European growth is not sustainable so get used to higher unemployment rates

Much has been made of the fact that the European economy (since the creation of the European Economic and Monetary Union or EMU) has exited the worst recession in its existence. Many have pointed to the early actions of politicians and government officials as a reason Europe avoided a depression-like scenario. You might not know it or be able to feel it, but Europe is actually growing again. We will see that this growth has been led by government spending and a build up in inventories. With bond markets now demanding fiscal cuts and austerity measures, this type of growth will not be able to continue much longer.

To understand why this is the case, we need to understand how the bean-counters calculate GDP. For those of you that are unfamiliar with the inner working of calculating the GDP of an economy, I’d like to introduce you to the expenditure approach of calculating GDP. This approach tells us that:

GDP = private consumption + gross investment + government spending + (exports minus imports)

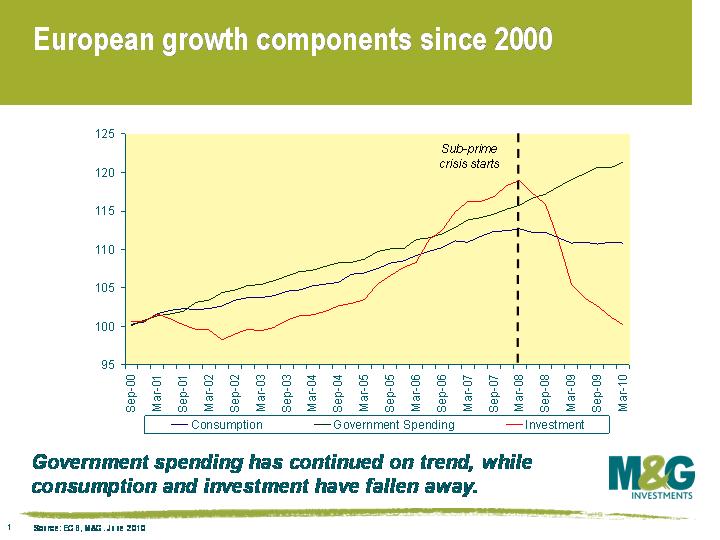

Looking at the chart, we can see the growth in real terms of the main components of European GDP since 2000. This data confirms many of the trends that we have been highlighting on this blog. Investment has fallen off a cliff because banks have had to replenish the amount of capital on their balance sheets. As a result, banks have reduced their lending to businesses. Governments – forced to step in to secure the economic recovery – have continued to borrow from capital markets and spend. Whilst the European economy is out of recession, it is a recovery led by inventory stockpiling and government spending. This is not yet a sustainable recovery.

The health of the household sector or the ‘private consumption’ component of GDP is crucial to generating any sort of self-sustaining economic recovery. And at this stage it appears to us that growth in the household sector will be positive but remain below trend. This is important because in Europe, the household sector is about 60% of the economy, meaning it is almost 3 times larger than the government or investment components of GDP. The European economy needs consumers to start spending again and governments need a strong household sector so they can start raising more tax revenue. In order to generate solid growth we need to see the labour market start to improve. Of course consumers can draw on savings that they have built up through investments and pensions but the events of recent years have left many feeling poorer.

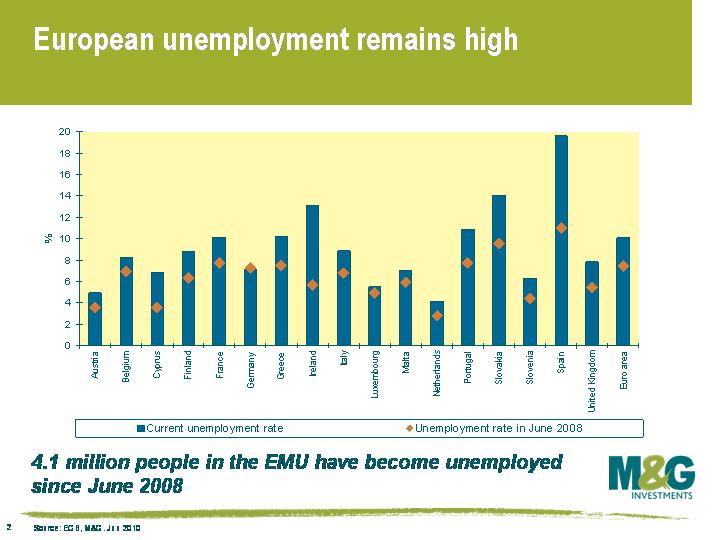

Turning to the labour market, the chart shows the deterioration in official European unemployment rates since June 2008. The unemployment rate has risen from 7.4% to 10.0%. This equates to an extra 4.1 million people out of work (equivalent to the population of Ireland). In Europe, almost 16 million people are now out of work. If we include those who would like to work more (the underemployed) these numbers are much higher. A quick analysis of why unemployment has risen might help us determine when we can reasonably assume to see labour markets improve again.

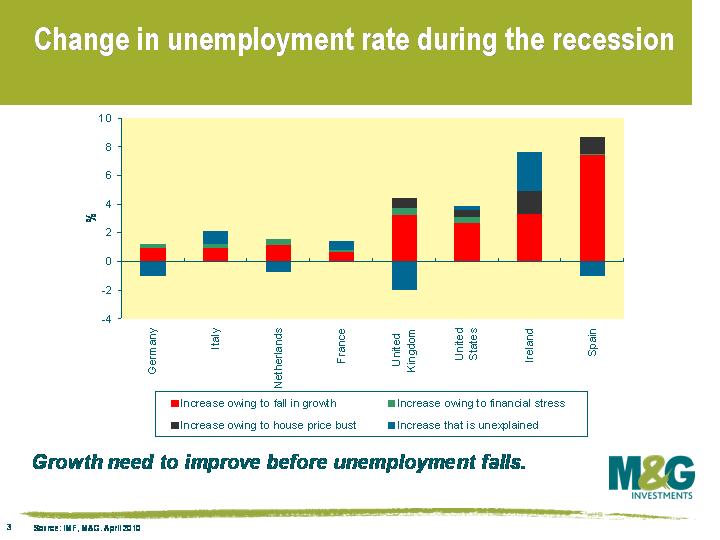

Fortunately for us, the IMF recently analysed labour markets in great depth in its World Economic Outlook. The IMF chart decomposes the change in the unemployment rate during the recession and explains why the unemployment rate has risen. We can see that the rise in unemployment rates globally can largely be explained by the fall in growth. House price busts and the financial crisis have also had a large impact on unemployment rates. These impacts have been higher in countries like Spain and Ireland that had an overheated housing market leading into the crisis – the result of easy credit and lending standards for mortgages. These bad loans are not only coming back to bite the banks, but also the countries in which these banks operate in. By nationalising these bad debts, governments have put their own finances in peril, resulting in skyrocketing debt/GDP ratios and the sovereign crisis we have seen this year.

We know that the main driver of the unemployment rate is economic growth. Thus, given the main driver of growth is consumption, we are likely to see persistently high European unemployment rates over the next couple of years. In an environment such as this, the ECB has been right to reduce interest rates to historic lows. European governments have been right to expand fiscal policy. The IMF conclude that “in countries where unemployment rates remain high and the economy is operating below potential, policy stimulus remains warranted”. But with markets demanding that governments implement harsh austerity measures and budget cuts in coming years, expansionary fiscal policy will no longer be accepted. It looks like Europe is going to have to get used to a period of high unemployment, sub-trend consumption and weak economic growth.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox