The M&G UK Inflation-Linked Corporate Bond Fund and the M&G European Inflation-Linked Corporate Bond Fund

We’ve announced today that we are launching two corporate bond funds which aim to deliver returns ahead of inflation in the medium to long term. We believe that these are the world’s first inflation-linked corporate bond funds for retail investors. These funds will hopefully capture the systematic overcompensation for credit risk that you get from investing in corporate bonds, as well as the inflation-linking obtained in assets where the coupon and final principal repayment rise in line with retail prices.

Is this the right time to launch an inflation-linked bond fund? As we’ve said before, we remain more worried about disinflationary pressures than inflationary pressures – the still growing reserve army of the unemployed should keep a lid on wage growth for the foreseeable future, and manufacturing capacity is also still high. However, we know that many of our clients and blog readers disagree with us on this. We also worry that whilst in the short term price pressures remain subdued, longer term we might not fully understand the impact of the huge Quantitative Easing programmes in the western economies. To quote from the out of print Dying of Money: Lessons of the Great German and American Inflations, “each big inflation – whether the early 1920s in Germany, or the Korean and Vietnam wars in the US – starts with a passive expansion of the quantity of money. This sits inert for a surprisingly long time. Asset prices may go up, but the latent price inflation is disguised. The effect is much like lighter fuel on a camp fire before the match is struck”.

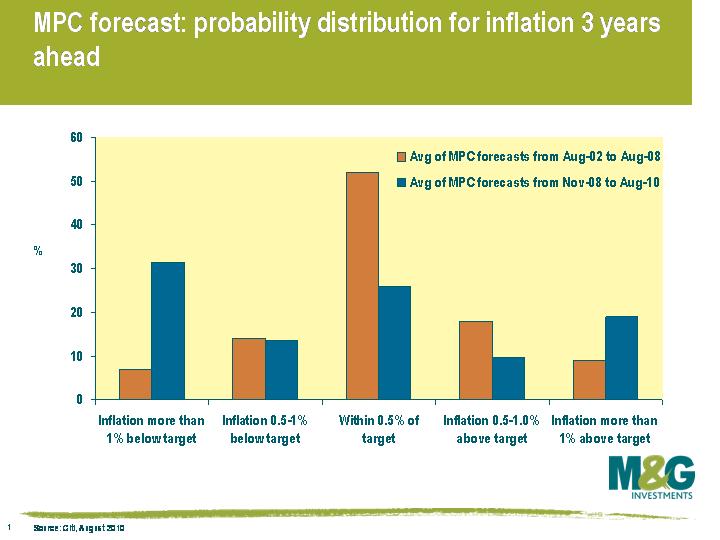

As we’ve said before, perhaps we’re Japan, and concerted action from the authorities can’t dislodge deflationary pressures from the economy, or perhaps we’re Zimbabwe and the turning on of the printing presses will bring about hyperinflation. Certainly the growth of such tail risks and the end of predictable inflation (and the end of faith in Central Banks to control inflation in either direction) makes investment decisions in any asset class much more difficult. This chart derived from the Bank of England’s Inflation Reports over the past 8 years shows that their expectations for inflation have moved from a normal distribution curve, with only a 15% chance of inflation being more than 1% above or below target 3 years into the future (taken from the Inflation Reports from 2002 to 2008), to a more than 50% chance of future inflation being more than 1% above or below target in the next 3 years in the most recent Inflation Report. This Abnormal Distribution Curve accords with our own view – we’d put more emphasis on the deflation risks, but we can’t ignore the inflation risks either.

So we don’t think you necessarily need these funds right now, but we’ve decided to build the fire engine before the fire breaks out, rather than waiting until it’s burning out of control. We’ll probably blog a bit more about the small (£11 billion in the UK) but interesting corporate inflation-linked bond market in due course.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox