IMPRESSive

Over the weekend Ardagh Glass announced a transformative acquisition of another well known packaging name in Impress Cooperative U.A. The deal left me with mixed emotions and came as something of a surprise because an IPO had been considered the most likely exit for sponsor Doughty Hanson.

The purchase of Impress sees the departure of a European high yield market stalwart. The company’s inaugural transaction back in May 1997 saw it raise DEM 200m paying a coupon of 9.875%. That was followed by a further €150m raised in 2003, paying a coupon of 10.5% until both bonds were called by the company in July 2006, the former at face value, the latter at a small premium, netting investors annual returns of 10%, give or take. Those obligations were replaced with the current debt stock, set to be retired again either at face value or a premium depending on the exact bond in question.

The sale to Ardagh Glass raises a couple of interesting points:

Firstly the IPO exit that never materialised. The ongoing volatility in equity markets, the scarcity of capital and the level of suspicion levelled at private equity from the public markets has resulted in fewer IPOs in recent times than many had imagined. Without a significant change in any of these conditions, the much touted IPO exit will give way to tertiary and secondary LBOs, likely accompanied by lower multiples and weaker IRRs.

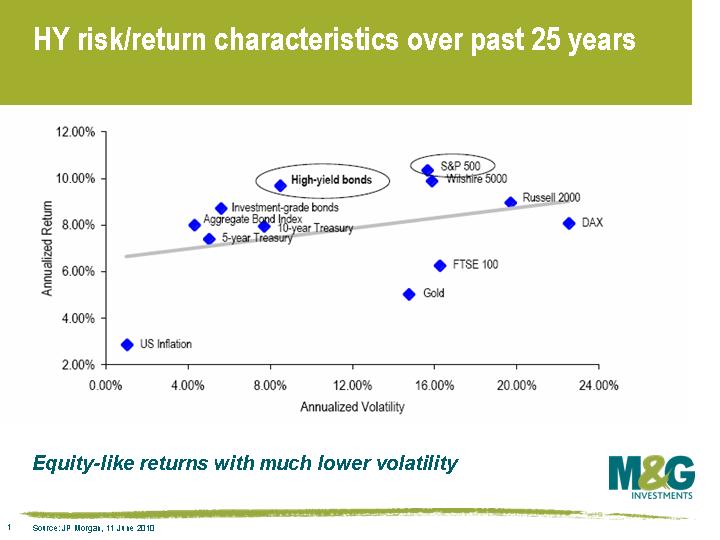

Secondly, the Impress story clearly demonstrates the attraction of high yield as an asset class. While it’s obviously disappointing to lose a conservatively run business (it’s all relative), with defensive and stable cash flows historically paying around 10% annually for its unsecured debt, it does highlight the importance of income and its ability to smooth volatility. In fact, comparing the US high yield market and the S&P 500, the two markets have realised similar annual returns over the past 25 years, yet the high yield market has done so with nearly half the volatility.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox