Gilt supply update: back to a world of issuance exceeding buybacks

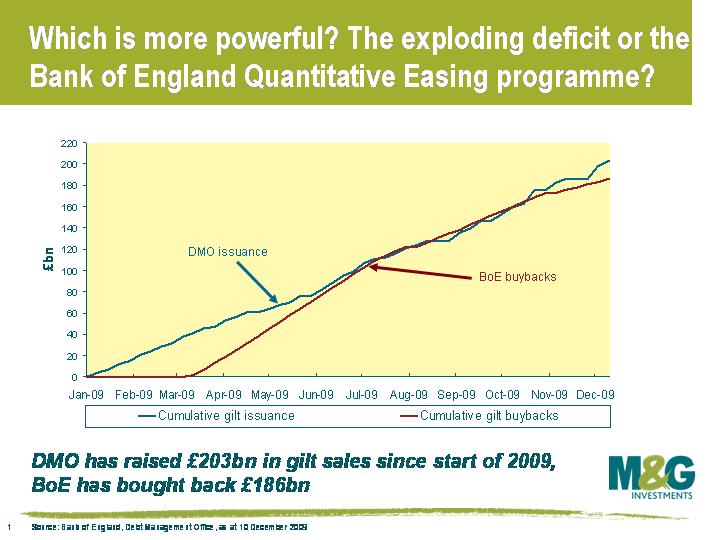

In last week’s Pre-Budget report, UK Chancellor Alistair Darling announced that gilt issuance for the current financial year would total £225.1bn – a shocking and record figure, although not far off the £220bn that was originally planned in this year’s Budget. But while on one side we’ve had this huge volume of supply from the DMO, we’ve also had the unusual situation of the BoE busily mopping up gilts at a frantic pace. In fact as this chart shows, in Q2 and Q3 of this year, the BoE was actually buying gilts back faster than the DMO could issue them. This massive demand for gilts has kept a lid on gilt yields – 10 year gilt yields today are where they were at the beginning of June.

In last week’s Pre-Budget report, UK Chancellor Alistair Darling announced that gilt issuance for the current financial year would total £225.1bn – a shocking and record figure, although not far off the £220bn that was originally planned in this year’s Budget. But while on one side we’ve had this huge volume of supply from the DMO, we’ve also had the unusual situation of the BoE busily mopping up gilts at a frantic pace. In fact as this chart shows, in Q2 and Q3 of this year, the BoE was actually buying gilts back faster than the DMO could issue them. This massive demand for gilts has kept a lid on gilt yields – 10 year gilt yields today are where they were at the beginning of June.

However, the demand/supply dynamic is changing and is set to change further. Looking at demand, the pace of buybacks has recently slowed considerably, as pointed out by Richard here. In November, the BoE ‘only’ increased the scale of QE by £25bn versus a £50bn increase previously, and year to date gilt issuance has once again overtaken the volume of BoE buybacks. In terms of supply, we still have around £50bn of mainly conventional gilt issuance to come over the remainder of this financial year, followed by another £174bn in the pipeline for 2021/12 and probably a similar amount the following year.

The quantitative easing pressure cooker has clearly kept gilt yields lower than they would have been in its absence, but the worry is what will happen once the lid is eventually taken off. Who’s going to buy the gilts? Will the gilt market bubble over and make a big mess?

You shouldn’t underestimate the power of the authorities to find new ways of generating domestic demand to keep sovereign debt yields yields suppressed, as the Japanese experience of the past decade has shown, and in the UK we’ll see that a significant part of next year’s gilt supply will find its way onto banks’ balance sheets. But in our view there’s a greater risk that gilt yields will rise from here rather than fall, and the prospect of a hung parliament and the potential for a UK credit rating downgrade increase the risks.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox