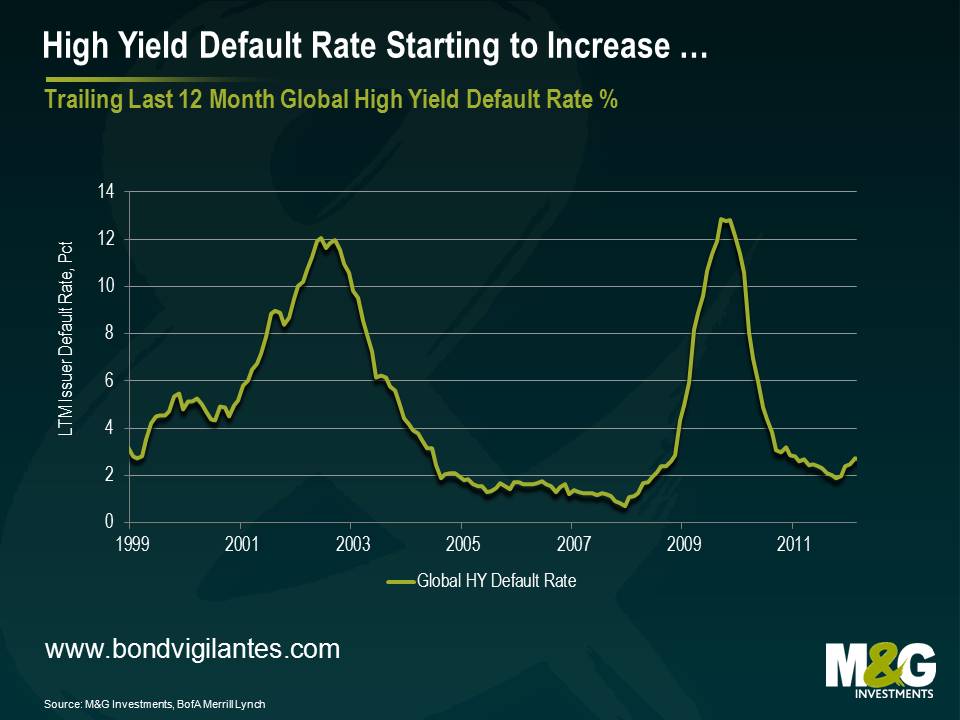

High Yield Default Rates Finally Starting to Rise

Default rates for high yield bonds have started to rise from a low level over the past few months. The trailing last 12 month default rate for Global High Yield was 2.7% in April, having bottomed out at 1.8% in October 2011 according to data from Bank of America Merrill Lynch. This in itself is not unexpected as default rates were running at historically low levels, helped by very loose monetary policy, markets that were willing to refinance many companies and some positive underlying earnings growth.

How far default rates will rise from henceforth is the real question. Some of the elements that helped keep default rates low over the past 2 years are unsustainable or unrepeatable. For instance the huge fiscal easing from many of the G8 economies that spurred a lot of the bounce back in 2009 is not an option available to many governments today. Likewise, underlying earnings growth in today’s world of austerity and uncertainty is much harder to come by. Finally, whilst the credit markets are willing to finance good businesses with sensible balance sheets, it’s far more discriminating when it comes to businesses that are struggling to grow or have too much debt.

How far default rates will rise from henceforth is the real question. Some of the elements that helped keep default rates low over the past 2 years are unsustainable or unrepeatable. For instance the huge fiscal easing from many of the G8 economies that spurred a lot of the bounce back in 2009 is not an option available to many governments today. Likewise, underlying earnings growth in today’s world of austerity and uncertainty is much harder to come by. Finally, whilst the credit markets are willing to finance good businesses with sensible balance sheets, it’s far more discriminating when it comes to businesses that are struggling to grow or have too much debt.

The bottom line is that we think the next few years will be a tough environment for highly leveraged issuers and that in the absence of a dramatic pick up in growth or a very dramatic policy response (full Eurozone QE and Eurobonds anyone?), bearing in mind the huge range of potential outcomes in the European economy, our best guess is that default rates in the European high yield market will average 6% per annum for the next five years.

One area of the market which could see a marked impact is the short dated or short duration high yield strategy. This type of strategy has performed very well in the past few years in terms of providing reasonable returns but with much lower volatility than conventional high yield strategies. The benefit of a low default rate over the past 2 years has been a key element of this performance. However, as the number of defaults starts to increase, this following wind will disappear and the scope to deliver similar levels of risk adjusted returns becomes much harder. At the end of the day, your downside risk in a default is the same if you hold a 2 year bond or a 10 year bond.

The good news is that valuations in the broader high yield markets already compensate you for a default rate of a little over 8% p.a. over the next 5 years, so there is already a lot of bad news in today’s prices. There are also many ways to mitigate the risks of default when taking on high yield risk (active stock selection, sticking to defensive industries and focusing on regions that have healthier economies for instance). Nevertheless, as default rates start to rise, we think investors need to tread with a degree of caution.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox