Sell off in high yield markets provides a buying opportunity

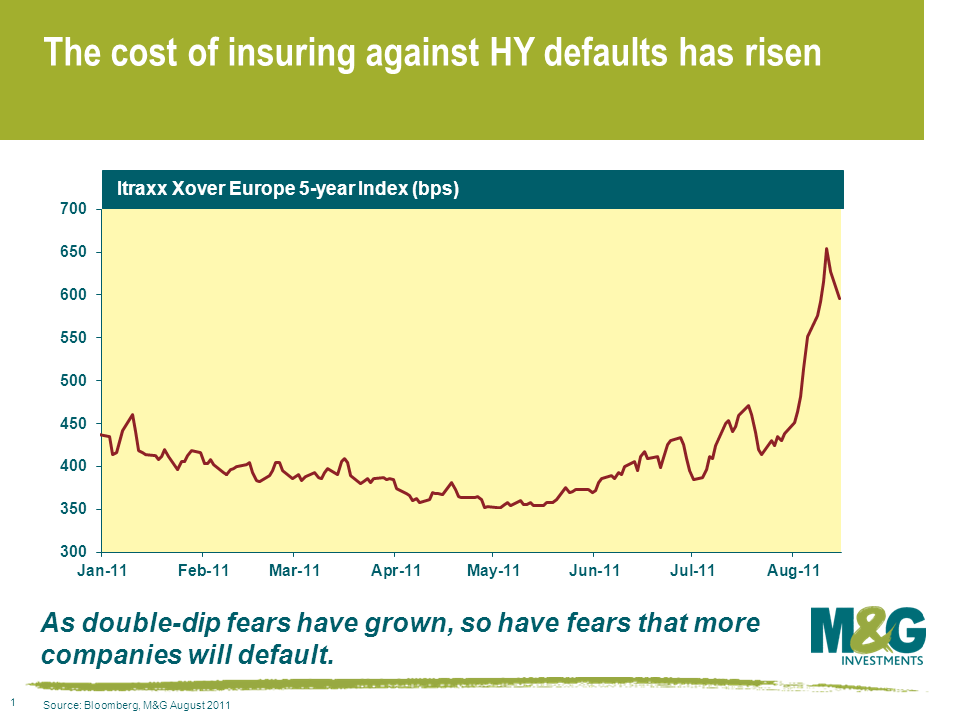

The price action in the high yield market has been brutal over the last few weeks. A very respectable year-to-date return of 3.8% as at end of June currently stands at -1.3% (according to the Merrill Lynch European Currency HY Index as at 15/08/11). That’s a significant re-pricing of risk. To put it in context, look at the iTraxx Europe Xover Index (for an explanation, see here). The most liquid vehicle in European high yield has seen spreads almost double from 350 in May to 595 today, and around 650 late last week. In other words, investors now require almost double the compensation for investing in the same 40 high yield names from three months ago.

Concerns around a stalling economic recovery & sovereign fears have seen investors redeem money in record amounts, forcing unprepared investors to sell indiscriminately into a very nervous buyer base. We’ve seen this sort of price action before – back in 2009, and it created some superb buying opportunities. Around $3bn of outflows were recorded in the US during the week to Aug 10th 2011, with the figure estimated to be around €600m in Europe. These are near record outflows respectively. Again taking the Xover Index as a proxy, the market is pricing in a default probability of some 42% (assuming a 40% recovery). Whilst this is some way shy of what the same index was pricing in at the nadir of the crisis, excluding CCC grade bonds, it is still pricing in a higher default rate than anything experienced in any five year period since 1970s.

Now I’d be a fool to call the bottom of the market here. If the global economy double dips, spreads will undoubtedly go wider again. Yet I am convinced that there are some bargains on offer. As James talked about in his recent blog, good old fashioned credit analysis is key. Where I can lend to sensibly capitalised businesses – with decent earnings prospects, strong liquidity, limited re-financing risk and good investor protection in the form of comprehensive covenants – I remain inclined to continue to do so. In a world where we expect interest rates to remain lower for longer, the 8-12% yields on offer from investing in senior secured paper issued by certain packaging and cable companies looks particularly attractive.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox