US economic data is falling off a cliff

The last month has been a horror show for the world’s biggest economy, and things are getting even worse if data released today is anything to go by. It seems that almost every bit of data about the health of the US economy has disappointed expectations recently. US house prices have fallen by more than 5% year on year, pending home sales have collapsed and existing home sales disappointed, the trend of improving jobless claims has arrested, Q1 GDP wasn’t revised upwards by the 0.4% forecast, durables goods orders shrank, manufacturing surveys from Philadelphia Fed, Richmond Fed and Chicago Fed were all very disappointing. And that’s just in the last week and a bit.

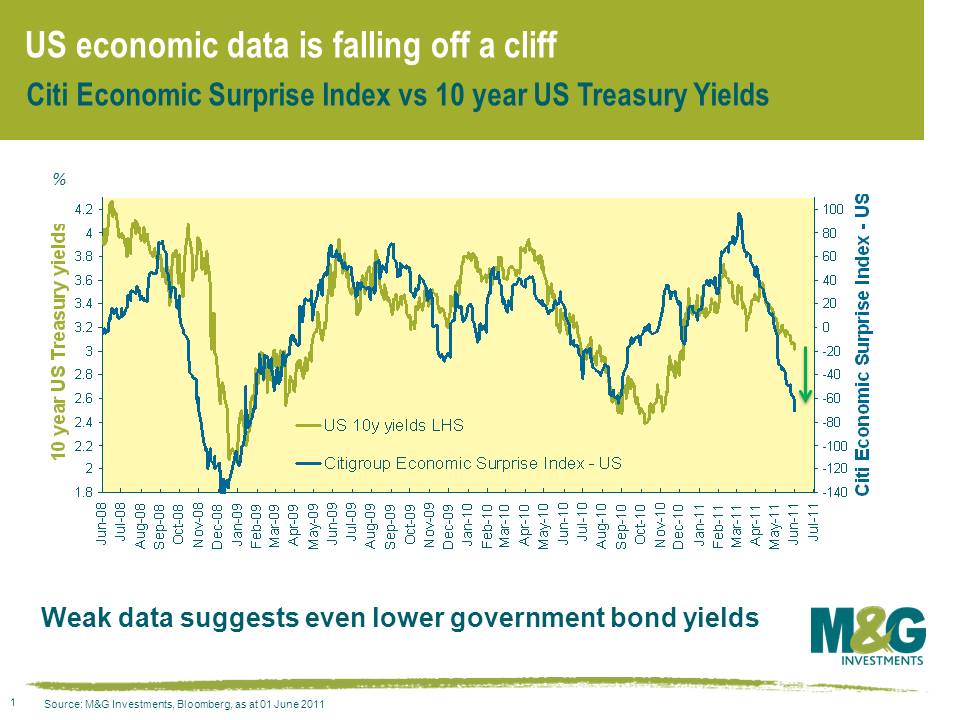

The string of disappointing economic data can be captured in the Citigroup Economic Surprise Index for the United States. A reading above zero reflects a positive economic data surprise, while a reading below zero constitutes a negative surprise. The sharp swing from positive territory at the beginning of this year into negative territory is almost as bad as the collapse in economic data that began in October 2008.

I’ve overlaid the economic data surprise index with US 10 year Treasury yields (note that the surprise index data is as at the end of yesterday, so it doesn’t even include the pretty horrific ADP employment data and ISM manufacturing data from today). The correlation between the economic surprise index and Treasury yields is very close, so the lesson is that whatever your long term macro views are regarding hyperinflation vs deflation or the risk of the US defaulting (and I’m not denying any of these are possible), the reality is that if you want to have a view about government bond prices, the best thing you can do is look at the economic data to see what’s actually going on. And right now, the economic data is suggesting that however measly you may think a 3% yield is on a ten year treasury, the yield should probably be a fair bit lower given what’s going on in the US economy. You’ve also got to wonder at what point the markets for risky assets start noticing too.

QE3 anybody?

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox