Oil prices and the impact on inflation linked bonds

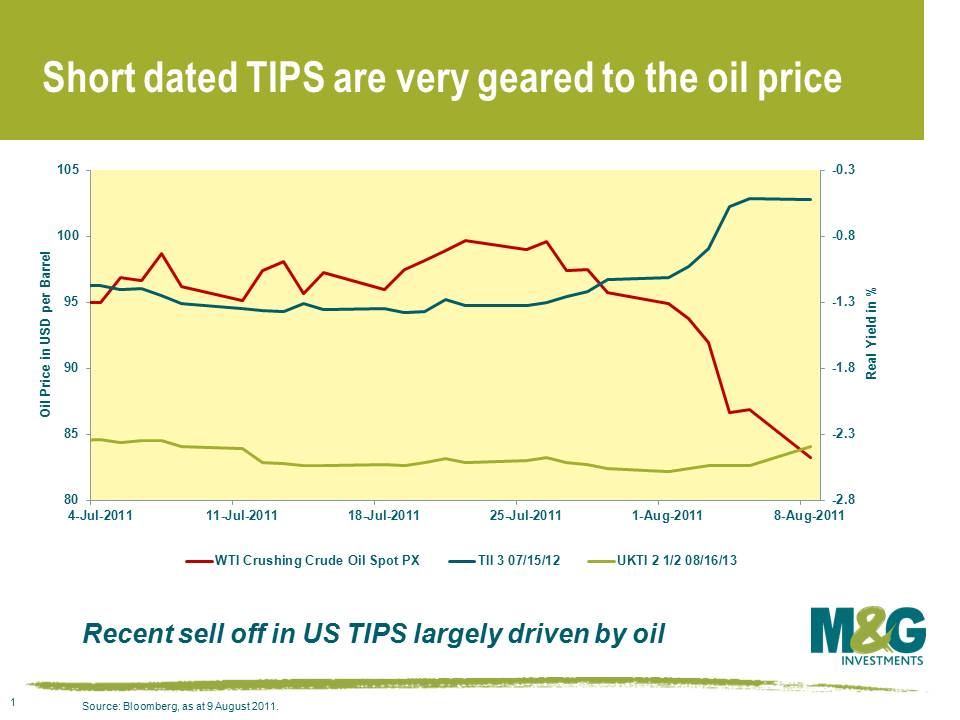

With a significant fall in the oil price (-28% since the end of April), inflation linked bonds are underperforming their nominal counterparts. The biggest impact though is in the US market, where TIPS yields have risen, especially at the shorter maturities. This chart shows that whilst short dated index linked gilt yields have edged up in the last couple of weeks, the yield on the 2012 maturity TIPS has risen aggressively.

Why are oil prices (both rising and falling) much more important for US inflation linked bonds than they are for those in the UK and Europe? It’s all about tax. In the UK, the duty rate for road fuel is the equivalent of £2.20 per US gallon, and VAT at 20% is charged on top of both the fuel and the duty. European taxes are similarly high (the Netherlands is especially high). In the US, federal tax is just 18.4 cents per gallon – adding in other state taxes, the average is 48.1 cents per gallon. So UK fuel taxes including VAT are about 10 times higher than those in the US. As a result, a rise or fall in the crude oil price impacts a much, much bigger part of the cost of a gallon of gasoline in the US than elsewhere, and therefore there is a more significant impact on the CPI as a result (both directly in the fuel element, and then subsequently through pass through costs to delivery drivers etc.).

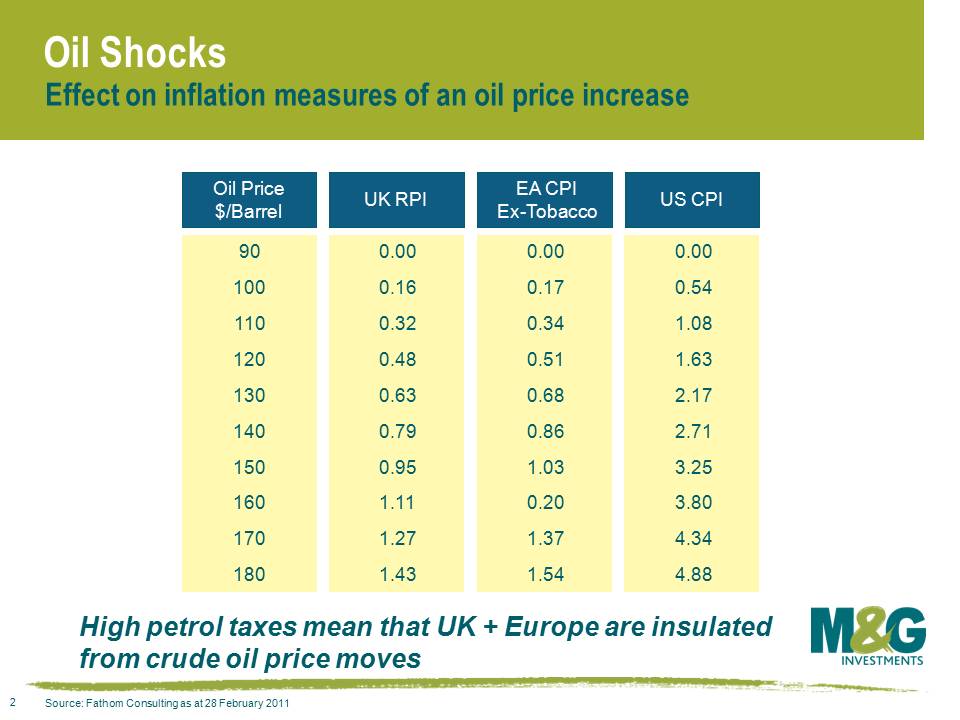

This chart shows the impact of oil prices rising up to $180 per barrel and shows the impact on UK, EU and US inflation rates. All other things being equal, a rise to $180 would add 1.43% to the UK RPI, 1.54% to EU CPI and a massive 4.88% to US CPI. So higher tax rates protect UK and EU consumers against inflation and inflation volatility – not sure they’d see it like that though…

Anyway, elsewhere, I read a review of a BBC2 Horizon programme called Do You See What I See? It looked at sporting results for teams that play in red and blue – there’s always been an argument that teams in red do disproportionately well – this looked at a study from the 2004 Olympics, where taekwondo results were analysed. In that sport, red and blue combat gear is assigned at random – yet the results showed that red won 2/3rds of the results. Better still, when the fights were filmed, and the colours reversed digitally, judges watching the recordings still awarded of the “red” fighters the bouts. Fascinating stuff – and congratulations Nottingham Forest (in red) on a stunning cup come back last night versus Notts County!

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox