Why are TIPS yields negative?

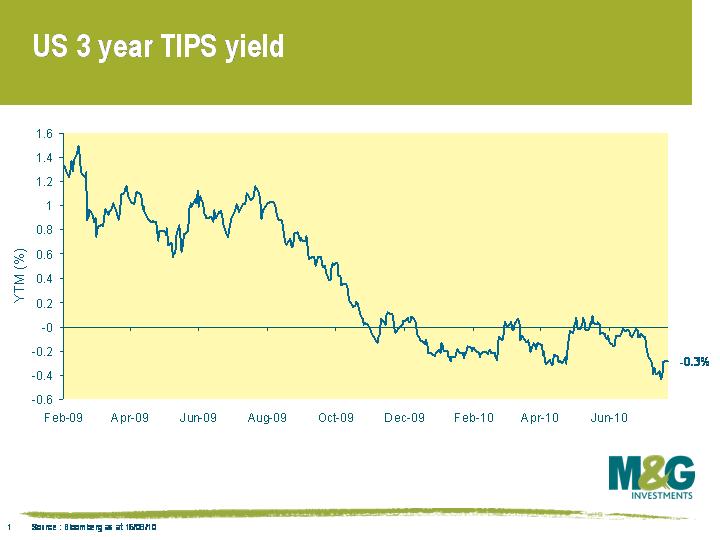

Last week a client asked us why US TIPS (inflation linked government bond) yields have been negative for much of this year (see chart), and we’re not sure we gave a very good answer. This weekend, to distract myself from the monotony of doing laps of Richmond Park on my bike, I came up with these 7 reasons why an investor would lock in a return guaranteed to be lower than inflation over the maturity of the bond.

1) Unlike the UK index-linked market, US TIPS protect the investor from deflation as well as inflation. If over the lifetime of the bond you experience negative price inflation, the $100 you invested when the bond was issued is what you get back, rather than a lower amount representing the increased purchasing power of your dollars. So as deflation fears grow, the TIPS market has an embedded option in it that turns your inflation linked bond into a nominal bond in a sustained deflationary environment – this is very much to your benefit, and is worth something. So the negative yield partly reflects the option value of the deflation floor.

2) Government bond yields traditionally reflect an amount related to nominal GDP growth in an economy. You have a choice – lend $100 to the government or invest it across the whole US economy and receive the average growth rate across all sectors, plus compensation for inflation. The efficient markets hypothesis says that ex-ante there shouldn’t be a difference between the two, or capital will flow from one to the other to equalise the difference. If you buy an inflation linked bond, you can remove the inflation compensation element of this calculation, so the TIPS real yield equals expected US GDP growth over future years. The market therefore believes that we are heading into a period of prolonged negative economic growth.

3) The market might also, or alternatively, believe that we will get strong inflation, and that they need to buy insurance at any cost. After all, where else can you buy inflation insurance? Equities, nominal bonds, property and even commodities perform badly in high inflation environments. So there’s a monopolistic seller of inflation insurance out there, and desperate buyers. When we buy house insurance we know we are overpaying relative to the risks of a fire or flood, but because the downside is so severe in the event of those things happening, we can’t afford not to be insured. And at least there is competition amongst sellers in that insurance market. So expensive and incomplete inflation insurance is better than nothing.

4) As discussed in my earlier blog about the Barclays Inflation Conference, the official inflation measures probably overcompensate investors for their experienced inflation. The Boskin Report suggested this overcompensation could be as much as 1% per year for US investors. In other words a TIPS investor gets paid measured CPI, which is much higher than the actual inflation they experience – thus they can buy TIPS at a negative yield and still get paid more than their own, actual, inflation rate.

5) Another explanation for why short dated inflation linked bond yields are negative (not just in US but in much of the world, e.g. France, Germany, Sweden, UK) is that the authorities’ reaction to the financial crisis was to slash their central bank rate (a nominal rate), such that negative real interest rates would encourage spending and borrowing. Now, if you put your savings on cash deposit at a bank, the nominal interest rate is marginally positive, but the real interest rate is sharply negative. If inflation linked bond real yields were positive in this environment then it would represent a ‘free lunch’. So negative global linker yields demonstrate that markets believe that expansionary monetary policy will be run for some time (i.e. the central bank rate will remain below the inflation rate – US TIPS yields are only negative out to 2014 but positive thereafter).

6) The previous suggestions have been about the demand for TIPS, but we can also consider the supply of TIPS by the US Treasury. Whilst the UK’s Debt Management Office targets around 20% of issuance into the index linked gilt market, the US Treasury has focused issuance on nominal bonds. So whilst the supply of TIPS has increased this year in absolute terms, as a percentage of issuance, supply has been in severe decline since 2006. Then it accounted for around a third of issuance, whereas by 2009 this had fallen to under 3%. There might be a scarcity premium in the TIPS market, which links back to the “buyers at any cost” argument.

7) Finally, one feature of a speculative bubble is that informed commentators can come up with six well thought out, rational, plausible reasons to explain an irrational price valuation. Perhaps this is one of those times.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox