Office of National Statistics or Office of National Savings? The Future of the UK’s RPI-CPI wedge

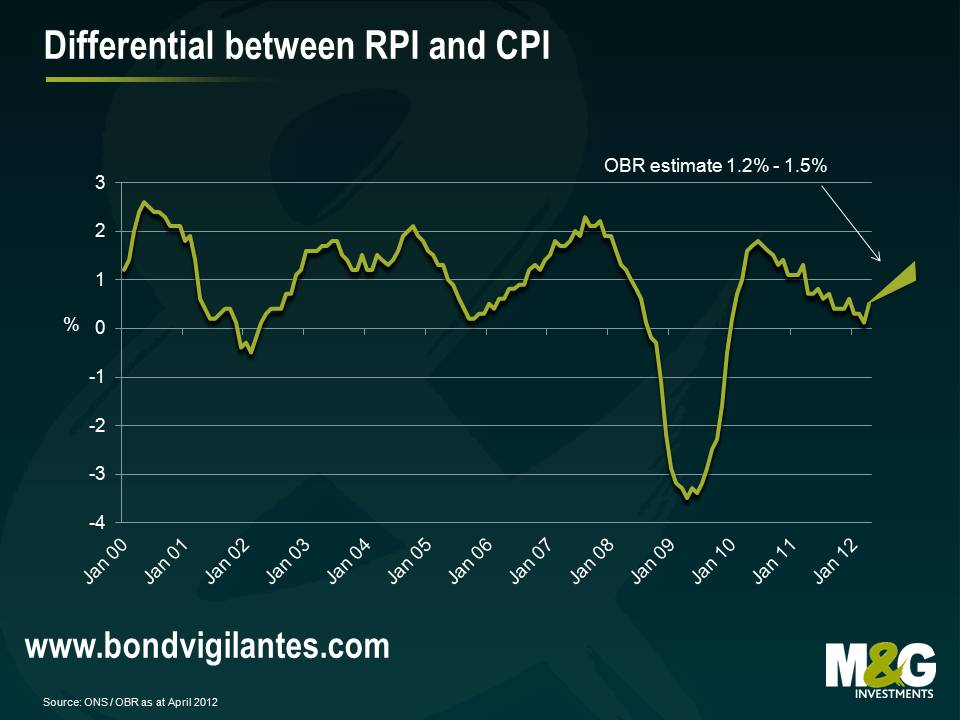

There has at almost all times been a ‘wedge’ between RPI and CPI, given different calculation methodologies (arithmetic mean vs geometric mean, respectively), different items within each, and different weights of these different items. The long term difference has on average seen RPI at 0.5% to 0.8% more than CPI. Recent changes, though, saw the wedge widen in 2007 to more than 2%, and to almost 2% again in early 2010.

What are these changes? RPI is a much older index, originally conceived in the early 20th century to track the effect of price moves on workers during The Great War, using less up to date and less relevant averaging calculations and, arguably in some cases, weightings and items. CPI was not developed until much later, in 1996.

Since the coalition’s formation we know that the government has been attempting to change certain future liabilities’ (eg public sector pensions and benefits) indexing from RPI to CPI. Why? Simply, because this wedge of RPI over CPI means over the long term it is more expensive for the government to pay RPI than CPI. And given the long duration of these liabilities, the present value and so budgetary impact today of such changes are extremely powerful in terms of delivering on austerity. From a rather different perspective, that’s why there has been so much resistance to these changes on the part of public sector workers, amongst others.

The ONS is the body that is responsible for the classification, collection and measurement of these compensation indices – no mean task I hasten to add. We have heard much in research notes and certain press articles in recent weeks about the ONS undertaking a project to eradicate the wedge entirely! What would this mean for us as investors? It would be less attractive to own UK linkers, as inflation as defined by RPI would be structurally lower than it has been. The breakeven rate (the rate between nominal gilt yields and index-linked gilt yields) would fall, meaning that index-linked bonds would underperform nominal bonds. This would be especially so at the long end, where the price or present value impact would be felt most.

I can think of 5 strong arguments against such an assault on the wedge:

1.To eradicate the wedge altogether would be tantamount to an event of default, especially if this is specifically to eradicate the structural difference between the two indices! We bought these securities on the basis that we would be paid RPI, which we know changes in terms of items and weightings on an annual basis, but according to changes in spending habits rather than Government policy. That’s fine! But the index is based on an arithmetic mean and always has been, and so will (almost always!) be higher than an index calculated according to a geometrically calculated mean. To change this, willingly and knowingly, with the purpose of reducing future outgoings of index-linked borrowing cashflows feels very similar to the altering of the War Loan’s coupon from 5% to 3.5% in 1932, or to the Greek PSI exercise of coercive write-downs, neither of which, arguably, were ‘defaults’.

2. The Statistics and Registration Service Act that covers changes to RPI states that any changes to the index must be carried out in consultation with the Bank of England as to whether the changes are fundamental and materially detrimental to holders. If the BoE decides that both of these conditions are met, then the changes to RPI cannot go ahead without prior approval of the Chancellor. Well, given the changes Mr Osborne has been trying to make elsewhere in his search for austerity, might he simply approve the changes in the index? Well this would not be without significant risks, electorally, and it would have a fundamentally and materially detrimental impact on the ability of the DMO to borrow through the linker market, which we will touch on in a moment. But perhaps it would be open to legal challenge? Consideration of this last issue involves looking into the contractual protections embedded within the old-style 8 month index-linked gilt prospectuses. It turns out that these documents state that if both the conditions of a change to the index above are met in the opinion of the BoE, HMT will inform bond holders of this, and offer them the right to redeem their stock. So the next issue for holders is: at what price can I put my bonds? The prospectuses state that “the amount of principal due on repayment and of any interest which has accrued will be calculated on the basis of the index ratio applicable to the month in which repayment takes place”. Thus, in current markets, with substantial negative real yields, the protection provided in these old style bonds is not sufficient to compensate holders fully, as it only pays accrued inflation. As a result of this, holders are going to be very sensitive to any chatter about substantial changes to the index. And this will have pretty major consequences. For instance, looking at the 4.125% gilt linker of 2030, the current price of the bond (given by current accrued RPI relative to RPI at the date of issue, along with future assumed inflation of 3% per year, positive real coupons, and negative real yields) is 316.5. To take this bond and assume we put the bond in the event of a change to the RPI, we multiply par (100) by the index today (242.5) over the base RPI at issue (135.1) to arrive at a price of 179.5. A holder would be set to lose 137 points, or 43% of the bond’s current value!

3. It would also serve to ruin the RPI linker market, at least for a long while. The uncertainty from recent headlines cannot be helping sentiment among the linker buyer base at the moment, and this has been an extremely important source of funding for our high levels of borrowing in the UK in recent years. It would be unwise to annoy these buyers, as it will only serve to increase the costs of issuance (through demanding higher real yields), irrespective of the final outcome of the ONS’ project to lower the paid level of inflation. Indeed, this begs the question as to whether to make the change to linkers from the perspective of our financing position would be to shoot ourselves in the foot?

4. The ONS states on its website under its ‘Vision and Values’ that: “Our mission is to improve understanding of life in the United Kingdom and enable informed decisions through trusted, relevant, and independent statistics and analysis” (my emphasis added). To target the structural and total eradication of the RPI-CPI wedge would in my opinion clearly be an impeachment of its independence, and would see huge criticism about the political motivations of such a change in the index. This could perhaps lead to legal challenge.

5. Could this not be interpreted as an attempt to specifically and deliberately conceal high levels of headline inflation, Argentina style? Or, if not, to artificially and deliberately manage UK inflation down? It is not just pensions and benefits that are linked to inflation, but wages and commercial contracts, which all have significant impacts on the economy’s overall level of inflation. To change the major index underlying all these contracts from RPI to CPI (the logical equivalent of making RPI CPI) would be to manage inflation down, at a time when so many are concerned about stubborn inflation in recent years, as well as the effects of super-accommodative monetary policy on future inflation. What would this tell us about our politicians’ and policymakers’ inflation targeting attitudes and indeed capabilities?

As a result of these arguments, I personally find it difficult to believe that this is the intention of the ONS or of its project to examine the wedge. I believe instead that the review is targeted at removing some of the anomalous sources of the wedge, which resulted, in no insignificant part, from a change in measurement that took place in 2010 that particularly impacted the wedge between RPI’s clothing price level and CPI’s clothing price level.

Indeed, the clothing and footwear components of RPI and CPI alone represented 60% of the total wedge between the two indices! This kind of change would be justifiable in my opinion. Anything else would at best be ill-advised, and at worst would be mismanagement on a major scale.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox