Government bond returns and “back door” QE policy

Journalists and financial commentators have been kept very busy this year. Market participants and investors have clamoured for information on debt ceilings, credit ratings, and restructurings. 2011 looks like a year that will go down in history as one of the most volatile on record.

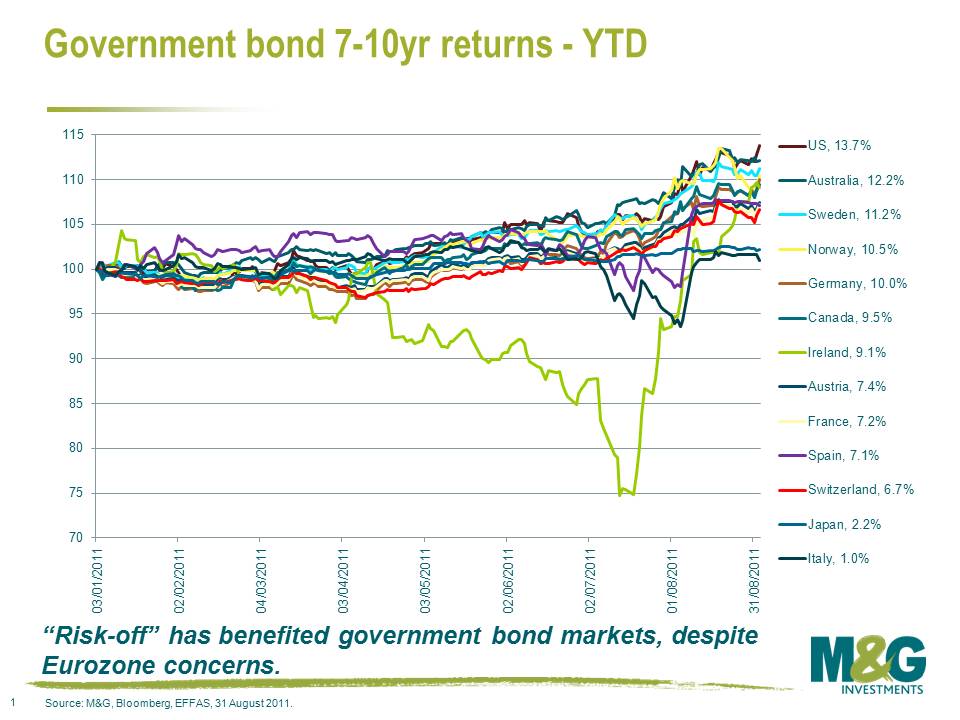

With that in mind, I thought it might be useful to focus on the actual returns within government bond markets over the course of the year. The below chart represents the total return of a 7-10 year bond index compiled by Bloomberg/EFFAS in local currency terms.

We found this analysis very interesting. Looking at the member nations of the EU, the German government bond market has been the top performer with a 10.0% return, followed by Ireland and Austria with 9.1% and 7.4% respectively. Investors in Italian government bonds have made 1.0% , despite a widening in Italian 5 year CDS from 240 to 450 basis points (currently equating to a 30% probability of a default event occurring in the next 5 years).

There are a couple of factors at play here.

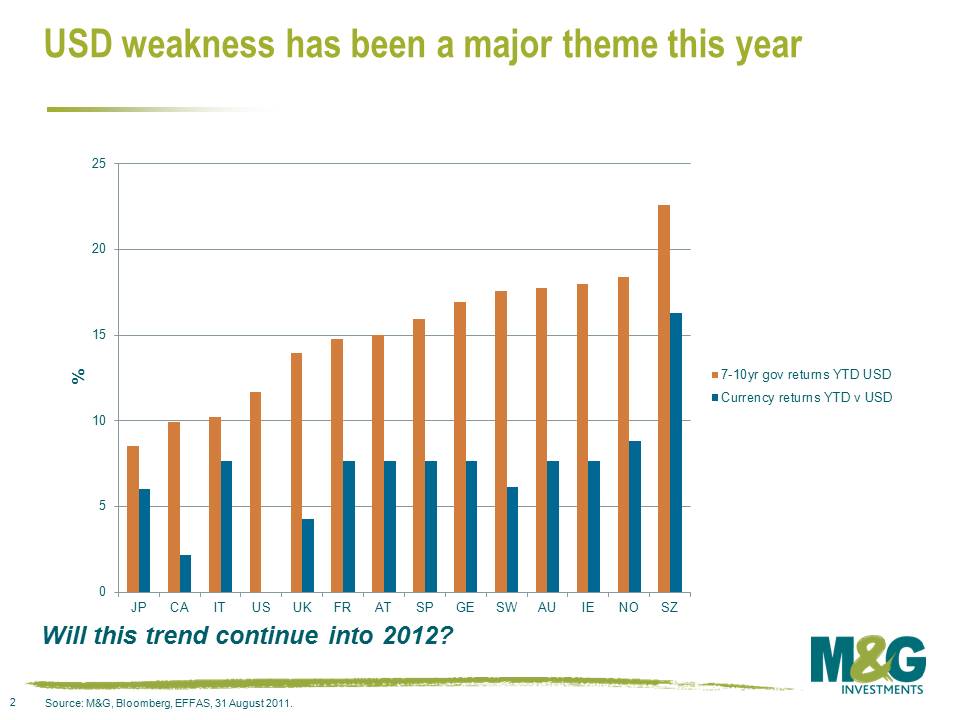

Firstly, all returns are local currency. Government bond yields are major drivers of currency, so the above chart could be capturing currency strength or weakness. In order to account for the currency impact, I have re-based the returns to the world’s reserve currency – the US dollar.

We now get a clear picture of a) the US dollar weakness versus most major currencies this year and b) the impact that an increase in risk aversion will have on the returns for government bonds. Clearly, Switzerland and Norway have benefitted from solid appetite for government debt and strengthening currencies versus the USD. Time will tell whether the Swiss National Bank’s intervention in currency markets will be able to be maintained without inflation becoming a concern for the SNB. Though there might be an easier way for the Swiss to benefit from a weak currency – join the euro.

Secondly, European bonds have performed very strongly this year, despite concerns over the ability of governments to fund themselves in capital markets. These returns show that Germany remains a safe haven of choice, despite concerns that it will have to backstop weaker peripheral European nations. This has resulted in Bund yields collapsing, and peripheral European sovereign bonds have benefitted from this (as they are priced off “risk-free” bunds, in a similar way that corporates are). Spreads on peripheral sovereign debt are wide, but absolute yields have fallen.

Finally, there is a big elephant in the room, and Jean-Claude Trichet is riding it. The ECB, through its Securities Markets Programme, spent €13.3bn on sovereign bond purchases last week which brought its total holding of Eurozone government bonds to €188.6bn. Having such a large buyer in the market is obviously keeping yields on European government debt lower than equilibrium levels. The big question that we are trying to digest is just how governments and policymakers can stimulate their economies without further extraordinary monetary policy measures. It looks to us like this has been a jobless recovery, consumers are hiding, and stimulatory fiscal policy can be ruled out due to heavily indebted governments.

Mike referred to QE3 in an earlier blog, and we are starting to think that the odds we might see QE10 in the US are rising. Top of the agenda at the Bank of England’s MPC meeting will be whether it should deploy more QE. As for the ECB, it may well be forced to provide “enhanced credit support” (also known as “backdoor QE” here on the M&G bond desk) for the remainder of 2011.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox