Interest rate duration or defaults – which is the lesser of two evils?

So far this year returns for the high yield market seem solid if unspectacular; 2.9% for the global index, 4.5% for Europe and 3.4% for the US. However, these overall numbers mask some interesting gyrations within the markets. It’s been a mixed year for government bonds but a solid year for credit spreads. Indeed, recent moves in the sovereign bond markets continue to focus investors’ minds on the haunting spectre of interest rate risk. The high yield market is not entirely immune to such fears but we need to remember that interest rates are only one driver of performance. High yield returns are also subject to factors such as changes in credit spreads, default rates and carry.

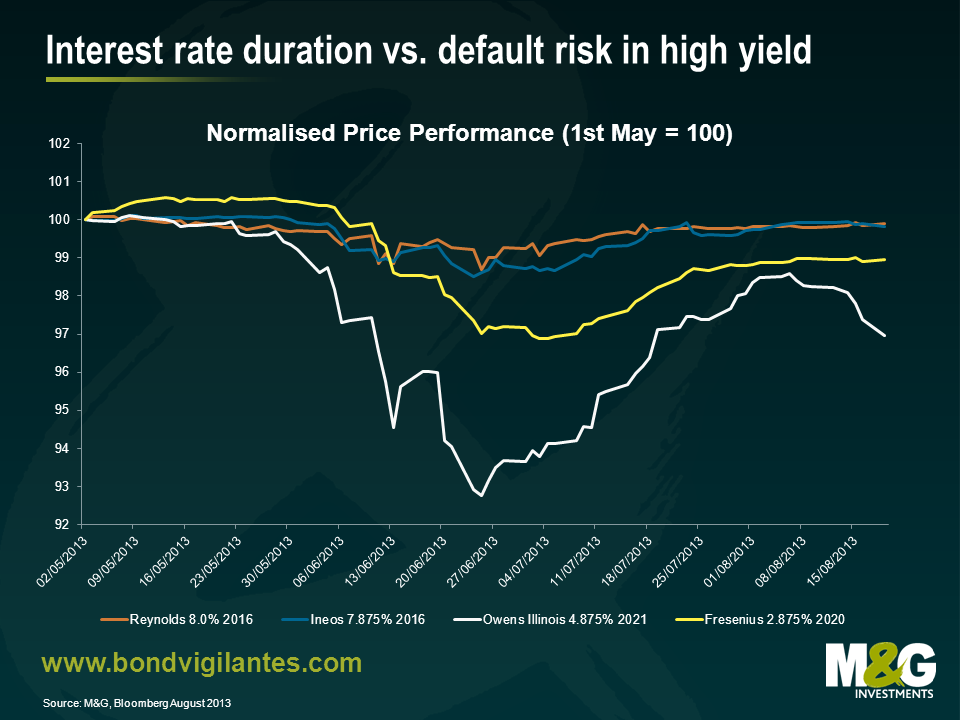

To illustrate this, we have two sets of bonds below: two long dated BB rated bonds (issued by German healthcare business Fresenius and US listed packaging group Owens Illinois) and two short dated CCC bonds (issued by the global chemicals company Ineos and another packaging group, Reynolds). The BB bonds carry relatively more interest rate risk than the latter due to their longer maturity, but less credit risk given the higher credit rating.

| Price | S&P Rating | Moodys Rating | Spread (bps) | Modified Duration (yrs) | |

| Fresenius 2.875% 2020 | 100.25 | BB+ | Ba1 | 162 | 6.1 |

| Owens Illinois 4.875% 2022 | 102.6 | BB+ | Ba2 | 313 | 6.1 |

| Ineos 7.875% 2016 | 101.25 | B- | Caa1 | 503 | 2.1 |

| Reynolds 8.0% 2016 | 100.125 | CCC+ | Caa2 | 565 | 2.8 |

Source: Bloomberg, M&G, August 2013

So how have these bonds fared over the past few weeks ? The chart below shows the relative price performance.

The chart shows that none of the bonds were immune to the volatility we saw over the summer. Indeed this was a relatively rare period where interest rate duration and credit risk premia moved in tandem. However, what is clear is that the longer dated bonds suffered more during the correction. When we consider total returns, this becomes more stark. The table below shows the impact of the different coupons over the three months in question. Again, the shorter dated CCC bonds fare better.

| Period 01/05/13 – 19/08/13 | Price Return | Income Return | Total Return |

| Fresenius 2.875% 2020 | -1.05% | 0.85% | -0.20% |

| Owens Illinois 4.875% 2022 | -3.03% | 1.37% | -1.66% |

| Ineos 7.875% 2016 | -0.18% | 2.31% | 2.13% |

| Reynolds 8.0% 2016 | -0.10% | 2.37% | 2.28% |

Source: Bloomberg, M&G, August 2013

The point here is that judiciously taking on more default risk in the form of a higher coupon and or spread whilst at the same time minimising your interest rate risk by focusing on short dated bonds, is one way that fixed income investors can ride out greater volatility within the government bond markets and still look to generate positive total returns. In this environment, default risk (as opposed to duration) really is the lesser of two evils.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox