Three handles

Last week conventional gilts of all maturities briefly traded – but failed to close – below the 3% level. The continuation of the gilt bull market has now reached an important psychological level, with the ascendant bulls seeing a 3% yield as a barrier to be overcome before the yield continues to grind lower, while the gilt bears are hoping that the 3% yield barrier (the 3 percent handle) will not be breached. We discussed this change of big figure yield (change of handle) in a previous blog where the four handle was lost. Sadly the Two Ronnies didn’t write a 3 handle sketch, but if they had we imagine a 21st century version could have gone something like the below.

In a hardware shop. Ronnie Corbett is behind the counter, wearing a warehouse jacket. He has just finished serving a customer.

CORBETT <muttering>: There you are. Mind how you go.

(Ronnie Barker enters the shop, wearing a scruffy tank-top and beanie)

BARKER: Three Candles!

CORBETT: Three Candles?

BARKER: Three Candles.

(Ronnie Corbett makes for a box, and gets out three candles. He places them on the counter)

BARKER: No, three candles!

CORBETT <confused>: Well there you are, three candles!

BARKER: No, three kindles! kindles for reading!

(Ronnie Corbett puts the candles away, and goes to get 3 kindles. He places it onto the counter)

CORBETT <muttering>: Candles. Thought you said “three candles!’ (more clearly) Next?

BARKER: Got any pods?

CORBETT: Pods. What kind of pods? iPods, pea pods?

BARKER: iPods,

CORBETT: How many?

BARKER: Three

CORBETT: black, red, green, purple, pink, orange, rainbow, mauve, tangerine, white

BARKER: White

CORBETT: White iPods

BARKER: 3 iPods white

(Ronnie Corbett gets out a box’s of iPods, and places them on the counter)

CORBETT (pulling out three different sized iPods): What size?

BARKER <looks puzzled>

CORBETT: What size 16gb, 32gb, 64gb? what size?

BARKER: Six foot six

CORBETT; Six foot six!

BARKER: High pods for working in, high white pods

CORBETT <muttering>: It’s pre-fabricated high workstation pods, we call them, in the trade. Work pods!

(He puts the box away, struggles with three huge boxes, and places them on the counter , then puts the iPod box away)

BARKER: Pads

CORBETT: You’re ‘avin’ me on, ain’t ya, yer ‘avin’ me on?

BARKER: I’m not!

CORBETT iPads , you mean iPads

BARKER: Pads

CORBETT <getting really fed up>: Padded soft eye pads, or skinny hard iPads?

BARKER: Soft eye pads

CORBETT; <double checking> Two or three!

BARKER; <looks down quickly quizzically> Two.

CORBETT <muttering, as he goes down the shop>: Eye pads. See any eye pads? (He sees a box , and picks it up) Tidy up in ‘ere.

(He puts the box down on the counter, and empties it aggressively)

BARKER: (picks them up, and looks at them, puts them back on the counter). Bit small.

CORBETT; Bit small, bit small, what do you men a bit small!

BARKER: Soft high pads fer me knees! For when I’m gardening!

CORBETT <almost at breaking point>: You are ‘avin’ me on, you are definitely ‘avin’ me on!

BARKER <not taking much notice of Corbett’s mood>: I’m not!

CORBETT: (He takes back the eye pads , and gets a pair of high gardening knee pads, and places them on the counter) Go on give it your best shot!

BARKER: Washers!

CORBETT <really close to breaking point>: What? Dishwashers, floor washers, car washers, windscreen washers, back scrubbers, lavatory cleaners? Floor washers?

BARKER: ‘Alf inch washers!

CORBETT: Oh, tap washers, tap washers? <He finally breaks, and makes to confiscate his list> Look, I’ve had just about enough of this, give us that list. <He mutters> I’ll get it all myself! (Reading through the list) What’s this? What’s that? Oh that does it! That just about does it! I have just about had it! <calling through to the back> Mr. Jones! You come out and serve this customer please, I have just about had enough of ‘im. He wants to buy a gilt yielding more than three percent!

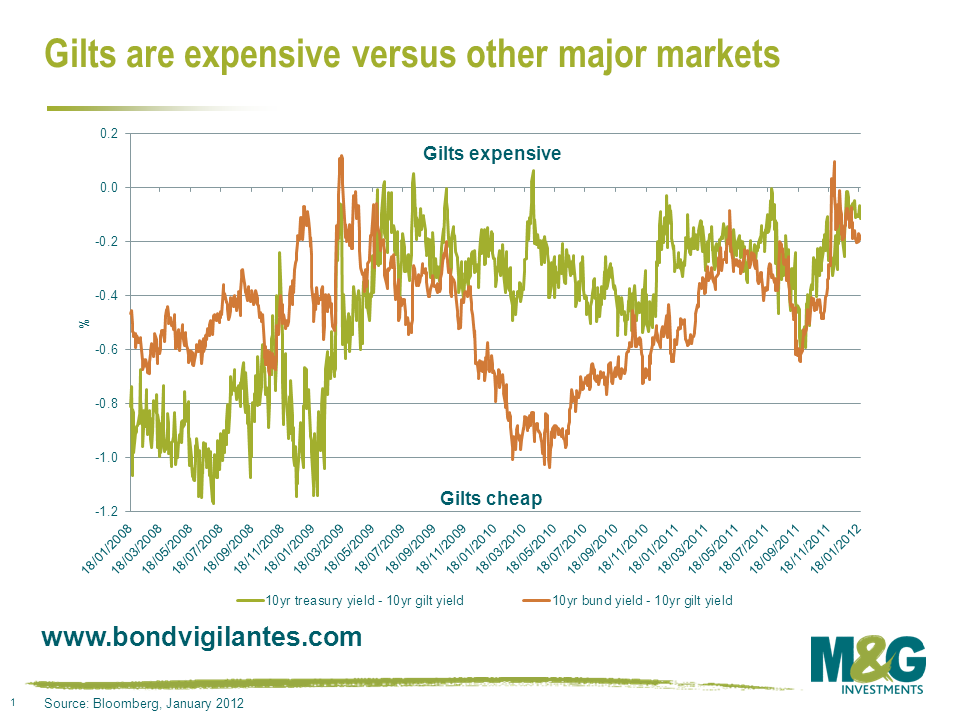

Looking at the gilt market on an absolute yield basis, 3% is a crucial level. The question is, which way will gilt yields go? As fund managers we also think in relative terms when we ask ourselves a question like this. Looking at gilts versus other large high quality government bond issuers like the US and Germany, gilts look expensive.

They are also historically expensive versus current inflation and equity valuations. Therefore from a fundamental basis gilts look relatively dear which will satisfy the bears, while the bulls will point to further quantitative easing as the one reason why gilts can continue to rally from here.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox