Are Sovereign CDS Evil?

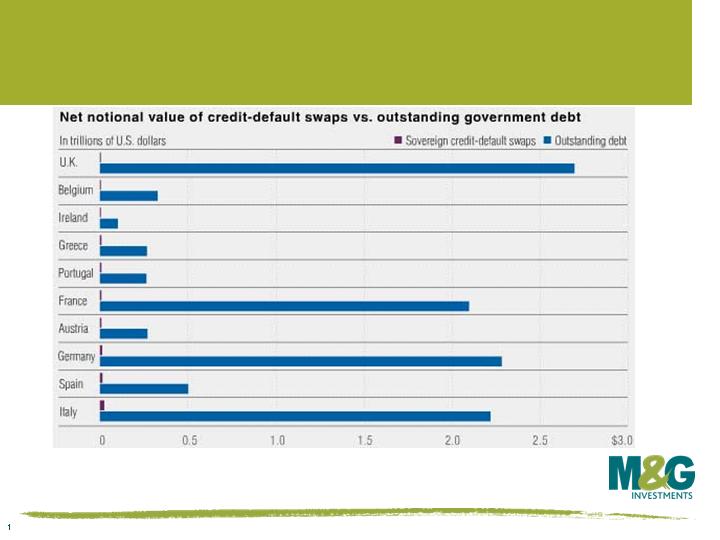

Following on from Jim’s Sovereign CDS Q&A blog (see here) I came across this chart at zerohedge.com. Whilst I can’t vouch for its accuracy, the chart shows that the actual net amount of outstanding sovereign CDS contracts, relative to outstanding government debts, are actually very small. That would seem to add weight to Jim’s argument that the pressures faced by governments are borne ‘of fiscal imprudence and a lack of will to resolve this,’ rather than the sole work of evil speculators.

Following on from Jim’s Sovereign CDS Q&A blog (see here) I came across this chart at zerohedge.com. Whilst I can’t vouch for its accuracy, the chart shows that the actual net amount of outstanding sovereign CDS contracts, relative to outstanding government debts, are actually very small. That would seem to add weight to Jim’s argument that the pressures faced by governments are borne ‘of fiscal imprudence and a lack of will to resolve this,’ rather than the sole work of evil speculators.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox