Japanese investors are not buying foreign bonds, they’re selling

One of the stories that has driven global financial markets higher for the past few months has been about how Japanese investors are piling, or will pile, into foreign assets. Surely a rational Japanese investor would dump Japanese assets in an attempt to escape the exploding yen and the ravages of domestic inflation, or at the very least seek out a bigger yield than the puny returns available on the artificially suppressed domestic government bonds?

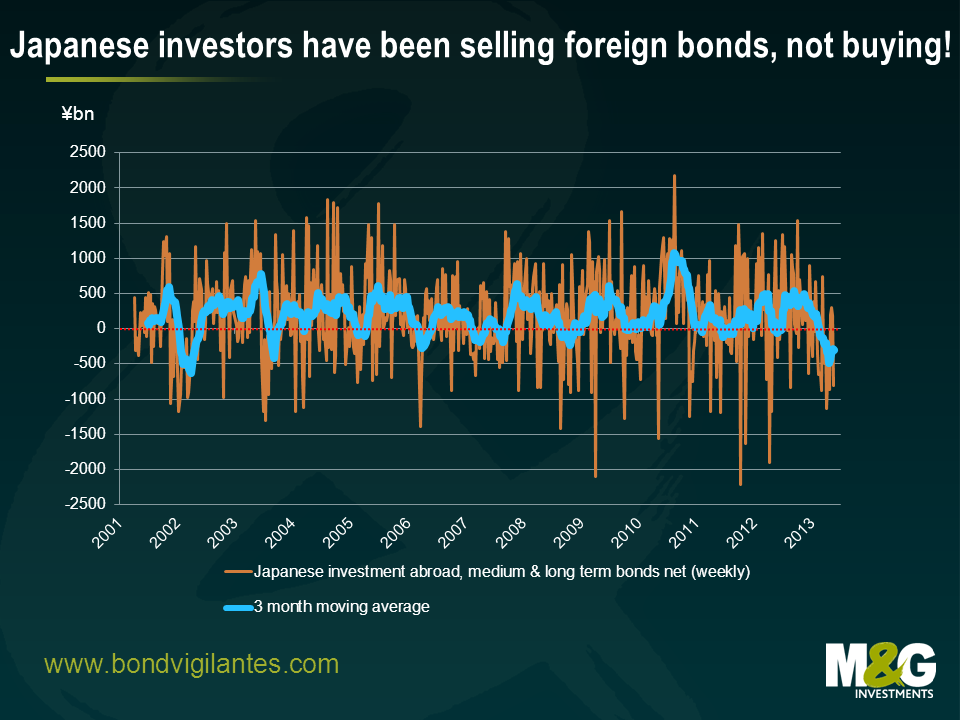

Well, they haven’t been buying foreign bonds; actually they’ve done the opposite. There were lots of headlines earlier this month after Japanese investors were (just about) net purchasers of foreign bonds in the three weeks to May 10th. But data out overnight showed that there were ¥804.4bn worth of net sales of foreign bonds in the week to May 17th, which more than reversed the previous three weeks’ purchases.

The chart below shows the weekly net purchases of foreign bonds, where the data is based on reports from designated major investors including banks, insurance companies, asset management companies etc. The blue line in the chart below is the 3 month moving average, and it shows that Japanese redemptions of foreign bonds are running at close to the highest rate since data began in 2001.

It’s difficult to deduce too much from all the data, but it appears likely that the rally in the Nikkei, the drop in the yen and the rally in semi-core Eurozone government bonds has been down to foreign investors front running something that so far has not actually happened. Japanese investors may still flee their domestic market, but it will require (mostly foreign) investors’ already high inflation expectations to be realised (the bond market is pricing in Japanese inflation averaging +1.8%pa for the next 5 years, despite there being little evidence that QE in Japan or other countries has succeeded in either generating inflation or in weakening currencies). It probably also requires changes to the higher capital charges that major Japanese investors face when investing in overseas assets, although even with this, funding costs and hedging requirements will ensure that home bias continues.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox