A little less conversation and a little more action. Gilts underperform and sterling rallies when the BoE speaks

“Now, much has been made of the upwards movements in market interest rates since our announcement of forward guidance and I would like to give you my perspective. There’s been a generalised upward movement in long term bond yields, across the advanced economies, including the UK, over the course of the past month. The main common driver is speculation that the US Federal Reserve will soon reduce the pace of its asset purchases (and) …. liquid sovereign bonds of the world’s largest economies are close substitutes for each other”.

Bank of England Governor Mark Carney in the “Jake Bugg” speech, Nottingham, 28th August.

In other words, according to Mark Carney, gilts sold off because treasuries sold off. Personally I do not share this view, and feel some of the blame also lies with the Bank of England. Indeed, if we look at the aftermaths of the 4 occasions of Carney writing or talking about forward guidance (the August Inflation Report, the Nottingham Speech, the BoE Monetary Policy Committee Meeting, and at the Treasury Select Committee), we see that in each instance the pound appreciated markedly and gilts underperformed.

Put together, the result so far of forward guidance has therefore been a tightening in UK monetary policy – Governor Carney said last week that monetary policy has become more “effective” as a result of guidance. Perhaps, but only if you thought the UK was overheating, and this does not appear to be his, or other MPC members’, position.

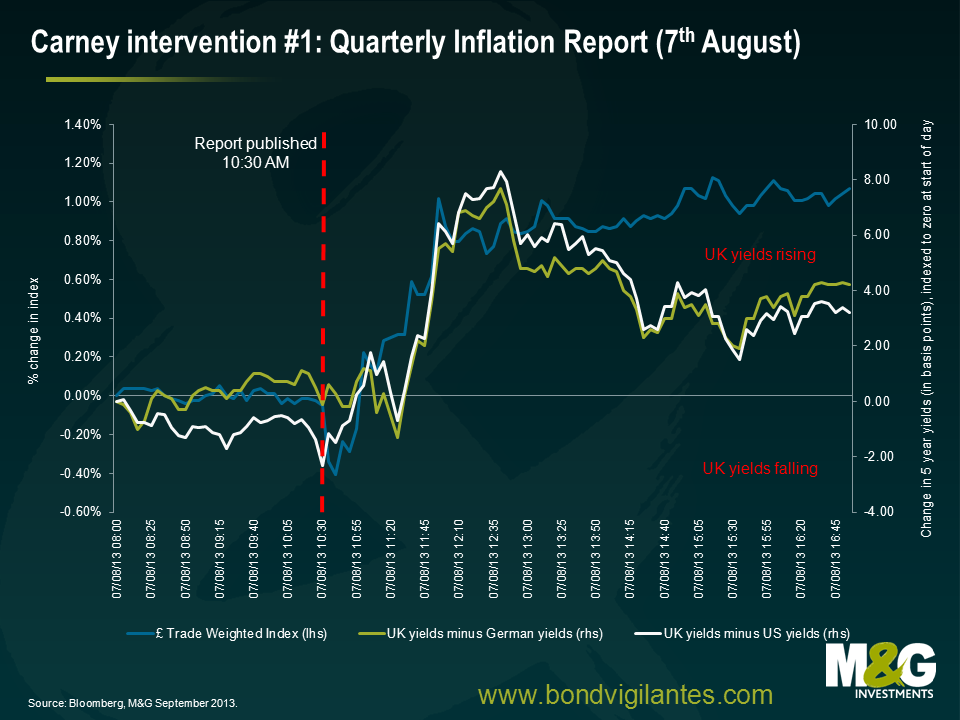

7th August: the Inflation Report is published.

The August Inflation Report contains the forward guidance that the Chancellor commissioned in the Budget. It said that rates would be no higher than 0.5% until unemployment was down to 7%, and that the Asset Purchase Facility wouldn’t shrink. But it contained the three killer knockouts – that you could ignore forward guidance if the Bank’s forecast of inflation rose to 2.5%, if market/consumer inflation expectations became unanchored, or if there were risks to financial stability as a result of low rates. The market focused on these knockouts rather than the unemployment promise. Sterling rallied and gilts underperformed both US Treasuries and German bunds.

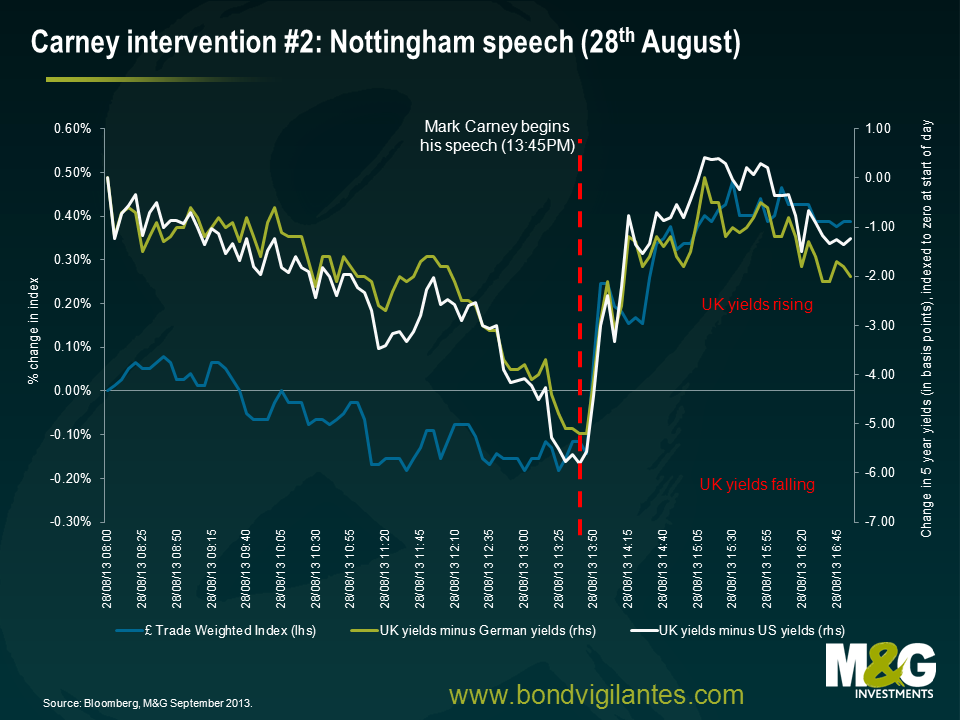

28th August: the Nottingham speech.

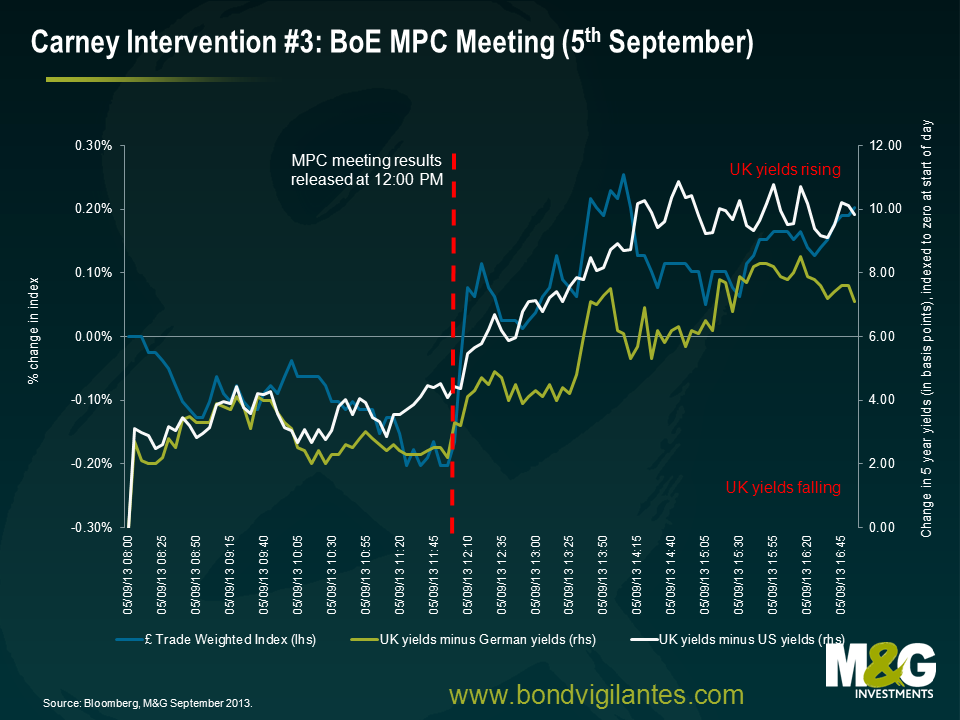

There was no mention of the famous knockouts in this speech and the tone tried to be dovish. But there was a repeat in both the performance of the currency (a rally) and the gilt market (an underperformance). These same trends are also exacerbated when the Bank of England’s MPC makes its “no change” rate/QE announcement on 5th September without any attempt to reinforce the commitment to forward guidance.

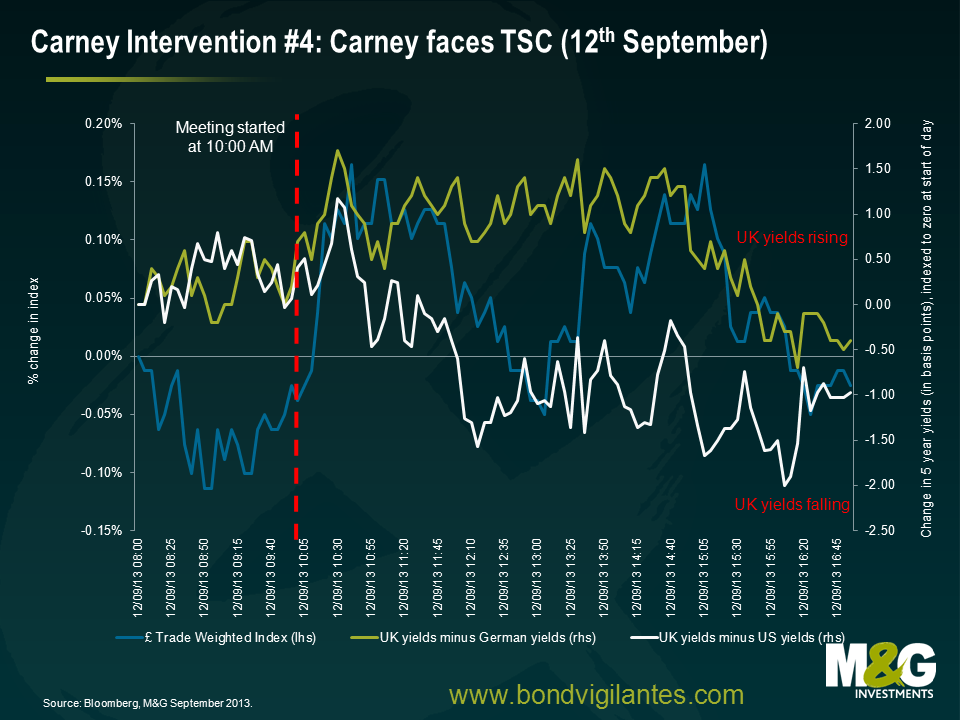

12th September: the Governor and MPC members appear in front of the Treasury Select Committee.

Not so strong this one – there was a reaction initially from sterling, and to a lesser extent gilt spreads. But they weren’t especially long lived.

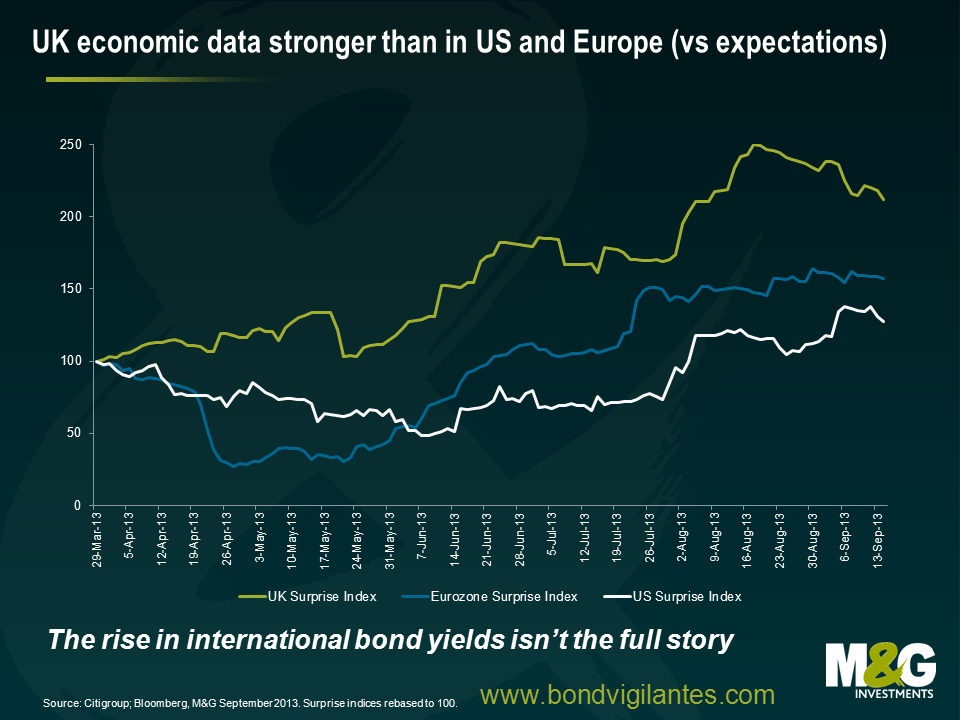

So I have no sympathy for Mr Carney’s view that forward guidance isn’t working because of the adverse movements in the pesky international bond markets – gilts have underperformed both bunds and treasuries, and the appreciation in the pound suggests that the markets think that Carney’s central expectation of three years without a hike is wrong. But in the Nottingham speech, Mr Carney also suggested that another explanation for rising gilt yields is that “the markets think that unemployment will come down to 7% more quickly than the Bank does…that would of course be welcome”. This is credible. We look at economic surprise indices, and it is clear that around the time of the publication of the August Inflation Report, the UK economic data started to not only surprise on the upside, but to be even more upwardly surprising than the (also better than expected) economic data coming out of both the Eurozone and the US. It’s a combination of the lack of clarity around the knockouts (made worse at last week’s TSC – I recommend you go along to watch this live if you get the chance by the way) and an expectation that the Bank’s unemployment forecast is overly bearish. Of course the rise in international yields is important, but it’s not the full story.

So the timing of sterling rallies and gilt underperformance around the time of Bank communications suggests that they ARE getting something wrong, and the grilling in front of the TSC did not go well. If I were them I wouldn’t try to use open mouth policy to try to reverse the trends we’ve seen, as it could lose them more credibility were the markets not to react positively. Doing something is another matter though, and could lead to a big reversal in the gilt and currency markets. As UK economic data improves and surprises on the upside I doubt we’ll see anything yet – but we do need a little less conversation and a little more action.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox