Is an ‘A’ rating the new ‘AAA’?!

We’ve written recently about the bond world going ‘topsy turvy’, in that a consequence of QE may be that the higher inflation economies could end up with having lower yielding sovereign bond yields than the lower inflation economies.

Another way that the bond markets are starting to look topsy turvy is in terms of sovereign credit rating versus a country’s perceived risk of default, whereby a number of lower rated sovereigns are now yielding less than higher rated sovereigns. This is particularly the case if you look at the CDS market, which measures the cost of insuring against sovereign default.

This chart shows French CDS versus a number of single A rated issuers. As you can hopefully just about see, France (AAA) is now wider than single A issuers such as China, Malaysia, Chile, Slovakia and even South Korea (whose 5y CDS reached almost 500 in early 2009). If the perceived risk of French default increases further in the next few months, which is quite possible given the French public’s lack of appetite to engage in any meaningful reform, it won’t be long until France trades wider than another group of emerging markets including BB rated Colombia. France obviously isn’t alone in terms of developed economies seeing their risk of default rising; the big story this week has been Ireland (rated AA-), which yesterday briefly saw its sovereign CDS trade wider than Argentina (rated B-).

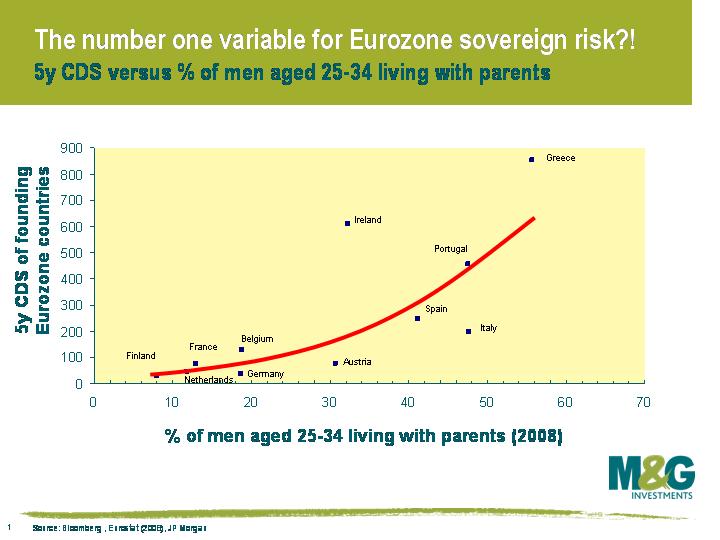

Or, on a more light-hearted note, perhaps austerity, growth and inflation have little to do with default risk. JP Morgan have an alternative explanation (see chart).

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox