Corporate credit: might now be a good time to revisit exposures?

Don’t get me wrong, I am not sounding the death knell of the post QE (1) credit rally. But a couple of pretty important and recent developments have got me asking: should I be chipping away at some of the higher beta corporate bonds I own?

Let’s start with the good news. Companies broadly are in fantastic fundamental positions, having responded to the crisis by cutting costs and debt and building up cash, and then subsequently by taking advantage of ultra low interest rates by borrowing for the long term. These strong fundamentals have not only led to very low default rates, but also augur for continued low default rates in the future, on account of the very low financing costs many of them have for the next 5, 10 or even 30 years. (I am not, here, talking about banks!)

Along with the above strength in companies’ balance sheets though, we have witnessed unprecedented amounts of monetary and fiscal policy stimulus. Both of these combined have served deliberately, substantially and artificially to support aggregate demand and consumption. And let’s not forget that consumption still makes up close to a 70% share of our western economies. So, with companies in strong financial health, and with consumption supported by unheralded levels of low interest rates, tax breaks and handouts, it is little surprise that the result has been nothing short of a nirvana for corporate credit.

But is this set to change? Austerity measures are starting to bite here in the UK. And in Europe interest rates have begun their upward trajectory (and there looks, from where I’m sitting, to be a pretty good chance of another hike in July, or not long thereafter). All over the West the extraordinary policy stimulus is starting to be withdrawn, albeit rightly at an incredibly tentative pace. And even though we are only a few months into this process, economic data has turned negative, fast (see Mike’s blog). Government bond markets in the US, Europe and the UK have watched this data in horror, and have started to rally again as the growth picture worsens.

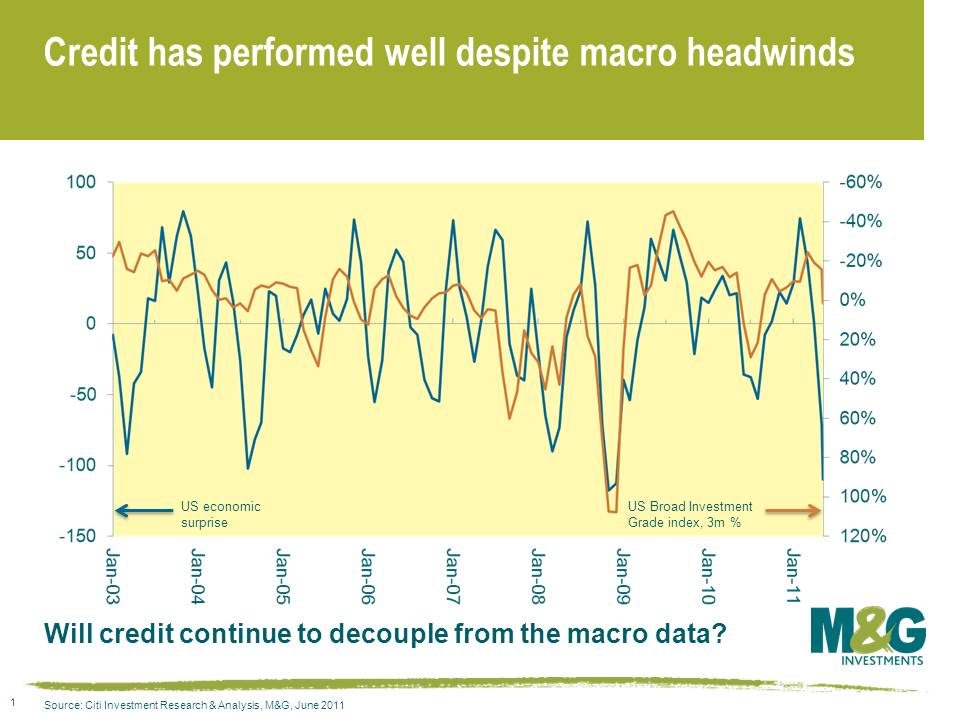

Corporate credit, though, has remained remarkably resilient, only moving a few basis points wider whilst the data has turned negatively, and whilst the government bond markets have rallied substantially. This is illustrated in the following chart, which maps the economic surprises index Mike blogged about recently over broad investment grade credit spread performance.

*our thanks go to Hans Lorenzen at Citi Investment Research and Analysis for this slide.

If, as I do, you worry about the macroeconomic picture in a world where interest rate rises, government spending cuts and higher taxes are all detrimentally impacting consumption and economic growth, then perhaps there is a good chance that investment grade credit has to start to react to the change in the economic releases? But which way? If credit is still too cheap and spreads too wide, then a worsening macroeconomic picture could see a flight to quality out of higher credit risk names into relative safe havens in the investment grade universe. However, if credit is not too cheap, there is a good chance a more bleak world order could see investment grade spreads sell off. In other words, it might not matter how strong companies are fundamentally, if people are not spending their money on their products or services anymore.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox