Japan and inflation expectations; and velocipedes

A couple of months ago I mentioned the Billion Prices Project – a daily CPI estimator which collects online prices to construct an index which we can compare with the official inflation releases. Sadly there is still no UK measure, but a month after the Japan earthquake and tsunami we can see what appears to be happening there. It looks like there was an intial inflationary shock, but prices have since fallen back again. Another index they produce is the Product Availability index (page down on the previous link); this shows that from a pre-quake base of 100%, only 85% of goods are currently available, reflecting broken supply chains.

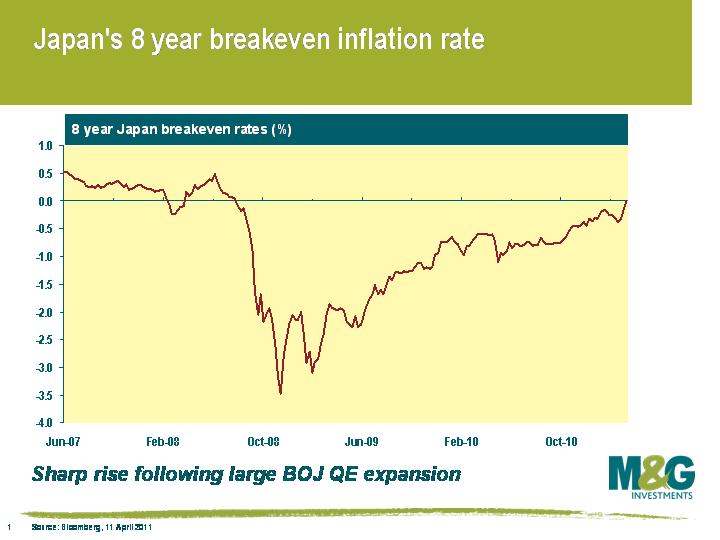

Because the BPP looks at online prices only, it is possible that food is under-represented (the methodology detailed on the website is pretty sparse) relative to, say, DVDs and clothing. So the fall back in inflation in recent days might be reflecting discounting as retailers start to suffer. Bond markets however have priced in a significant increase in inflationary expectations. The Japanese inflation linked bond (JGBi) market has stalled in development for some time now – they had always been pretty illiquid, and the longest bond outstanding is now under 8 years to maturity. Perhaps this isn’t surprising in a world where the Nationwide CPI measure has been negative for most of the last 13 years! Looking at breakeven inflation rates as priced by the JGBi market (see below) however, you can see that there has been an upward trend in expected inflation since the depths of the Great Financial Crisis in 2008, and most recently, since the earthquake, the 8 year breakeven rate has increased from minus 0.4% (i.e. deflation on average over the next 8 years) to zero. The Bank of Japan announced a 10 trillion yen increase in quantitative easing following the disaster, and it’s probably this that has lead to higher inflation expectations amongst investors (although the BOJ’s previous attempts at QE had very little impact on inflation or the economy).

Elsewhere on the BPP site you can see that the trend of sharp acceleration of prices in the US relative to the lagged official CPI data continues, and looks consistent with a 3% number, rather than the 2.1% we saw for February. No wonder TIPS are massively outperforming nominal US Treasury bonds. The 5 year US breakeven inflation rate has risen from 0.75% in early 2010 to 2.25% today.

Finally, given the splendid weather in the UK this weekend, please enjoy this spiffing photograph of me out on my velocipede on the Tweed Run through London. Similar photos are likely to also be found soon on the Sartorialist website.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox