The US: living in a lower population growth environment

The 2000s were the slowest decade of population growth in the US since the Great Depression. The first set of state population counts for 2011 revealed that there has been no change to this trend. The US experienced the lowest annual population growth rate in 2010-11 since 1945.

William H. Frey concludes that the weak labour market in the US appears to have slowed down immigration to the US and to have led to a decline in birth rates. What is more, the baby boomers have passed their prime years for childbearing, affecting the natural increase of population. He has also observed a slow down of internal migration within the US as a consequence of fewer job opportunities across the country. Furthermore, the housing sector in the US is still under water. It remains difficult for a large share of the population to sell houses and raise capital. That makes it unaffordable for many Americans to pursue job opportunities elsewhere in the country.

What could follow economically from this demographic trend? Lower population growth will lead to an increase in the dependency ratio. More people will live on state pensions, and government spending on health care will increase. At the same time fewer workers will pay taxes and, consequently, negatively affect government revenues. The talent pool of skilled workers will shrink which might decrease economic competitiveness. Companies might have to pay higher wages due to lesser competition in the labour market. In the end, it could incentivise companies to look into outsourcing production or relocating business, which would also decrease government revenues.

It is fair to say though that this demographic trend of lower population growth might turn out to be only a relatively short episode in US history, just like after the Great Depression. The US economy might also prove to be able to maintain its high level of competitiveness and to continue to sufficiently attract talent as well as to improve productivity.

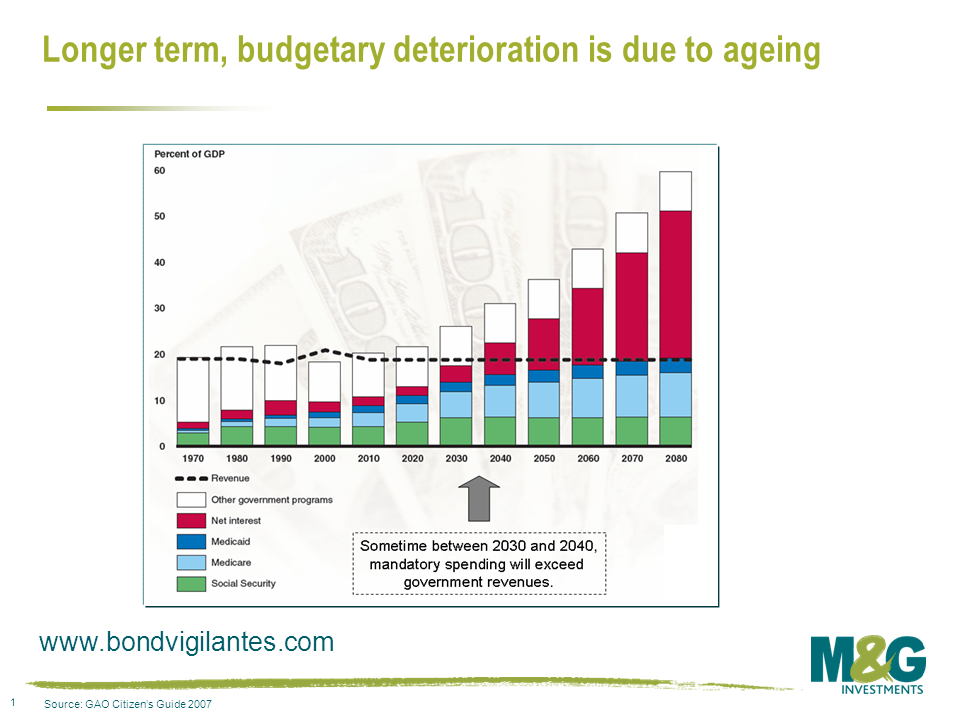

If not, government spending and/or tax benefits might need to be increased to support the economy and to maintain the current standard of living. Costs for social security and healthcare will inflate significantly at the same time. The negative impact on the US debt dynamics is striking. According to an estimate from 2007 that was available to us, mandatory spending composed of contributions to Medicare, Medicaid and social security as well interest payments will exceed government revenues between 2030 and 2040. This estimate stems from a time before the financial and sovereign debt crises corrupted US politics as well as the economic prospects of many US citizens.

What we also have to bear in mind is that potential GDP growth is traditionally considered being a function of population growth and productivity growth. I leave it open for debate how likely it is that future productivity growth will offset the lower population growth. In a gloomy scenario, lower population growth could prove to be not only the consequence of economic struggle, but also its future catalyst.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox