Peripheral corporate bonds and mass downgrade risk

Staying with the Bon Jovi theme, ‘Ugly’ was a track released by Jon Bon Jovi on his second solo album in 1998. It isn’t well known, or any good for that matter, but it does aptly describe the price action of Spanish and Italian corporate paper of late.

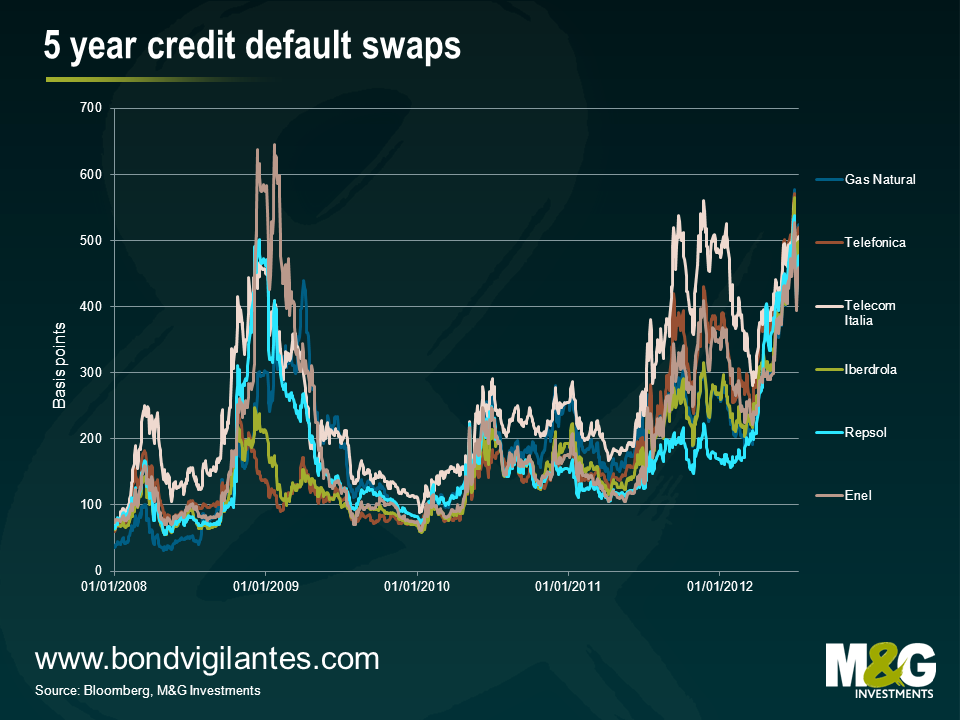

Plenty of attention has been paid to the yield on Spanish and Italian govies – currently around 7% and 6% for 10-year bonds – but their bellwether non-financial corporate issuers have also seen their yields come under significant pressure. 5-year CDS levels for the likes of Iberdrola, Gas Natural, Repsol and Enel are trading near their all-time wides at 500, 525, 475 and 455 bps respectively. And it isn’t just the utilities that have come under pressure: Telefonica and Telecom Italia have also seen their risk premia balloon to over 500bps. (see chart 1)

Whilst the aforementioned companies are still rated investment grade – some by many notches – they are actually trading wide of the Merrill Lynch BB Euro High Yield Non Financial Index (current asset swap of +440). Put another way, the market does not believe that these businesses represent investment grade risks.

Such a view isn’t without logic. The current ratings for the largest Spanish and Italian non-financial issuers (see chart 2) suggest that the market is right to be nervous. On average, the four largest Spanish issuers are only two notches above high yield status; for Italy’s five largest issuers it’s about three notches. That may seem like a fair bit of runway until you think about the pace of downgrades suffered by their sovereigns of late. Keep in mind that as late as July 2011 Moody’s rated Spain at Aa2, seven notches higher than its current Baa3 rating. Italy has also seen its rating cut a full four notches between June 2011 and Feb 2012 by the agency. And S&P hasn’t been much kinder, slashing Spain’s rating from AA- to BBB+ in under a year and reducing Italy from A+ to BBB+.

Both Spanish and Italian corporates saw negative rating actions as a consequence of those sovereign downgrades. Moody’s allows non-financial corporates a maximum two-notch rating uplift versus the sovereign, whereas S&P permits a maximum of six in extremis, with a couple of notches uplift far more common. The impact on Greek and Portuguese corporate bonds – such as EDP, OTE and Portugal Telecom – after their sovereigns lost their investment grade status serves to reinforce the potentially significant relationship between sovereign and corporate credit ratings.

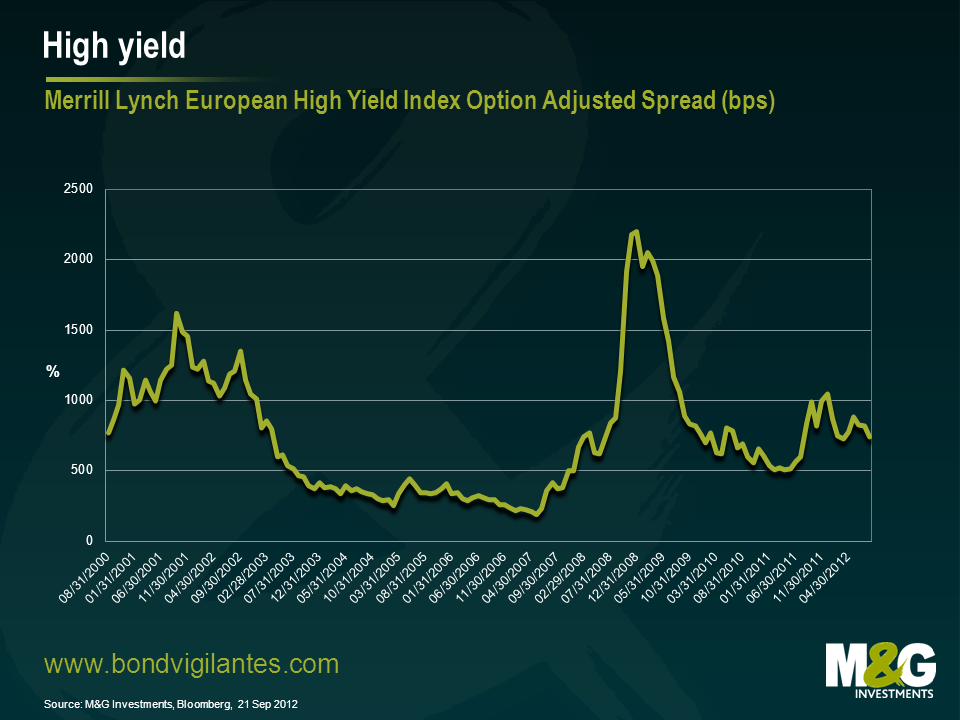

So, in a hypothetical mass downgrade scenario what quantum of debt could be downgraded to high yield? If all Italian and Spanish non-financial paper were eventually to lose its investment grade status, we calculate that €47bn nominal of Spanish paper and €59bn nominal of Italian paper could fall into high yield territory. That would be a massive €106bn worth of paper – or 80% of the existing non-financial Euro High Yield index – heading into the high yield market. That’s a lot of paper for it to swallow.

Of course, the actual amount of debt that would end up for sale is difficult to quantify. This would depend, among other things, on index rules and investors’ willingness and ability to hold high yield bonds. However, it seems reasonable to assume that over the coming months and even years a significant amount of paper will need to find a new home. Yields may well have to climb further, potentially a lot further, before traditional high yield investors see value in these names.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox