What is the risk free rate anyway?

The risk free rate is a concept beloved of micro-economists and bond math geeks. It’s the building block of Modern Portfolio Theory and an input into option pricing models. It’s supposed to represent the interest rate available in the market that is without credit risk and as such is the lowest interest rate in the market. The complete absence of risk has always been more observable in theory than in practice but in the last month or so, swap rates have fallen below gilt yields – can it be right that the lowest interest rate in the market is lower than the traditional risk free rate? Are government bonds still the right instrument with which to observe the risk free rate?

Interest rate swaps are a means of turning a floating rate cashflow into a fixed rate cashflow for a set period of time, or vice versa. If you decided to receive fixed rate payments for ten years, you would agree to pay Libor (reflecting the cost of short term money) and receive the fixed payment for the life of the contract from the bank with which you’d traded. Historically the fixed rate payment would be more than you could get by buying a gilt from Her Majesty’s government. On average over the past decade it was around 0.5% more than the ten year gilt yield. This seems to make sense, as there is a risk that the bank counterparty that you have traded with disappears and can no longer service the contract, so the premium over gilts reflected credit risk.

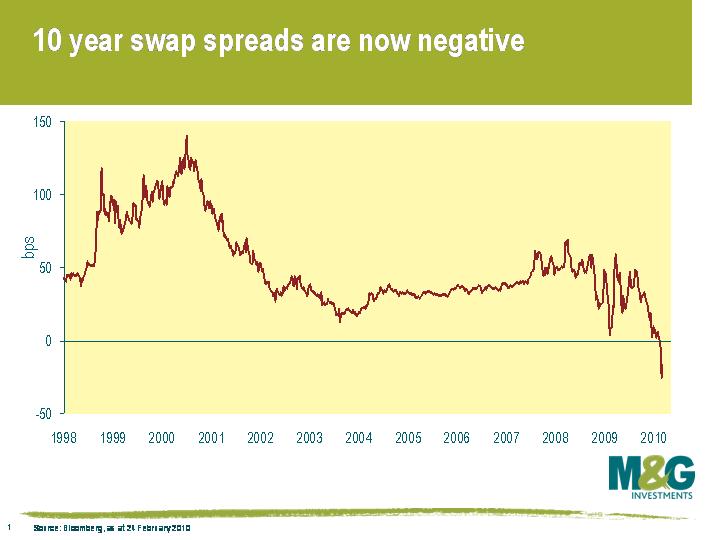

As this chart shows however, this swap spread (the difference between the swap rate and the gilt yield) has fallen substantially since the start of 2009, and in the first couple of months of this year it has turned negative. The ten year swap spread is now -0.18%. In other words you get a lower rate of interest in receiving a fixed payment from a bank than you would from a AAA rated (still!) government bond. Does this make sense? After all, if you are a UK investor that swap might well be with a government owned bank anyway, so isn’t the credit risk the same? There are two reasons why you might want to receive fixed via an interest rate swap rather than buying a gilt. Firstly, if there was a UK sovereign default you would probably lose capital if you owned a physical gilt, whereas your downside in a swap default would be limited to having to replace the counterparty at a potentially less advantageous rate of interest. More significantly though, the markets are reflecting not just the increased risk of a UK default (which in our view is much less likely than is priced into the CDS market, at about 9% over the next 5 years) but more importantly the relative supply of swaps and government bonds. Gilt issuance will be running at around a £200 billion rate for the next couple of years, but without the market’s biggest investor – the Bank of England has ended its Quantitative Easing programme (although not irrevocably).

As this chart shows however, this swap spread (the difference between the swap rate and the gilt yield) has fallen substantially since the start of 2009, and in the first couple of months of this year it has turned negative. The ten year swap spread is now -0.18%. In other words you get a lower rate of interest in receiving a fixed payment from a bank than you would from a AAA rated (still!) government bond. Does this make sense? After all, if you are a UK investor that swap might well be with a government owned bank anyway, so isn’t the credit risk the same? There are two reasons why you might want to receive fixed via an interest rate swap rather than buying a gilt. Firstly, if there was a UK sovereign default you would probably lose capital if you owned a physical gilt, whereas your downside in a swap default would be limited to having to replace the counterparty at a potentially less advantageous rate of interest. More significantly though, the markets are reflecting not just the increased risk of a UK default (which in our view is much less likely than is priced into the CDS market, at about 9% over the next 5 years) but more importantly the relative supply of swaps and government bonds. Gilt issuance will be running at around a £200 billion rate for the next couple of years, but without the market’s biggest investor – the Bank of England has ended its Quantitative Easing programme (although not irrevocably).

So with an implied default rate of nearly 10%, the gilt market cannot seriously be regarded as “risk free” any more, even if we do think that probability is nutty given the UK’s access to the printing presses of mass destruction if we ever did get stuck for a few bob to repay our bond debts. But once the gilt supply glut is out of the way in a couple of years time (we hope), expect swap spreads to move steadily higher. The swap market has become an increasingly important yardstick for valuations however, and maybe the UK corporate bond market will begin to price in relation to swaps rather than gilts – the European corporate bond market has already been doing this for years, as has the UK population whenever we’ve considered a fixed rate mortgage.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox