Wage inflation: Upward pressure on German labour costs in 2013

When I left Germany more than three and a half years ago, it was a good place to live. Germany’s polarising football superpower Bayern Munich had just failed to win the Bundesliga, horse meat was deliberately eaten in form of “Rheinischer Sauerbraten” and circa 40 million Germans were in employment. Despite all the bad news today – Bayern Munich has a strong lead in the Bundesliga table and horse meat is a basic ingredient in nearly every ready-to-eat meal available – Germany has not become a worse place to live. Employment is at record highs in absolute terms and the unemployment rate stands steady at 6.9%.

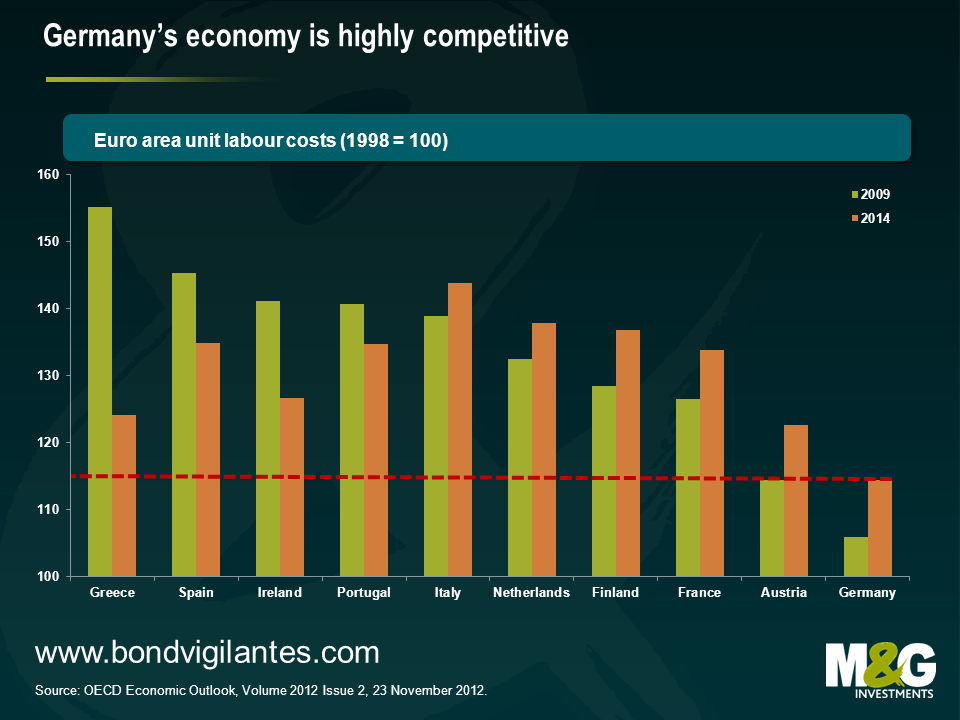

Although some of the peripheral countries have made some progress to lower their unit labour costs through harsh austerity measures (as projected by the Organisation for Economic Co-operation and Development (OECD)), Germany’s competitiveness still stands out as exceptionally high within Europe. Austerity is a tough medicine to take, so I doubt that the Greeks, Spanish and especially Italians (as the recent electoral outcome confirmed) are willing to take their prescribed doses all the way through until they reach a similar level of competitiveness to Germany.

For this reason, it is generally argued that the Eurozone rebalancing has to come not only through structural reforms in the periphery, but also through internal devaluation in the core of Europe. Unlike peripheral Europe which is attempting to reduce labour costs, in 2012, Germany’s economy saw annual real wage growth for the third consecutive year. Employees keep demanding higher salaries after cutting back for years. Hiring intentions and business confidence have not even dropped considerably after the economy’s slowdown in the last quarter. But most importantly, it’s electoral season in Germany.

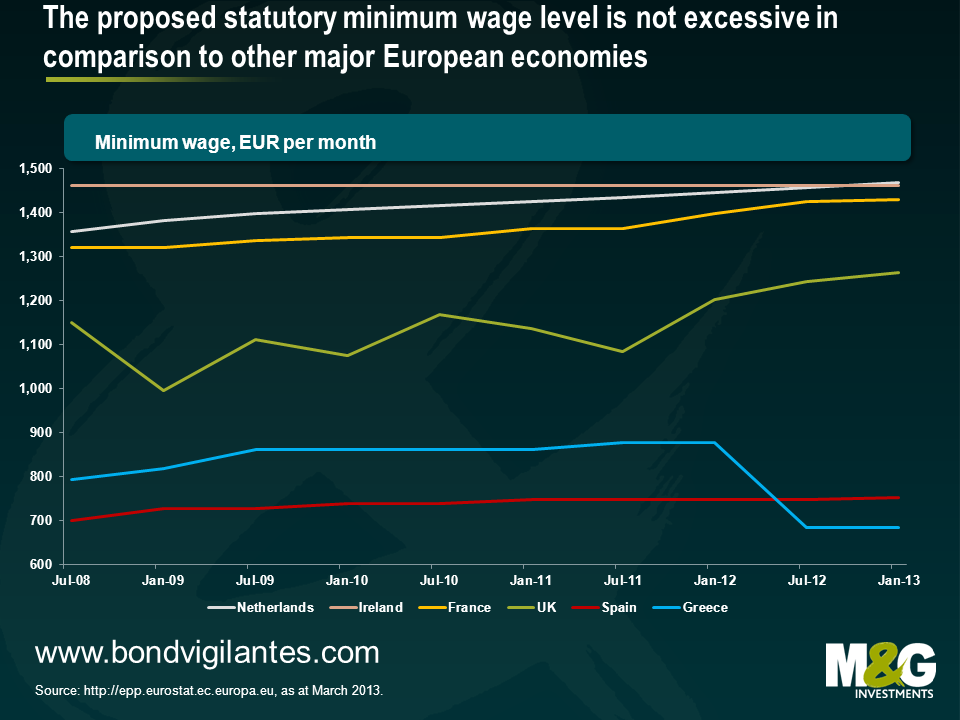

At the start of March, the SPD, Greens and “Die Linke” (The Left) officially kick-started their electoral campaign around the topic ‘social justice’ (Soziale Gerechtigkeit). In Germany’s upper chamber (Bundesrat), where they now hold the majority of the votes, the three parties voted in favour of a statutory minimum wage of EUR 8.50/hour (or circa EUR 1,300 per month if we assume an average weekly working time of 35 hours for full-time workers).

Germany is one of the few countries in Europe which has not got a statutory minimum wage. The proposed minimum wage would roughly equal the minimum wage level of the United Kingdom and would be below the minimum wage of France, the Netherlands – and Ireland (looking at the below chart, I have been wondering if this is one of the reasons why we have not seen as many Irish people on the streets as Spaniards or Greeks). The proposed law is still subject to the approval by the CDU/FDP-led German Parliament though. It is very unlikely that it will be approved in its current form, but it puts considerable pressure on Angela Merkel to make concessions on this topic and to somehow set a floor level to German wages.

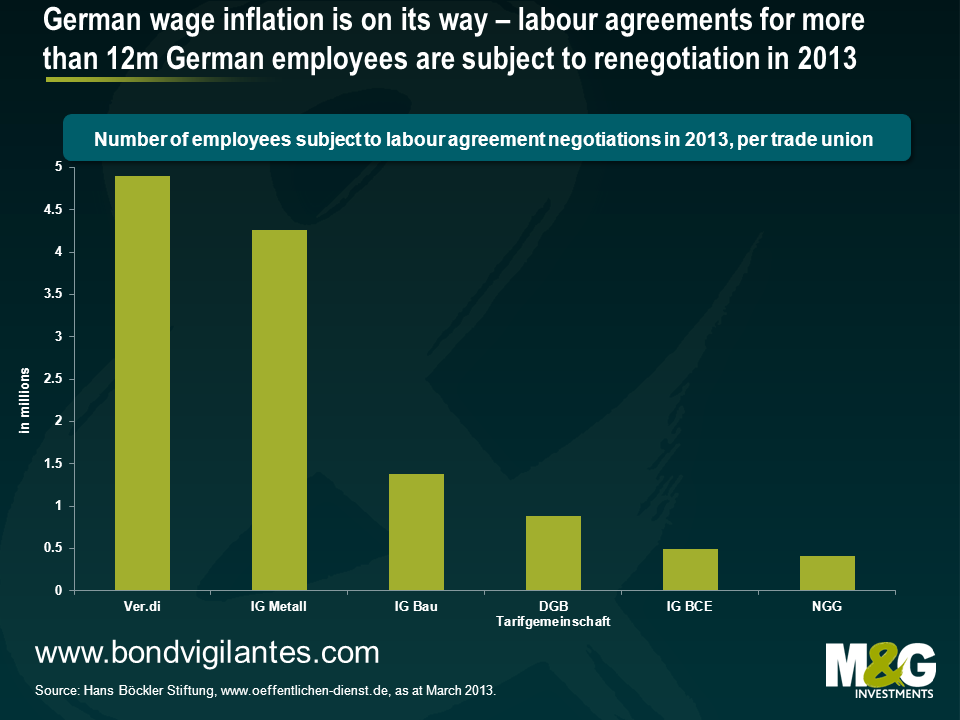

The main source for wage pressure in Germany though stems from expiring labour agreements between the powerful trade unions and industrial employers. It is estimated that labour agreements concerning up to 12.5 million workers, or around 30% of the German labour force, are subject to re-negotiation in 2013. Trade unions Ver.di and IG Metall represent the interests of around 9 million German workers alone this year. The wage negotiations with the biggest impact take place for compensation in the metal and electronics industries (concerning circa 3.4 million employees), in the retail industry (1.3 million), in the wholesale commerce sector (780,000), and in the main construction sector (650,000).

So what are they asking for? One of the very first renewed agreements was concluded last weekend. Labour union Ver.di and the public sector representatives agreed on a 5.6% wage rise throughout 2013 (+2.65%) and 2014 (+2.95%) for around 800,000 public sector employees. Furthermore, job guarantees were granted for all public sector trainees and a uniform holiday allowance of 30 days per year was agreed. Elsewhere, IG Metall currently aims at a nominal wage growth in the metal and electronics industries of 5.5% and IG Bau has demanded wage growth of 6.6% for workers in the construction sector. Beyond doubt, this could mean significant real wage growth for a considerable part of Germany’s 41.7 million labour force.

The power of German trade unions, particularly in electoral times, must not be underestimated. The German “blue collar” workers are the traditional voters of the left parties, so the social democrats will do everything to support the trade union efforts. Angela Merkel has to find a way to accommodate the unions’ demand for higher wages because she will not be able to afford an outright electoral recommendation for her competitors to 12.5 million blue collar workers.

Wage inflation is certainly on its way in Germany. And it might come at exactly the right time for the German economy. In an environment in which we can’t see Eurozone demand for German goods picking up and Chinese demand for German goods is increasingly likely to slow down, it strikes me as a positive development that German workers have more money in their pockets and can stimulate domestic consumption, making the German economy less dependent on the export sector. But the German economy clearly walks a fine line here. Excessive wage growth might decrease German competitiveness too much. We don’t see this danger stemming from the suggested minimum wage which seems to be too low to have a significant immediate negative impact. In the longer run, there is the risk though that the minimum wage level could prove to be an enticing lever for governments to please the electorate ahead of general elections.

In the shorter run, the impact on overall wage levels from labour union agreements might prove to be more considerable. The rigid Bundesbank models suggest that a 2% increase in real wages in the German economy would translate into a ¾% decline in the rate of GDP growth and a 1% increase in unemployment. The same models say that the effect for the peripheral nations from the decreased competitiveness of the German economy would be close to zero because of the structure of trade flows. So the net negative effect to European trade overall is attributable to what Bundesbank president Jens Weidmann phrases as the realisation that “Europe is not an island, but part of a globalised world”. In our opinion, it would be interesting to see what the models say when you feed them with a 30% Yen depreciation and 20% sterling depreciation against the euro and what the Bundesbank’s suggested reaction to such a scenario might be.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox