(Fiscal) rules are there to be broken

A fiscal rule is a permanent constraint on fiscal policy through simple numerical limits on budgetary aggregates. The purpose of fiscal rules is to force governments into responsible fiscal behaviour at a time when it may not be in that government’s short term interests. Both the EU and the UK experimented with fiscal rules until the great financial crisis hit. Then all the rules flew out the window.

The twenty members of the European Economic and Monetary Union (EMU) are subject to the Stability and Growth Pact (SGP). Within the SGP, the member countries are expected to commit to three fiscal rules: the general government fiscal deficit is to be less than three percent of GDP; gross government debt is to be less than 60 percent of GDP and; the general government fiscal deficit should be close to balance or in surplus over the economic cycle. The Maastricht criteria were put in place for EU member states joining the EMU. The SGP was meant to ensure that European nations continue to observe the Maastricht criteria after they join the EMU.

In the UK, the “Code for Fiscal Stability” was passed into law in 1998 and contained a number of budgetary rules. The golden rule is over the economic cycle, the government will only borrow to invest and not to fund current spending. The sustainable investment rule states the public sector net debt as a proportion of GDP will be held over the economic cycle at a stable and prudent level. The government defined this level as 40 percent of GDP. The permanent balance rule indicates that tax revenues are planned to be a constant share of GDP, the permanent tax rate or share. This share is the lowest constant share of tax revenues in GDP that would ensure the long-run solvency of the government. The Code does allow the UK government to depart from the rules, as long as it gives a rationale for its decision.

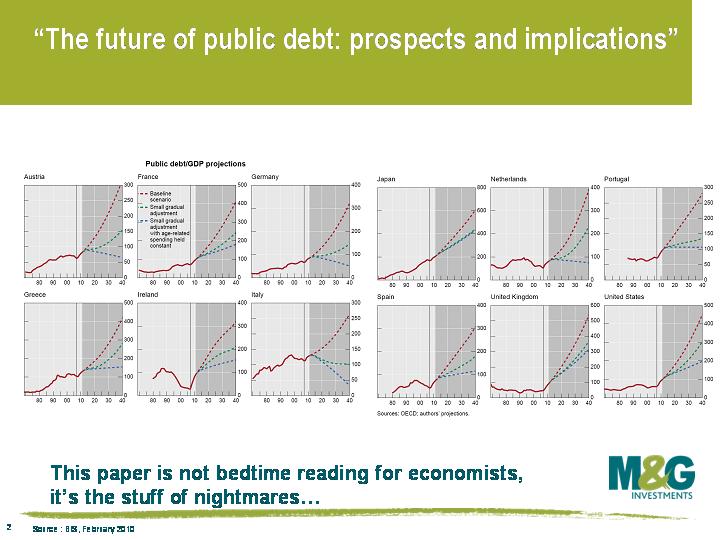

This chart shows that governments broke their own fiscal rules in order to support their respective economies and financial systems. There are now a number of countries that are in real danger territory. How they will get themselves out of the mess they have found themselves in is anyone’s guess.

In the UK, the government has formally suspended the rules and replaced them with a commitment to improve the government’s finances when the economy returns to a positive economic growth rate. In Europe, the SGP is being reformed but not to everyone’s satisfaction. Axel Weber (Head of Germany’s Bundesbank until April 30) has called for more consistent sanctions on any breach of the rules and a swift consolidation of European government budget deficits.

It is notoriously difficult to enforce fiscal rules. It is not possible to fine governments as they may exacerbate the issue that the government is being fined for and would be counterproductive. Potential enforcers of fiscal rules are the investors in government debt and credit rating agencies. If fiscal rules are broken and investors and credit rating agencies become sufficiently concerned about the sustainability of the government’s finances, it will have a large impact on the cost of capital through rising bond yields. Additionally, the government may find it hard to raise finance completely from capital markets as has been the case recently in Ireland and Greece. These countries have also had their respective credit ratings downgraded on concerns about the possibility of a debt restructuring event.

In February 2010, the BIS released a working paper entitled “The future of public debt: prospects and implications”. The attached chart show 30 year projections for the debt/GDP ratio in a dozen major industrial economies. The large deterioration in debt figures is the result of rapidly aging populations and unfunded liabilities stemming from future age-related spending in these countries. The red line represents the baseline scenario, the green line represents a gradual improvement of government finances, and the blue line represents draconian policy of cutting future age-related liabilities (an incumbent government would have to be bonkers to do such a thing!). The paper does not offer any advice on how to tackle the looming fiscal dangers but does note: “a decision to raise the retirement age appears a better measure than a future cut in benefits or an increase in taxes”. This is an interesting thought. In 20 years time, will the retirement age be 70, 75, 80?

It tends to be the case that governments faced with reducing government spending, cut potentially beneficial investment plans rather than current spending. Not good. As we all know, a newly elected government often has a tendency to abandon the previous governments announced policies. As mentioned previously on this blog, it may be the case that newly elected governments in countries like Ireland and Greece will choose to abandon the fiscal austerity plans of the previous government. This could have a massive impact not only on their respective economies but also on bond markets.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox