It’s a new dawn, it’s a new day. The ECB takes baby steps towards QE

Just when you thought the Fed had well and truly killed the carry trade, a surprisingly dovish Mario Draghi reminded markets yesterday that Europe remains a very different place from the US. Having previously argued that the ECB never pre commits to forward guidance, yesterday marks something of a volte-face. ‘The Governing Council expects the key ECB interest rates to remain at present or lower levels for an extended period of time.’ The willingness to offer guidance brings the ECB closer to its UK and US peers, the latter having been in the guidance camp for some time. This firmly reinforces our view that the ECB retains an accommodative stance and an easing bias.

The willingness to offer forward guidance to the market no doubt came after some long and hard introspection within the Governing Council. So why the change ? Firstly, the ECB is worried that it may miss its primary target of maintaining inflation at or close to 2% over the medium term. Secondly, Draghi indicated an increasing concern that the real economy continues to demonstrate ‘broad based’ weakness, and finally, as has been the case for some time, the Council worries that the Eurozone continues to labour with subdued monetary dynamics. This sounds increasingly like Fed talk of recent years.

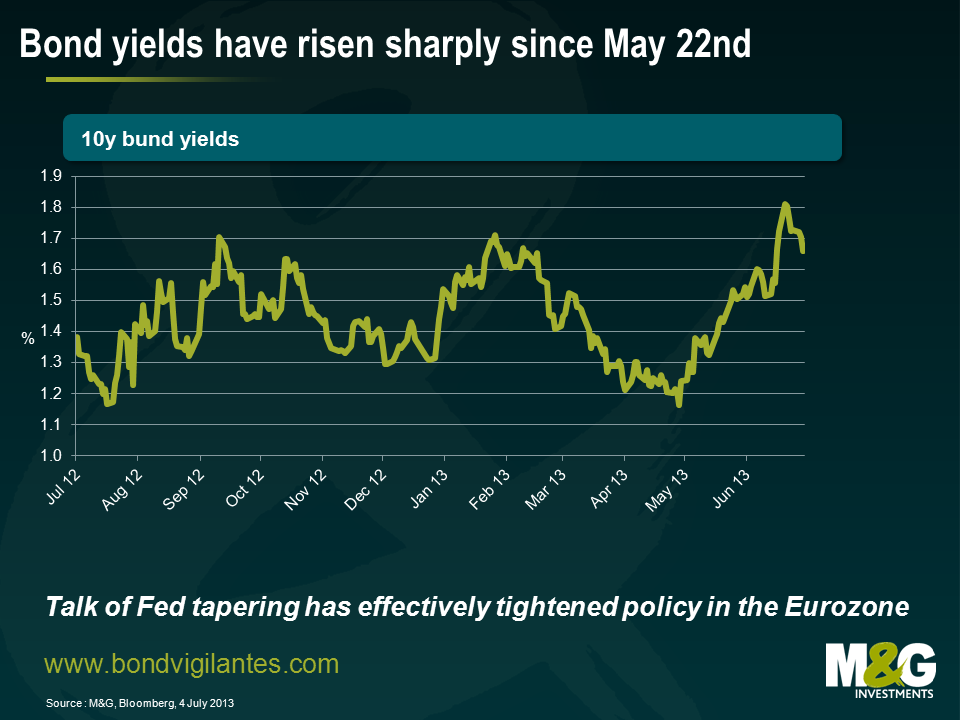

Draghi also expressed his concern yesterday during his Q&A at the effective tightening of monetary conditions via higher government bond yields (see chart) since the Fed’s tapering discussions. Frankly the last thing the Eurozone needs at this stage in its nascent recovery is higher borrowing costs.

Draghi in communicating that the next likely move will be an easing of policy has attempted to talk bond yields down. European risk assets appear to have taken his comments positively but the bond market remains sceptical. At the time of writing only short to medium dated bonds are trading at lower yields.

In conjunction with revising down its 2013 Italian GDP forecast from -1.5% to -1.8%, the IMF has publicly urged the ECB to embark upon direct asset purchases. Is this a likely near term response ? For now those calls will likely fall on deaf ears especially with German elections later this year. The ECB clearly believes that its next move would be to cut rates further in response to a weaker outlook. Buying time seems to be the current approach.

However, should Eurozone inflation expectations continue to undershoot (the market is currently pricing 1.36% and 1.66% over the next 5 & 10 years, see chart) and economic performance remain downright lacklustre across Europe, then the ECB will have to think very carefully about what impact it can expect from a ‘traditional’ monetary response. QE may be some way off, and would no doubt see massive objections from Berlin, but in the same way that the ECB never pre commits, maybe just maybe, QE will be on the table sooner than the market is currently anticipating.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.