The Bank of England should cut rates rather than make state run Halifax hike mortgage rates

I had lunch last week with a Bank of England MPC member, and I asked him why the Bank didn’t cut rates below 0.5% in order to help the banking sector improve its Net Interest Margins (NIMs) and thus its capitalisation. The MPC member replied that it was a matter of record that the Bank had discussed a rate cut in the Autumn but rejected it because of some technical reasons around the operations of the money markets (which nobody seems able to fully explain) and because the feed through into the banks’ funding costs would likely be limited.

I disagree that there would be no benefit in a Bank rate cut, and the news this weekend that Halifax is raising its mortgage rate from 3.5% to 3.99% for 850,000 Standard Variable Rate (SVR) mortgage borrowers will help show why. Halifax (HBOS) needs to improve its margins and become profitable before it will be able to increase its lending to the UK economy and slow its delevering. The method it (the state?) has chosen to improve its margins is to raise the interest burden on UK consumers (by 14% to those on the SVR). This is a zero sum game to the UK economy (consumers lose by the amount that the banks gain – there might even be a negative multiplier effect as the banks use their gain to delever whilst the consumer stops spending to the extent of their loss?), whereas if the Bank of England cuts rates (to near zero) many of the funding costs that directly impact HBOS, including LIBOR and 5 year interest rate swap rates would also fall. HBOS wouldn’t need to pass on these rate cuts to customers, but the mortgage borrowers are not worse off, and the banks have improved their margins. So the Bank of England should cut rates later this week – the impact will of course be relatively small as we reach the “zero bound”, but it is probably more certain in its effectiveness than a theoretically equivalent amount of Quantitative Easing.

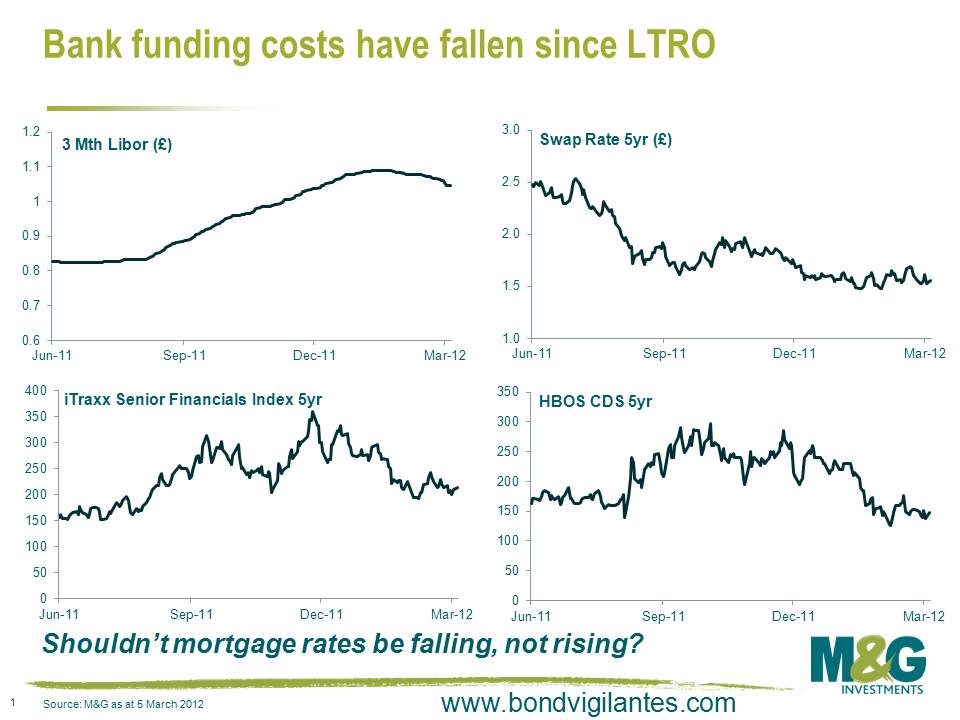

Finally, the papers I read this weekend talking about the Halifax SVR rate increase said that the reason for the hike was due to increased funding costs in the wholesale markets. But is that true? I’ve put 4 charts together here. They show that 3 month LIBOR rates (a measure of short term money market costs) have fallen year to date (albeit marginally), that 5 year swap rates (a measure of fixed rate mortgage funding costs) remain around record lows, and that senior CDS spreads for both European banks in general and HBOS specifically are both much lower than their 2011 Q4 highs. So if anything, since the ECB announced its 3 year LTRO facilities, the both cost of funding and the availability of liquidity for the banking sector have improved – and mortgage rates in an ideal world should be falling.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox