More on the impact of inflation on equities

A few months ago, Anthony wrote about inflation hedging (see here) and referred to an IMF paper which suggested that ‘traditional asset classes’, most notably equities, don’t fare well if inflation increases, which is something to bear in mind when trying to protect a portfolio against increases in the level of prices.

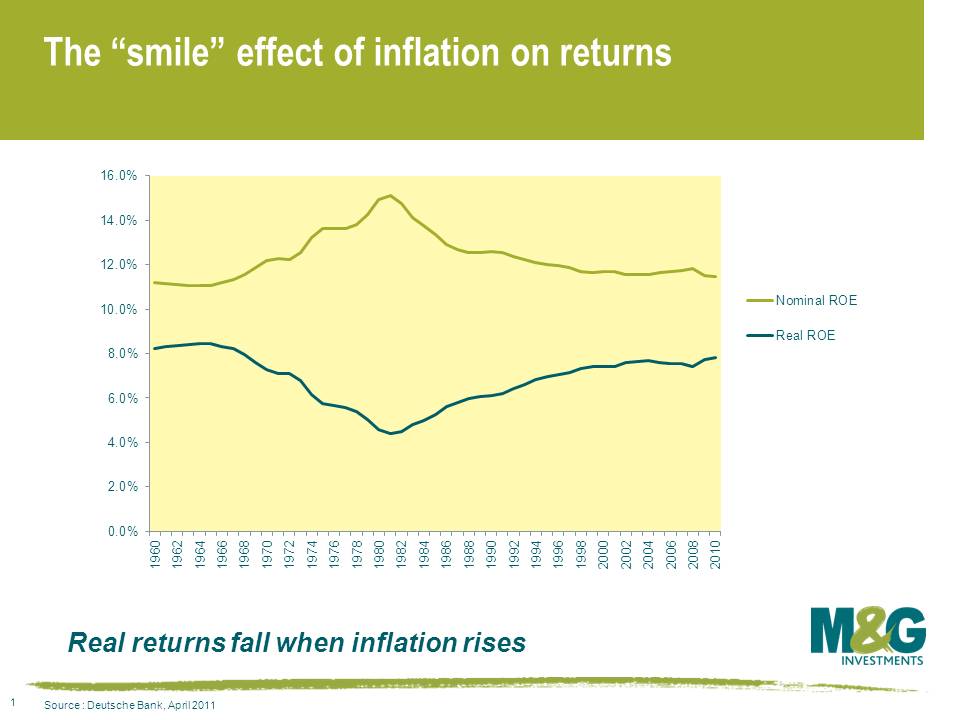

Francesco Curto at Deutsche Bank recently released a research piece that comes to similar conclusions. The article states that investors regularly use equities as an inflation hedge because of the view that nominal earnings and dividends rise faster when inflation is high, but this was not the case in the US during the 1970’s. Deutsche Bank show that over the last 50 years, while nominal returns on equity rose, real returns on equity actually fell.

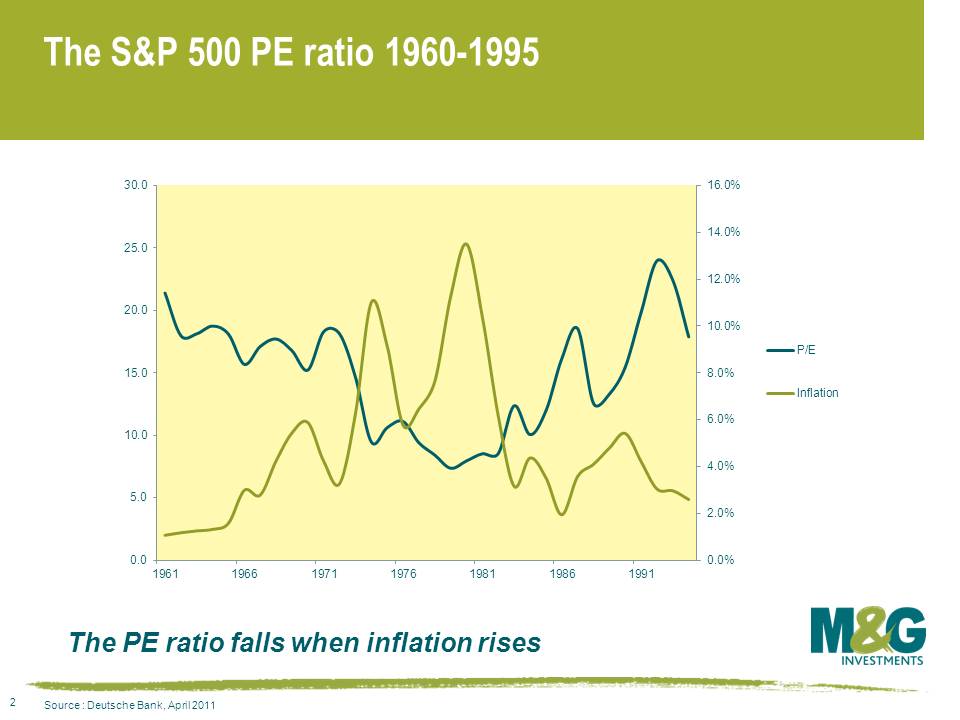

Deutsche’s research also shows that a fall in the PE ratio should be expected as inflation rises. For investors to be protected against inflation free cash flow would need to grow in line with inflation. If equities were a perfect inflation hedge, ceteris paribus, then the PE ratio should remain unchanged as the share price and corporate earnings increase in line with inflation. The article does suggest that inflation hedging with equities may be possible, but due to the depressed levels of PE it could prove to be more costly than expected.

Looks like bond investors and central banks aren’t the only ones that need to keep a close eye on inflation.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox