Europe, China and shale gas: euphoria or rejection?

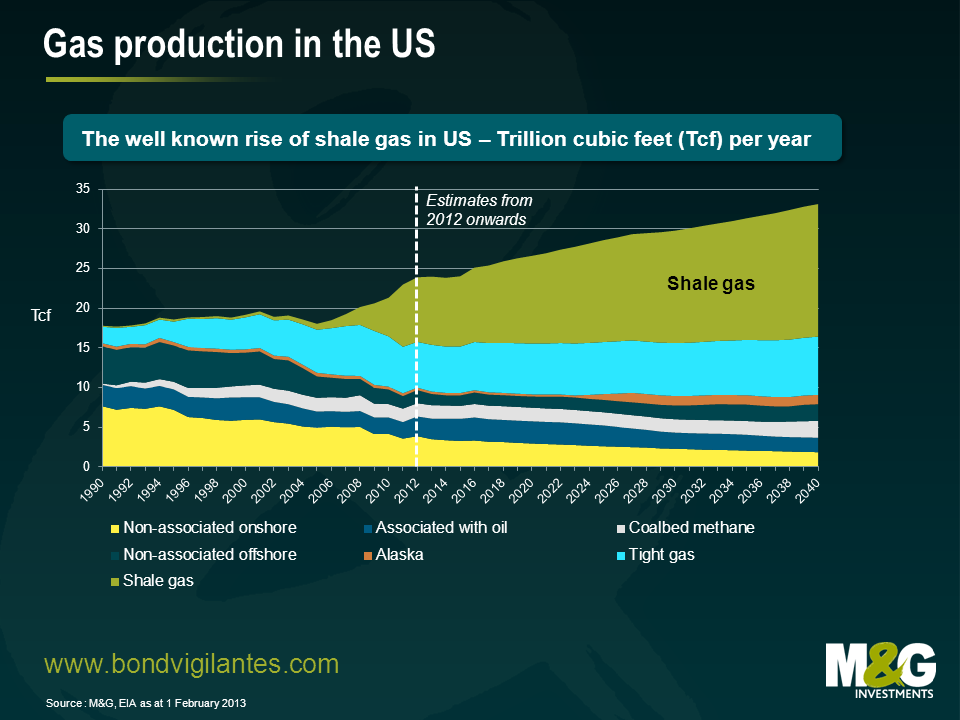

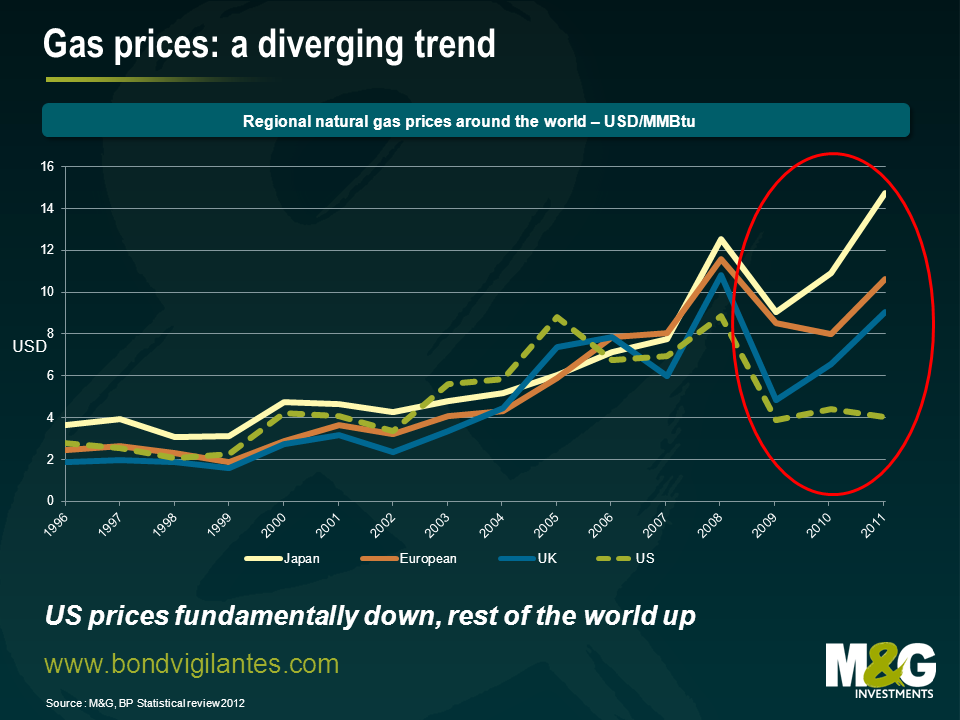

It is commonly believed that – thanks to shale oil and gas discoveries in the US over the past couple of decades – the US is on a path towards energy self-sufficiency. Subsequent cheaper gas prices are boosting competitiveness in some domestic industries, starting from bulk chemicals and primary metals, by lowering the costs of both raw materials and energy.

But will the US and its domestic companies be forever the only beneficiaries of cheap gas, as many believe? In Davos in January 2013, Royal Dutch Shell PLC signed a 50-year profit sharing deal with Ukraine to explore and drill for shale gas and oil. In fact, shale formations are not a prerogative of the US. Several countries in Europe and Africa have significant shale gas reserves (France, UK, Poland, Germany, Turkey, Ukraine, South Africa, Morocco, Libya, Algeria), and some other countries around the world too (Chile, Canada, Mexico, China, Australia, Argentina and Brazil). Preliminary research has shown that there are 32 countries with more than six times the amount of technically recoverable shale gas than the US. It will be key to understand which ones will prove of high “quality”: in fact US shale basins tend to have rocks closer to the surface (easier to reach) and more porous (where gas is easier to extract), while foreign reserves tend to be deep and harder to reach (therefore more technically challenging and expensive).

Currently in Europe the shale gas debate is divided between euphoria and total rejection. A drilling procedure called “fracking” sees a cocktail of water, sand and some chemicals pumped into a well under high pressure to force the gas from the rocks. Early drillings in Netherlands and Luxembourg were suspended because of environmental fears and contrarian public opinion. In France, fracking is now banned, while in Germany opposition to Angela Merkel is creating a good deal of noise around this topic. In Poland, ExxonMobil just walked away from preliminary explorations that didn’t deliver the expected results and, in Spain, the Basque local government has announced that there is 185 billion cubic meters of shale gas in the Gran Enara field with €40m invested in exploration.

No rapid breakthroughs are expected though. Exploiting shale gas reserves in Europe might be a long, technically difficult, politically tricky and also legally complex procedure, due to questions over property rights – determining who can drill and where. But the need to look for security of supply and cheaper energy sources remains. In particular, as Orlando Finzi – our M&G credit research director covering the energy sector – was telling me the other day, the latter is the subject of a key debate at the moment: EU long term gas contracts which supply most of the gas to Europe have prices linked to oil, but this might all change with recent negotiations between buyers and sellers seeing a modest dilution of the oil linkage. RWE, the German utility, is seeking full removal of oil price linkage in its Gazprom contract via arbitration courts. Where will European prices head to then? If lower, the idea of extracting shale gas may become less attractive than the existing natural gas options. If prices continue to rise, who knows? Also, the need to reduce CO2 emissions may push towards unexplored scenarios. Some think that the current CO2 emissions “cap and trade” system is disappointing (see the chart below): too many permits in the market and therefore no incentives to cut emissions.

Gas is a great alternative to other fossil fuels (and coal specifically, but also oil) to both cut down emissions and potentially to cover when renewables do not generate (for example, wind turbines in a period of no wind). Will European countries, eventually strangled by economic stagnation, fearful of security of supply and in need to cut emissions, find a way to overcome multiple issues to give a boost to shale gas exploration? In a positive political climate, what if UK and Spain will be quick and successful in exploiting their shale gas resources? Will this new energy source support growth, help employment in weak economies and make local companies more competitive in certain industries?

More euphoria is engulfing China. China’s revolution in shale gas is considered by some more a distant dream than a work-in-progress, but there are many new developments worth considering. Chinese public opinion has recently been shaken by the terrible air quality in many cities. China, estimated to have the biggest reserves in the world (50% more than the US as per an early research by EIA) is explicitly moving towards cleaner energy sources and has an incredible appetite for energy (and gas specifically, now fully imported). Even if little information exists, Petrochina, which is currently undertaking the development of shale gas in Alberta via a partnership with a Canadian company, has started shale gas drillings around China. Total is also preparing to sign an agreement, possibly within a few days, with a Chinese partner to explore for shale gas in the country. Furthermore, China just announced that 16 (only domestic) companies won a second round of bidding to explore 19 shale gas blocks around central China, agreeing to invest $2 bn over the coming years. The key issue also in China – and in some other countries such as Argentina and Mexico – will be to understand which technology to use and how to unlock reserves that are very difficult and expensive to reach for geological reasons: I would expect quicker progress only with foreign technology. But local energy needs, resolute politics and a more benign public opinion – now suffocated by smog – make the Chinese case stronger than Europe. If shale reserves are exploited quicker than expected, will China return to the good old days of double digit GDP growth? Will Chinese companies – which are losing their cost leadership position to neighbouring countries such as Vietnam and Indonesia or back to the US – find in local shale gas a new source of sustainable competitive advantage in the next ten years? Will the predicted shift of production and employment back to the US be a temporary adjustment only?

Reading the future of energy remains very complex. The prospects of shale gas developments outside North America will depend to a large extent on politics and developments in international gas markets, such as the future relationship between demand and supply, price relations (Liquified Natural Gas vs. pipelines for example) and movements, costs of production, shape of climate policies (it’s difficult to see how other countries such as Argentina, for example, will be able to persuade foreign companies to help it develop its reserves while it has been busy expropriating assets) and specific local challenges. But imagine a not-so-remote scenario at this point: US shale gas may return less than expected over the long term (as the EIA always reports, the long-term production profiles of US shale wells and their estimated ultimate recovery of oil and natural gas are uncertain), while China and Europe may start exploiting shale reserves quicker, thus reshaping energy pricing dynamics or even the balance of world trade and geopolitics.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox