Tier 1 capital: too much faith in a Q&A, or why didn’t you call me?

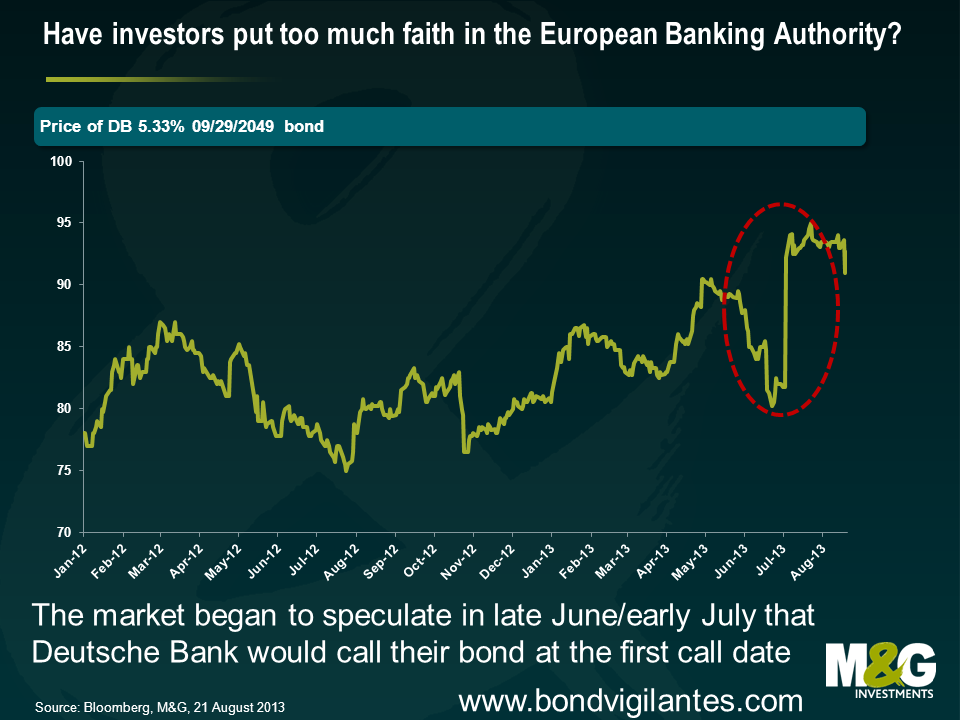

It turns out that market participants may have put too much faith in the European Banking Authority (EBA). The EBA’s answer to a submitted question indicated that non-called bank Tier 1 instruments – or at least those similar to one described by the questioner – cannot simply be reclassified as Tier 2 capital after the first call date. The EBA’s answer to this specific question – which some wrongly characterised as an “EBA ruling” – fuelled speculation that all callable Tier 1 would henceforth be called at the first call date because of a loss of capital credit. Deutsche Bank’s 5.33% Tier 1, callable on September 19, 2013, leapt in price.

The market began to speculate that Deutsche Bank – which has declined to call capital instruments before – would have a change of heart and redeem this bond at the first call date. We don’t want to comment specifically on Deutsche Bank’s decisions here, but this non-call demonstrates why we don’t believe that investors can or should base valuations on their own predictions about whether or when banks will redeem their callable capital instruments. And the point to bear in mind here is that capital credit is just one factor for banks to consider when asking their regulator for permission to redeem an instrument. The importance of capital credit – and of elements within the tiers of bank capital – will vary widely from bank to bank. Finally, regulators need to approve the redemption in any event.

So is this the beginning of a trend of banks not calling their hybrids? We wouldn’t make such a sweeping declaration. First, even with the EU Banking Union project underway, many decisions are still made at the national level with respect to capital. CRD IV, the new Capital Requirements Directive that implements Basel III within the EU, is still being passed by legislatures of the member states. It’s possible that some home country regulators are allowing banks to continue to count their hybrid Tier 1 securities as Tier 1 capital through the end of 2013 irrespective of a call being missed. That may mean redemptions in 2014. Or it may not: these bonds might still be useful for banks as a buffer to protect their senior funding under new rules that banks will have to have a minimum amount of liabilities available for write-down or conversion to equity in case of a resolution.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox