Bernanke calls for a 4% inflation target

Well sort of. It hasn’t got a lot of attention in the bond markets, but this week both Jon Hilsenrath in the WSJ, and subsequently Paul Krugman in the NYT have revisited Ben Bernanke’s paper Japanese Monetary Policy: A Case in Self-Induced Paralysis. Bernanke wrote this in 1999 as an academic at Princeton University. In it he calls on the Bank of Japan to set a “fairly high” inflation target to show that it “is intent on moving safely away from a deflationary regime, but also that it intends to make up some of the “price-level gap” created by eight years of zero or negative inflation”. Bernanke argues that an inflation target of 3-4%, to be maintained for a number of years, would give the private sector some confidence about the authorities’ desire to get away from the deflation trap.

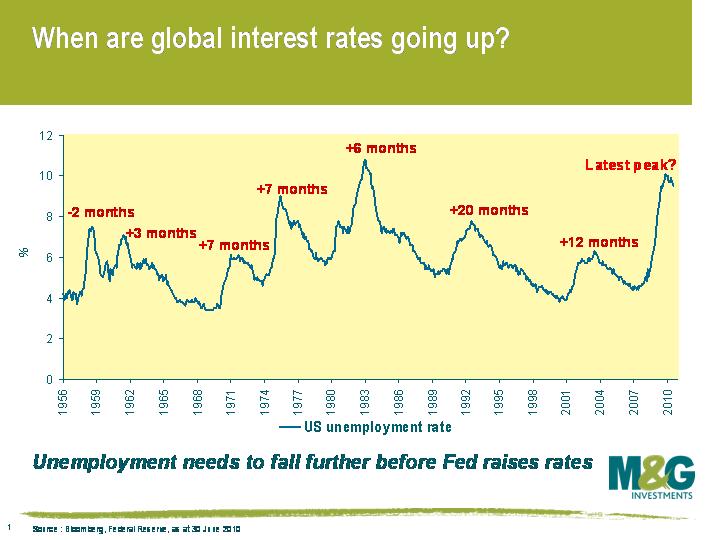

The BoJ obviously took no notice of Bernanke’s paper, and over a decade on from its publication Japanese CPI is still very negative year-on-year. The question is whether Bernanke’s plan to help Japan recover from the stagnation it suffered post the collapse of its commercial property bubble reflects his thinking on what the Fed should do to help America recover from the stagnation it’s suffering post the collapse of its residential property bubble. Currently the Fed targets a long term inflation rate of just 2%, but also has an objective to maximise employment. We’d argue that the Fed has generally put the function has always been to wait for the unemployment rate to start falling before it hikes rates (the lag between unemployment falling and the Fed hiking has been especially long in the last two economic recoveries – see chart).

However, a doubling of the US inflation target would cause carnage in the US Treasury bond market (who wants a 10 year bond yielding 2.7% when the Fed is targeting 4% inflation?) – and with one of the shortest debt maturity profiles of any developed economy, the interest burden cost of changing the target might be enough to trigger a credit rating downgrade (and in the medium term even a default?). For this reason alone I think that Bernanke is unlikely to talk about a change in the target publicly (although others, including IMF Chief Economist Olivier Blanchard have been arguing for such a change). Because of the political and public disregard for the runaway budget deficit, and the US Treasury’s behaviour in borrowing short to finance it (50% of the US Treasury market matures in the next 3 years), Bernanke’s hands might be tied. The positive impact on private sector behaviour comes from loudly signalling a change in inflation behaviour, but the reliance on overseas investors to finance the US deficit makes such signalling very expensive, and possibly lethal. So I don’t expect a change in Bernanke’s rhetoric around the inflation target. But actions speak louder than words, and we will see the zero interest rate policy continue for the foreseeable future, and continued excursions into the world of quantitative easing. As for the outcome of such policies, it would be foolish to put too much conviction as to whether the western economies end up looking more like Japan, or more like Zimbabwe.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox