all over again and eating into the new capital cushions that have only just been injected by governments.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox