A light in the storm – the German economic boom

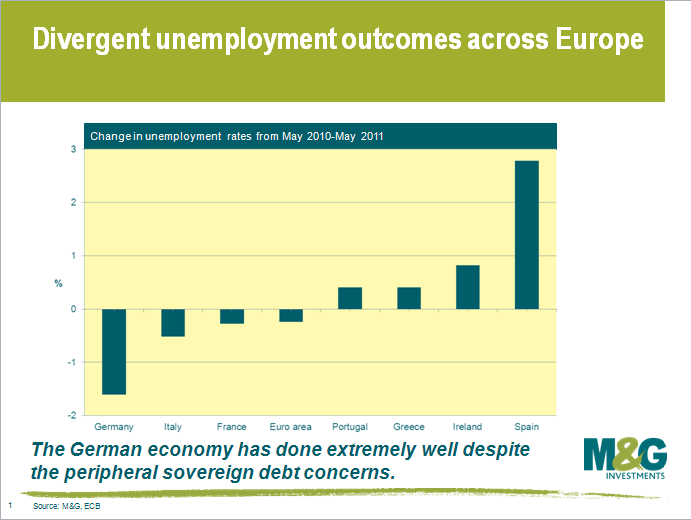

There is a shining light amidst the storm of the European sovereign debt crisis. Europe’s largest economy, Germany, is booming. Since June 2009, the German Federal Statistical Office has had the pleasure of notifying financial markets that the German unemployment rate has fallen. Today we received further confirmation of the strength of the German labour market, with the German unemployment rate remaining at a record low of 7.0%. This equates to a fall in unemployment of 11,000 in the month of July. In total, around 550,000 jobs have been created in the German economy since June 2009. Consequently, German consumer confidence is around record highs.

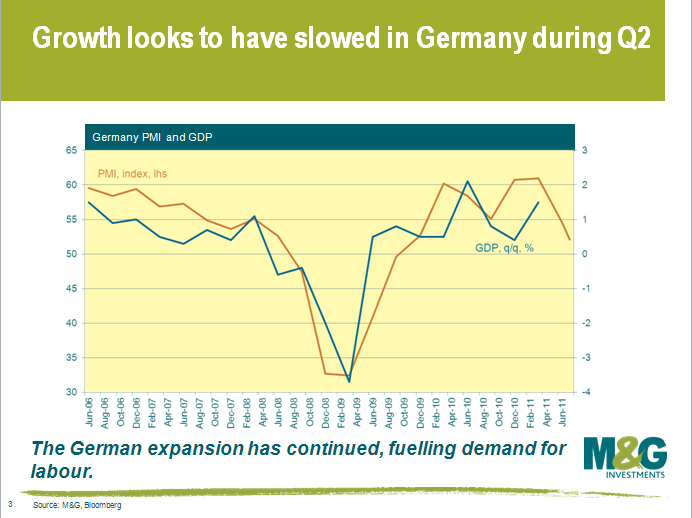

There are many reasons for the stellar performance of the German labour market. The German economy grew at 1.5% in the first quarter of 2011, or 4.9% over the year. Importantly, the growth numbers were mainly underpinned by strong domestic demand. Initially, the fall in the euro due to concerns over peripheral Europe provided the conditions for a boost in German exports. Now, the growth base has broadened, with domestic investment and consumption becoming increasingly supportive. It is our view that without the euro currency in place, the German Deutschmark would be the strongest currency in the world, German bunds may have negative yields, and the German economy would probably be in recession. The Swiss are experiencing this phenomenon through the strong appreciation of the Swiss franc in recent times. Is the Swiss franc a new safe haven?

Of course, GDP is entirely backward looking. It is important that we also assess what the forward looking indicators are telling us as well. German business surveys are a good place to start. Despite the current concerns, German purchasing and manufacturing indices (PMIs) for both the manufacturing and services sector continue to suggest that the expansion of the German economy continued in Q2. It isn’t the stellar growth experienced earlier in the year, but a growth rate of around 0.5% in Q2 isn’t too bad considering the concerns around Greece. Despite the worries, the Ifo business climate and expectations index both suggest that the German corporate sector is in a relatively good mood. German firms are telling us that they are planning on spending record amounts on capital expenditure and investment in the coming 12 months as indicated by the German DIHK business survey. Consequently, it is not unreasonable to expect that the German labour market will continue to improve in coming months as firms look to invest in profitable projects.

In a way, the strong German growth outcome is directly related to the peripheral sovereign woes. The euro is currently far too weak for Germany, which means that the German economy is extremely competitive, its economy is booming, and its inflation is starting to accelerate. This is why the ECB has been hiking rates and may hike again before the year is out. But the flip side of German growth is the utterly miserable growth rate in Southern Europe, which is because the euro is far too strong for these deeply uncompetitive economies. Fernanda Nechio, an economist at the Federal Reserve Bank of San Francisco, estimates interest rates based on a Taylor rule analysis for peripheral Europe and core Europe. Her analysis suggests an ECB target rate of around 3% for core Europe, and a target rate of around -3% for peripheral Europe. On the one hand, the ECB is hiking rates to tighten monetary policy for the stronger core European nations, and on the other it is retaining loose monetary policy by maintaining liquidity arrangements for the weak peripheral European banks.

Some might say, the German economic party is the result of the peripheral European economic funeral. The German public bailing out southern Europe is the cost that they need to pay for strong growth outcomes and rising standards of living. Bailing out peripheral Europe is like a tax that has until now been deferred. To quote Dolly Parton: “If you want the rainbow Germany, you sometimes have to put up with the rain”.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox