Something to keep everyone happy – Bond markets and equity markets outperforming

The month of August was an investor’s dream, with major asset classes like equities, government bonds, corporate bonds and property producing positive returns over the month. However, like two gunslingers in the American Old West, the equity and government bond markets are now currently staring each other down waiting for the other to flinch.

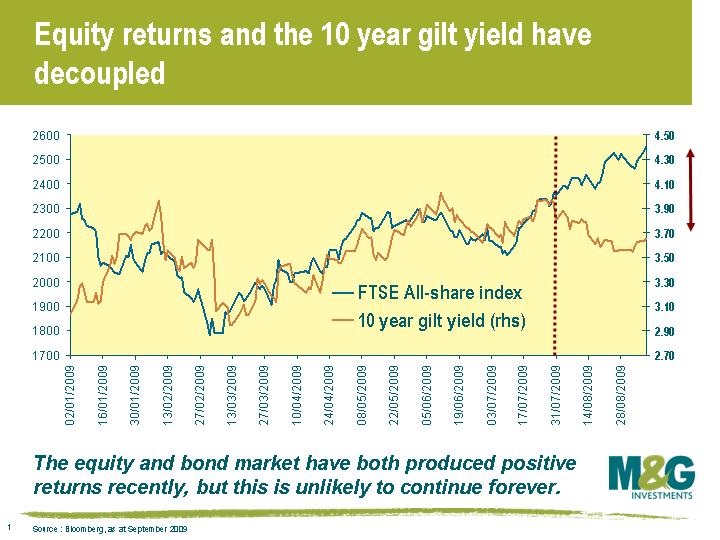

Taking the UK as an example, 10 year gilt yields and the FTSE All-Share Index are normally correlated, ie when the equity market goes up, gilt yields also go up and vice versa. As the chart on the left shows, up until the end of July this rough guide held true.

Taking the UK as an example, 10 year gilt yields and the FTSE All-Share Index are normally correlated, ie when the equity market goes up, gilt yields also go up and vice versa. As the chart on the left shows, up until the end of July this rough guide held true.

More recently, this relationship has broken down. And for our readers outside the UK, the relationship between equity returns and government bond yields has also broken down in Europe and in the US. The talking point in markets over recent weeks is the fact that equity markets have continued to rise while at the same time gilt yields have fallen. This has occurred very rarely in the past 5 years, so why is it happening now?

Part of the answer lies with the Bank of England’s Quantitative Easing programme. Bank of England Deputy Governor Charlie Bean has recently told markets that without the programme gilt yields would be around 50-75bp higher. And as the chart shows, a direct read of where gilt yields are relative to equity markets suggests the same.

Looking ahead, I’d expect that the usual relationship between gilt yields and equity market returns will reassert itself. But does this occur because equity markets fall or because gilt yields rise? That’s the interesting question here. In my view, the Bank of England will have to think long and hard about its QE exit strategy. Gilt yields are sure to rise if the Bank stops buying and the UK Debt Management Office keeps issuing.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox