Fallen Angel Delight – looking at returns from “junked” companies

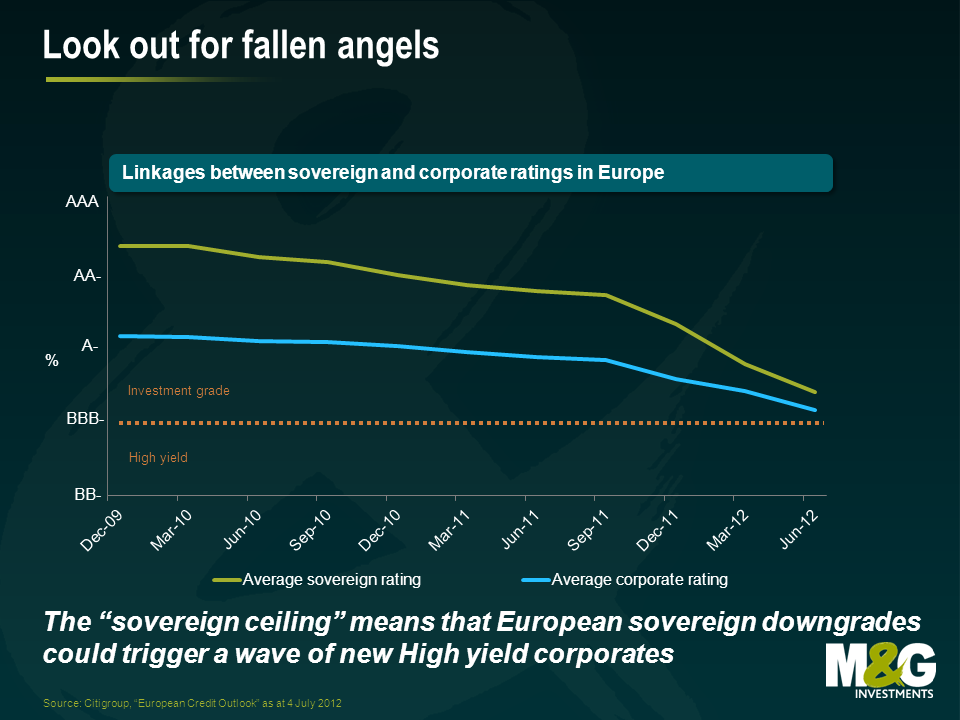

Earlier this year, Stefan highlighted the potential for sovereign debt downgrades to push big European companies into high yield territory becoming “fallen angels”, issuers downgraded from investment grade to high yield. This is something the Financial Times has also recently picked up on. The chart below shows how near the average European sovereign ratings are to sub-investment grade.

Rating agencies have flexibility in “capping” corporate ratings to the sovereign ratings of their respective home countries – the so-called sovereign ceiling. S&P for example has no strict limit on the number of notches by which an entity’s rating can exceed the sovereign but Moody’s is less generous, allowing a maximum two-notch rating uplift versus the sovereign for non-financials (the maximum is one notch above for financials). The reality is that a strong credit worthiness correlation tends to exist due to the likely exposure of companies to their domestic economy, and the ability of the sovereign to tax them (or worse) if necessary.

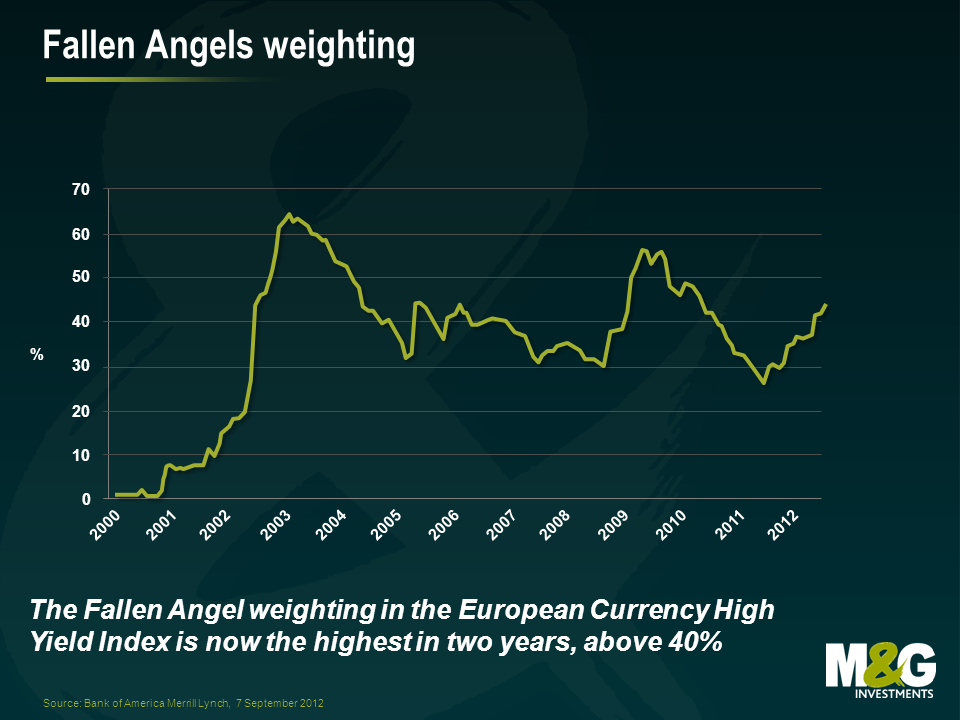

Where the market is not focusing enough is on the current role of existing fallen angels – companies that migrated from an investment grade index into a high yield index since the beginning of 2012. So far this year the fallen angels weighting in the Bank of America Merrill Lynch European Currency High Yield Index has increased by approximately 15% to 43.66%, the highest it has been in over two years.

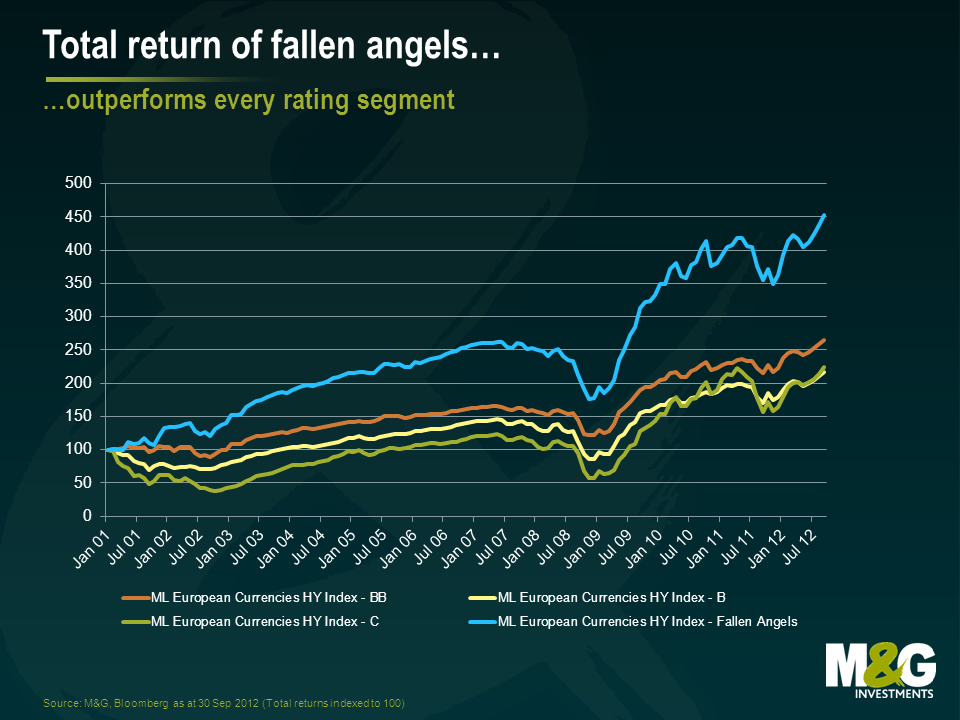

What is even more interesting is fallen angels’ contribution over time to total return.

Fallen angels have significantly outperformed the original issue high yield portion of the index over time, whether you look at annualised returns over the last 3, 5, 7 or even 10 years (+2.59%, +3.70%, +2.87% and +3.24%, respectively).

Now, many future fallen angels may be different from their predecessors from a credit quality point of view. In the past, downgrades pushing corporates and banks down to high yield were mainly due to company-related issues: worsening balance sheets and poor revenue outlook. They were therefore as risky a bet as the rest of the universe.

Is this still true today? Well, reviewing the list of fallen angels in 2012, 41 out of the 110 European securities downgraded to high yield were due to sovereign downgrades (specifically from peripheral Europe – Spain, Italy and Portugal). This is equal to 37% of the total downgrades: more than one third of the total. This increase in the fallen angel population due to “externalities” (i.e. sovereign downgrades due to the eurozone debt crisis, rather than for the intrinsic worsening of their performance) has a potentially significant impact on the BB segment of the high yield market. Arguably, this increases the underlying quality of the market and, if historical risk/return characteristics hold, this could have a beneficial impact for high yield returns in general. On the other side, given the higher underlying quality of these downgraded issuers (lower leverage, better cash flows, global scale) their yields may be lower upon entering the high yield indices, and the potential for subsequent performance may be weaker than with “real” junk.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox