Old Lady sells her bonds

Back in 2009 the Bank of England (the Old Lady of Threadneedle Street) began buying a portfolio of investment grade bonds to provide funding to UK corporates, to aid liquidity in the corporate bond market and to supplement their QE purchases of gilts. Last Friday this investor sold its last corporate bonds.

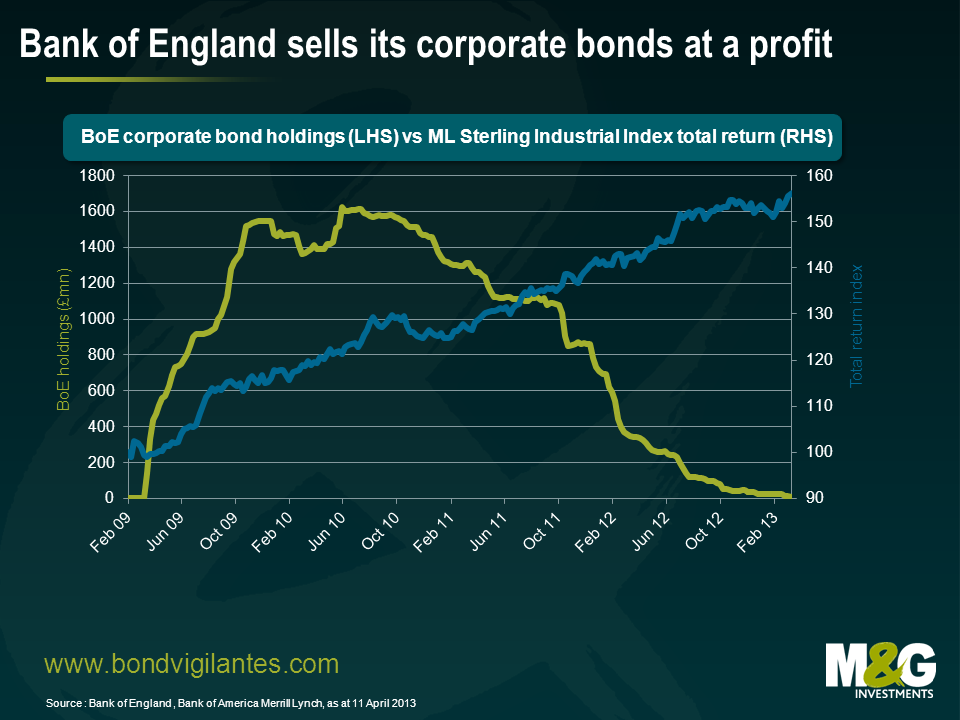

This has been a great success from a profit point of view. The attached chart shows the total return of an index of non-financial corporate bonds over the period of the bank’s purchases and sales as well as an indication of their total holdings.

I believe its actions helped stabilise the corporate bond market in the UK by providing a backstop bid, therefore helping to reduce the cost of funding at the margin for issuers, and would have added to the effects of QE. However, empirically measuring these effects is hard to do – corporate bond markets that experienced no domestic support from their central banks appear to have performed similarly, and the debate on the true effectiveness of QE remains.

What is the primary lesson we have learned? I think it is that state intervention can work where markets are priced inefficiently. This is illustrated by the large profits the bank has made by buying an out of favour asset class from the private sector. It is probably a good base to have the state intervene where markets are inefficient, for example in areas such as healthcare, defence, law and order, and infrastructure. The danger comes when the state interferes to the detriment of an efficient market. From an economic point of view, aggressive trade barriers are the first thing that comes to mind where there would be a great deal of consensus from the left and right side of politics. Other actions may depend on your economic or political view. The best current example of this is the single European currency experiment. Does it aid a free market via price transparency and low transaction costs, or does it hinder efficiency by having one single interest rate and exchange rate for such diverse economies ?

The Old Lady’s portfolio of corporates has served her and the UK well because she bought them at cheap levels from distressed sellers. Unfortunately, this investor has a significantly bigger portfolio of gilts. The carry and mark to market on these looks great. However, turning this unrealised gain into a realised profit still remains a challenge. If she comes to sell, her position is likely to drive the market against her.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox