The M&G YouGov Inflation Expectations Survey

Today we have launched the M&G YouGov Inflation Expectations Survey with the aim of assessing consumers’ expectations of inflation over the short and medium term. There has never been a better time to gauge the views of consumers, with interest rates at multi-century lows, central bankers waist-deep in the experiment of quantitative easing and politicians wavering on whether or not austerity is the right thing to do. The report is available here.

Surveys of consumers’ inflation expectations are now a key component of monetary policy and there are a few in existence. However, our survey differs from existing surveys of consumer inflation expectations in a number of fundamental ways.

Firstly, it is the main survey of its kind to ask a consistent set of six questions to consumers in nine different countries across Asia and Europe. In total 8,000 consumers are surveyed on a quarterly basis by YouGov, the online market research company, in order to get timely and highly relevant results. Our consumer panels are weighted and are representative of the entire adult population of the country surveyed.

Secondly, by surveying consumers across the UK, Austria, France, Germany, Hong Kong, Italy, Singapore, Spain and Switzerland, policy makers and investors alike will be able to analyse how inflation expectations are changing over time across nine different countries. Importantly, the survey will also give a good indication of whether inflation expectations are becoming unanchored. If they are it could trigger changes in the nominal exchange rate, affect consumption and investment decisions, as well as wages and prices, and could cause inflation to persist above the target for longer than the central bank expects.

Finally, we have used best practice developed by the Federal Reserve Bank of New York in determining how we ask consumers about their inflation expectations. In late 2006, the Federal Reserve Bank of New York joined academic economists and psychologists from Carnegie Mellon University to assess the feasibility of improving survey-based measures of consumers’ inflation and wage expectations. The results of this project were announced in 2010 and can be viewed here. Interestingly, academic researchers found that there were a number of limitations in existing surveys.

For example, the Reuters/University of Michigan Survey of Consumers asks respondents to forecast changes in “prices in general” rather than changes in the “rate of inflation.” This wording, the researchers suggest, invites diverse interpretations and prompts many respondents to focus on price changes specific to their own experience rather than changes in the overall price level.

To address this limitation, the M&G YouGov Inflation Expectations Survey asks respondents to report their expectations for the annual rate of inflation in one year and five years from now rather than ask about prices in general. We also question respondents on whether rising inflation is a concern at the moment, how they think their net income will change in 12 months’ time, whether or not their central bank is pursuing the correct policies to meet its target of price stability, and whether their government is following the right economic policy. Importantly, this should allow us to gauge the public’s perception towards the credibility of central banks and governments.

The initial findings of the survey are shown below. The next report will be available in September.

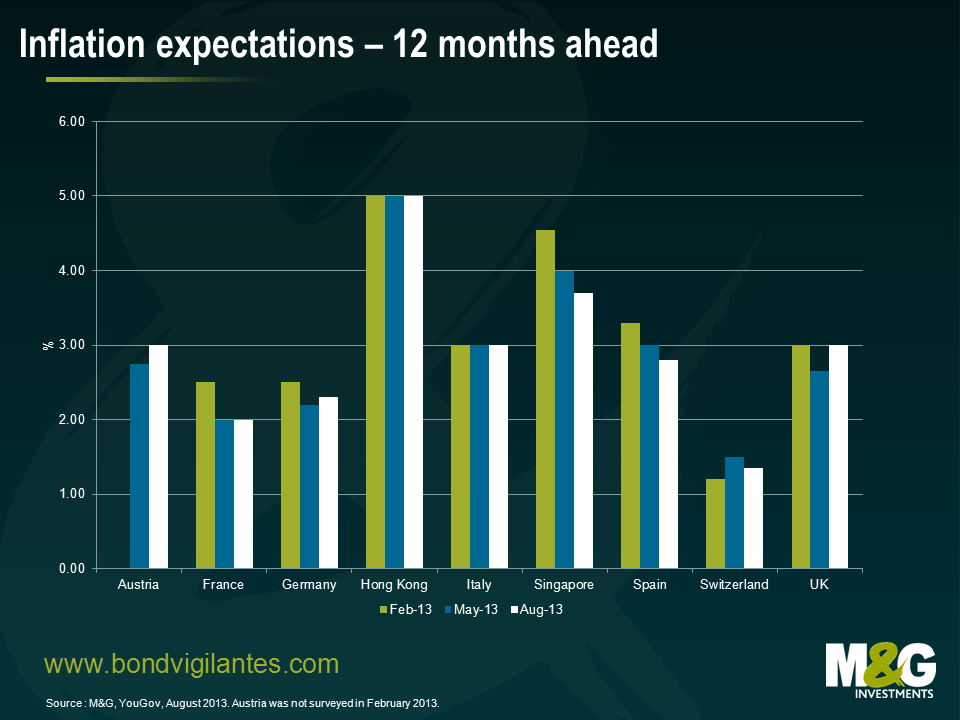

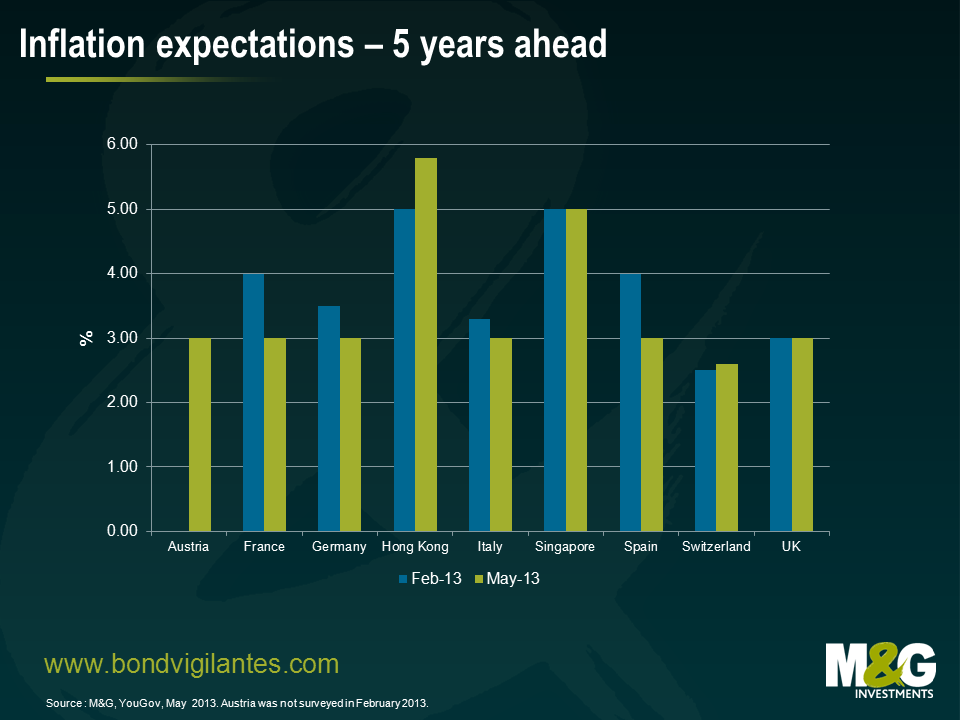

The results of the May 2013 M&G YouGov Inflation Expectations Survey suggest that consumers in most countries surveyed expect inflation to be elevated above current levels in both one and five years’ time. In the UK, inflation is expected to be above the Bank of England’s CPI target of 2.0% on a one- and five-year ahead basis. All European Monetary Union (EMU) countries surveyed expect inflation to be equal to or higher than the European Central Bank’s CPI target of 2.0% on a one- and five-year ahead basis. All countries expect inflation to be higher in five years than currently, while four – Hong Kong, Italy, Singapore and Spain – anticipate it being equal to or higher than 3.0% in a year. Encouragingly, there are some signs of short and medium term inflation expectations falling from the levels reported in February in some countries.

We think that this report will be vital reading for central bankers, particularly as a time series is built up over the next couple of years which will allow us to monitor trends that may be developing. Ben Bernanke, Mark Carney, and Mario Draghi are all on the record stating how important inflation expectations are in achieving price stability and the economic benefits that go with it. It will also be highly relevant for both consumers and markets alike, particularly in a world where Central Bank Regime Change – where debt and unemployment rates become more important to central banks than inflation targets and price stability – is likely to occur. We aren’t there yet, but initiatives like the M&G YouGov Inflation Expectations Survey may be the bellwether that signals inflation expectations are becoming unanchored. And when that occurs, that is when central banks will face one of their toughest tests – trying to maintain their inflation-fighting credibility.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox