LBOs and IPOs: have European equity investors woken up?

Back in January at our Annual Investment Forum I focussed on the changing face of the European Leveraged Finance markets – those companies financed with significant levels of debt. My belief is that the current, somewhat forced reinvention, will ultimately result in an increasingly deep and liquid European High Yield market (EHY), more akin to that of the USHY market.

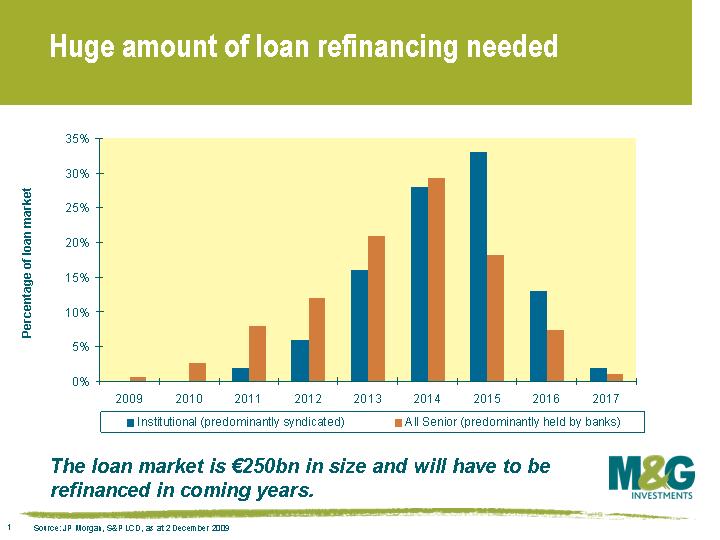

This change, which is already well underway is being predominantly driven by three factors. Firstly, a need within the European leveraged loan market to re-finance a huge wall of debts maturing between 2012 & 2015 (see graph). Secondly, we have witnessed a significant rise in the number of fallen angels issuers; those high yield companies who have lost their investment grade status, the likes of Fiat and ITV. Thirdly the now significant sub financial component of the high yield universe is changing the nature of the market. Subordinate debt issued by the likes of Lloyds, RBS and ING currently comprise around 13% of the EHY universe.

On my first point, the consensus has held that a mixture of trade sales, secondary LBOs, IPOs, restructuring and re-financings will offer a solution to the circa €200 bn worth of European leverage loans coming due. However, the recent decision to abandon attempts to IPO Travelport, and delay those for New Look and Merlin, has brought the spotlight firmly on the IPO market asking questions of its willingness to participate in future.

The European equity market has arguably learnt some harsh lessons over the last few years. The relisting of Debenhams back in 2006 was followed by three profit warnings in quick succession with its stock price predictably suffering. (See Times article here) Gartmore and Smurfitt Kappa’s IPOs are other examples of sponsor owned businesses that come to mind whose stock prices have underperformed the market since relisting. Had much, if not all of the low hanging fruit already been extracted by the sponsor?

In today’s volatile environment the ability of private equity to hit their IRR targets may be hampered by the scepticism pervading the European equity markets. The reality is that there will always be an equity market interest in backing companies with good prospects and strong track records, sensible debt levels and an alignment of sponsor/equity market interests. But the lack of willingness to underwrite the IPO’s of highly levered, cyclical businesses poses further questions for the European leveraged finance market. If the European equity market is unwilling to play its part in re-financing the excesses of previous years, then the implications are likely negative for both private equity returns and certain European leveraged finance investments.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox