Corporate bond market liquidity – flush or flushed?

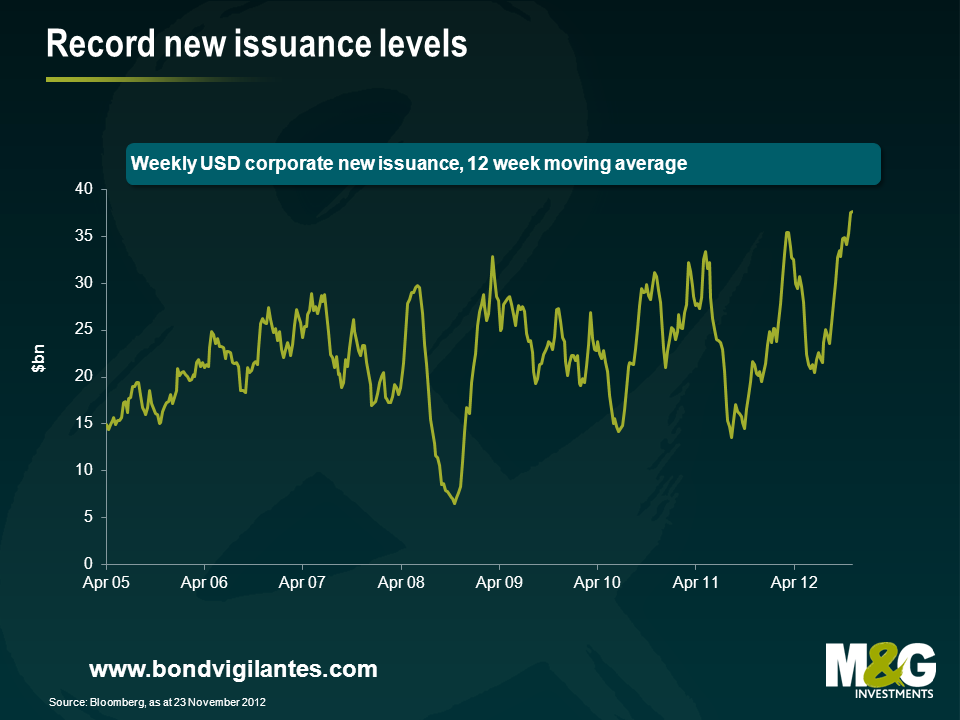

It has been a great few months for corporate bond issuance, as illustrated in the chart below. This huge flush of new transactions where buyer (investor) meets seller (issuer), shows that the primary market is in a historically healthy state, with buckets of liquidity. However, since the credit crunch there has been a great deal of discussion re the corporate bond market becoming less liquid, as dealers’ ability to bid for bonds has gone down the pan. Which is right?

Since the credit crunch began, the financial intermediaries who provide immediate liquidity for bond investors have been under a great deal of capital stress. Losses on securities, more conservative management, and reduced yet more expensive capital, have resulted in a shrinking of their market making balance sheets. This is illustrated in the chart below with data from the Federal Reserve showing primary dealer positions in corporates with maturities of more than a year.

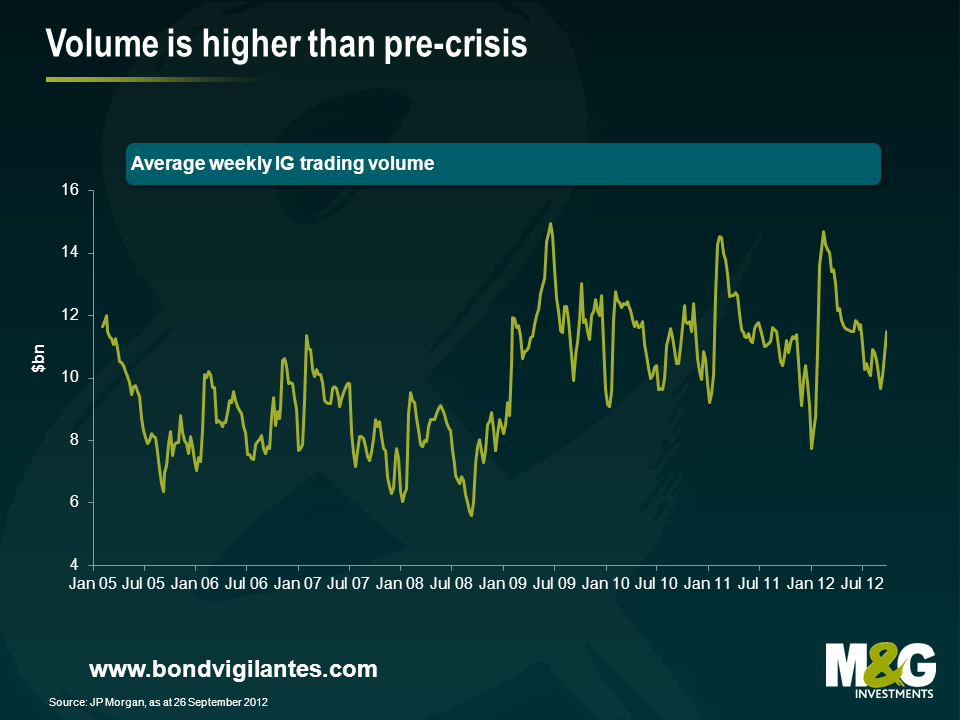

According to some market observers, the above indicates that traders’ ability to take on risk has collapsed by roughly 80 percent, and therefore corporate bond market liquidity must have collapsed significantly in tandem, due to the disappearance of this historic pool of capital to bid for securities. However, we think this is a rather simplistic way for investors to explore what is going on. The chart below shows a far more relevant number than the size of dealers’ books – the actual historic trading volume in secondary corporate bonds, which gives a stronger indication of real, rather than hypothetical liquidity. This shows that turnover has not collapsed 80 percent in the same way as dealer inventory, and in fact daily volumes are on a par with where they were in 2007. It is also worth noting that investment banks’, and their shadow bank counterparts’ percentage of this volume will have fallen, and so it is likely that transactions between genuine end investors have increased substantially in real terms, and as a percentage of this turnover.

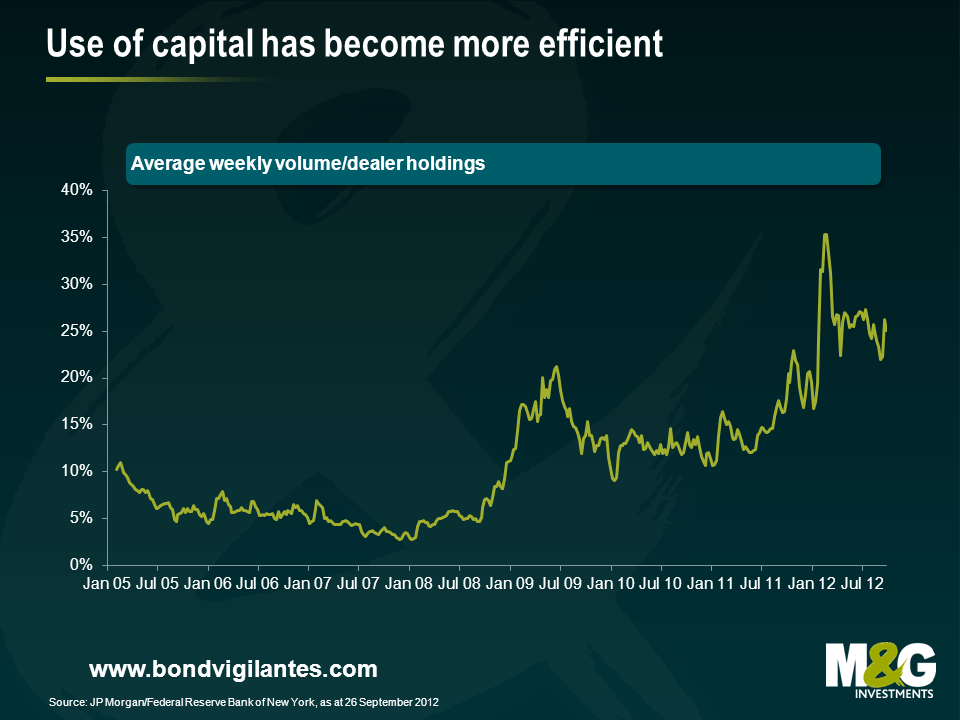

Back in 2007 the markets were exceptionally liquid. They were dominated by short term players using cheap regulatory capital to take on enormous credit risk. This was done directly by investment banks on their own account, or to warehouse positions to be sold on to vehicles such as CDOs and CLOs as they were launched. This activity has collapsed. So, along with the more stringent capital environment, the size of their inventories has understandably shrunk considerably. However, making markets and operating in the corporate bond market remains an important source of revenue for these financial intermediaries. Despite less capital being deployed, total secondary volume has recovered to 2007 levels, which means they have become more efficient and turnover per unit of inventory has gone through the roof, as illustrated below. The financial crisis has changed banks’ and investors’ appetites for and abilities to take risk.

The financial crisis has also driven a significant fundamental shift in how capital markets work. The recycling of capital (through the mismatch of risk taken by banks that was the route of the credit crunch) by using short term deposits to lend long term that dominated the landscape in 2007, is now morphing into a new, hopefully more stable process of borrowers being funded via the corporate bond market. Bank lending has shrunk, and the capital markets, led by the expanding bond market have attempted to fill the gap. As bank lending is replaced by more permanent term bond lending, then term mismatch and credit risk in the banking system is reduced, and that term and credit risk is assumed by the bond investor. The bond investor not only gets paid for assuming this risk but also has to work out what liquidity premium they need to be paid on top of the term and credit risk they have taken on board with their corporate bond position.

This premium will vary over the cycle like the other drivers of returns – credit and interest rates. It will expand when credit markets are weak, and liquidity poor (eg autumn 2009). It will contract when the credit outlook is great and liquidity high (spring 2007), and is something all investors need to be aware of when investing in the asset class. An investor in corporate bonds should examine where we are in the liquidity cycle, and should be aware that the perfect liquidity and huge dealer inventories of 2007 contributed to the ensuing rout in the asset class, while the illiquidity of the winter of 2008 was a great opportunity to buy and take advantage of the expanded liquidity premium. We know from the last 5 years that to an investor in corporate bonds, perfect liquidity can be a precursor to more dangerous times than illiquidity can.

Is corporate bond liquidity brilliant or is it at record lows? Well, it appears that daily volume of primary markets is at record levels, while secondary market liquidity has not grown in line with the size of the market place, but is not as low as a simple analysis of dealer inventory would imply. It is hard to know what average daily liquidity should be, as the market has been evolving in the recent dramatic economic conditions. However, the total liquidity of all transactions, both primary and secondary, indicates a growing, interesting market place as banks are being replaced by the corporate bond market as the funding vehicle of choice.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox