The European Central Bank withdraws the 12 month LTRO, just as banking system strains re-emerge

A report in the FT today highlights the lobbying of the ECB by Spanish banks to renew a one year funding facility known as the Long-Term Refinancing Operation (LTRO) that comes to an end this week. Banks borrowed €442bn from the ECB under the facility last year, at a time when borrowing in the market was either impossible or too expensive. When the facility closes, the banks that still need ECB funding will face two options – either roll into a 3 month facility, or into an even shorter 6 day facility. Banks worry that this shorter term facility will make their funding task more uncertain, and puts them subject to rollover risk when each facility matures.

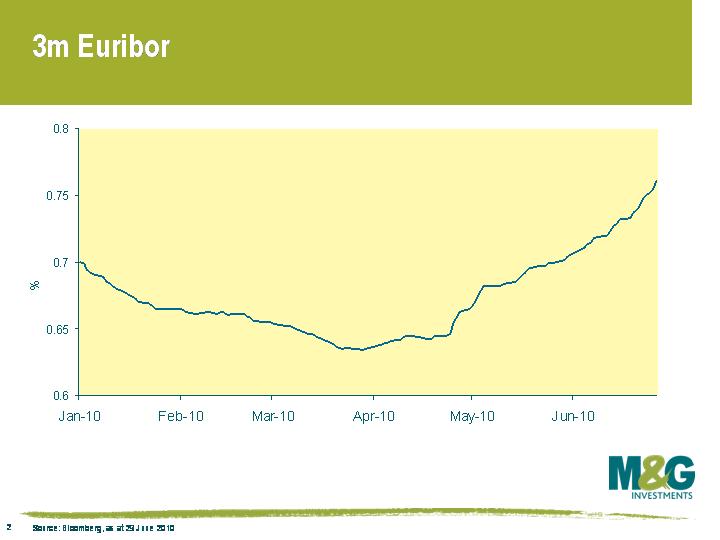

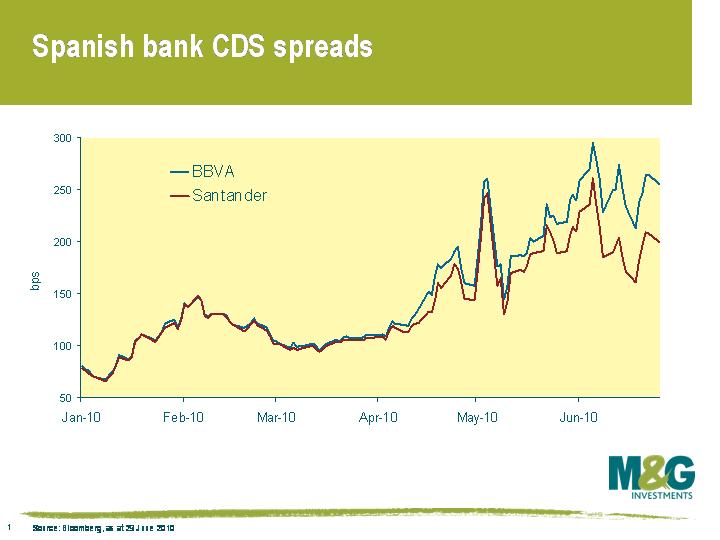

This highlights two issues. The first is the difficulty that Spanish banks (amongst others) are currently facing in accessing the capital markets (see first chart). It will be very interesting to see just how much of the €442bn gets rolled because it will give us an indication of the reliance of European banks on the lender of last resort – on the FT blog they show the market’s expectation of the roll, and the implications of this as an indicator of banking system health (the more that gets rolled, the more worried we need be). To what extent are banks able to fund themselves in the open market at all? This second chart shows that strains in the European interbank market have intensified in recent days, with 3 month money market rates up from around 0.65% at the start of May to 0.76% now.

The second and perhaps larger issue is the risk to the anaemic European recovery that the ECB is taking. I’ve been critical of the ECB in the past, such as when it raised rates in summer 2008, and its obsession over fighting inflation. Now it wants to withdraw term financing from the market when arguably it is most needed. Shouldn’t they be cutting rates? Where’s the European inflation risk?

Whilst President Obama warns of the dangers of tightening fiscal policy too early in the recovery, Europe (and the UK) is backing austerity. The austerity measures that are being implemented across Europe may act as a drag on growth for some time to come. Who knows which is the right approach, but the tightening of liquidity by the ECB seems to be premature and misplaced. The European banking system remains on life support. Whilst European banks can continue to access 3 month unlimited tenders, the message from the ECB is that it is uncomfortable being the lender of last resort and that inflation remains the enemy. Unless the market’s perception of the ECB changes I fear European banks will continue to struggle on their path to recapitalisation.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox