The Fed didn’t taper – what’s next for US monetary policy and bond markets?

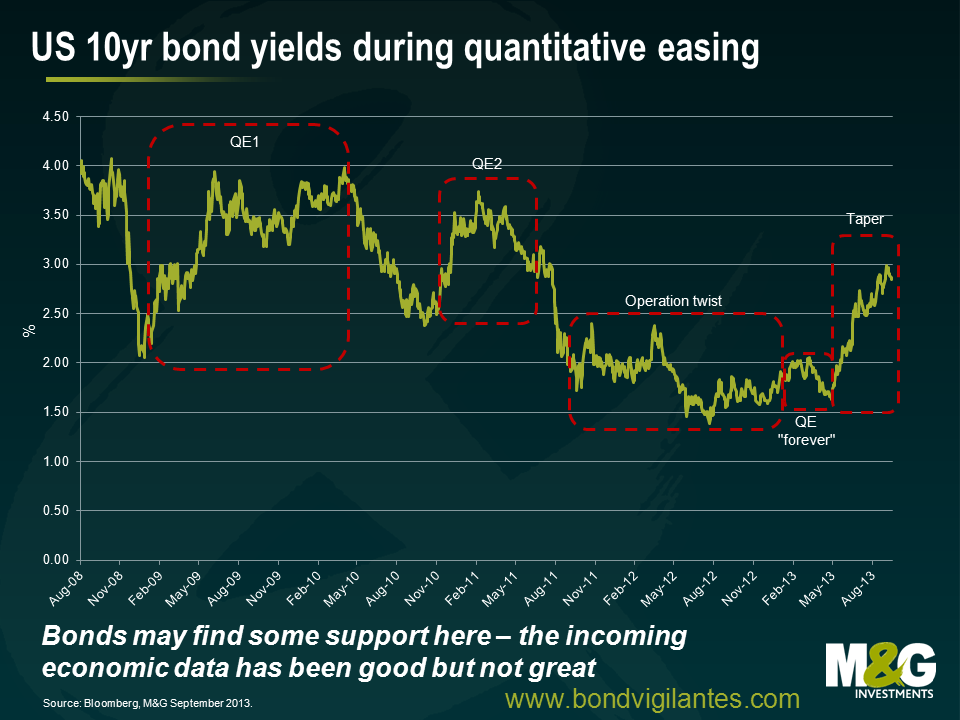

Last night the Federal Open Market Committee (FOMC) delivered a massive surprise by deciding to not taper QE. For us, this isn’t a huge deal. Since May, the market has placed way too much emphasis and concern over tapering and lost focus on the fundamental economic situation that the US has now found itself in – an economy where unemployment has fallen to 7.3% (helped by a falling participation rate) and a central bank that remains dovish due to a declining trend in core inflation. Now we are through the Fed meeting, arguably the market will now re-focus on the economic data. With interest rate policy set to remain very accommodative for a long period of time – even after balance sheet neutrality has been achieved – the sell-off in government bonds may be close to coming to an end (as witnessed by the 19bps fall in the US 10 year yield from 2.89% yesterday afternoon to 2.70% this morning).

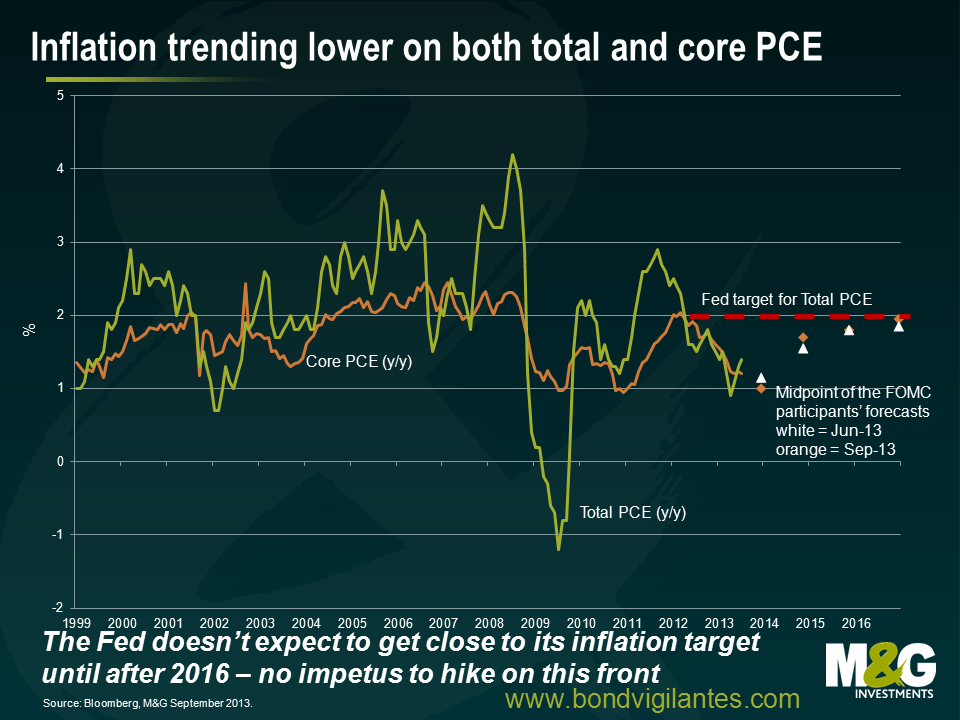

Fed concern number 1: US core PCE inflation is flirting with historic low levels

It is well known that FOMC Chairman Ben Bernanke, a student of the US economic depression of the 1930s, has great concerns about deflation and in 2002 gave a speech outlining how the US could avoid a deflationary trap which gave him the moniker “Helicopter Ben”. In the speech, Bernanke makes the important statement that “…Congress has given the Fed the responsibility of preserving price stability (among other objectives), which most definitely implies avoiding deflation as well as inflation.”

The Fed’s preferred inflation measure, the core PCE, is exhibiting a worrying downward trend. This greatly concerns at least one member of the FOMC – St. Louis Federal Reserve Bank President James Bullard – who believes the FOMC should have more strongly signalled its willingness to defend its inflation target of 2 per cent in light of recent low inflation readings. The Fed minutes from the June meeting (at which Bullard dissented) showed that Bullard believed that the Fed was not doing enough to protect against the threat of deflation and that the FOMC must defend its inflation target when inflation is below target as well as when it is above target.

A key component of the Fed’s dual mandate – price stability – is clearly below where the FOMC wants it to be. There are big risks to reducing stimulatory monetary policy when core inflation is running at recessionary levels and on this measure suggests any interest rate hikes a long way away.

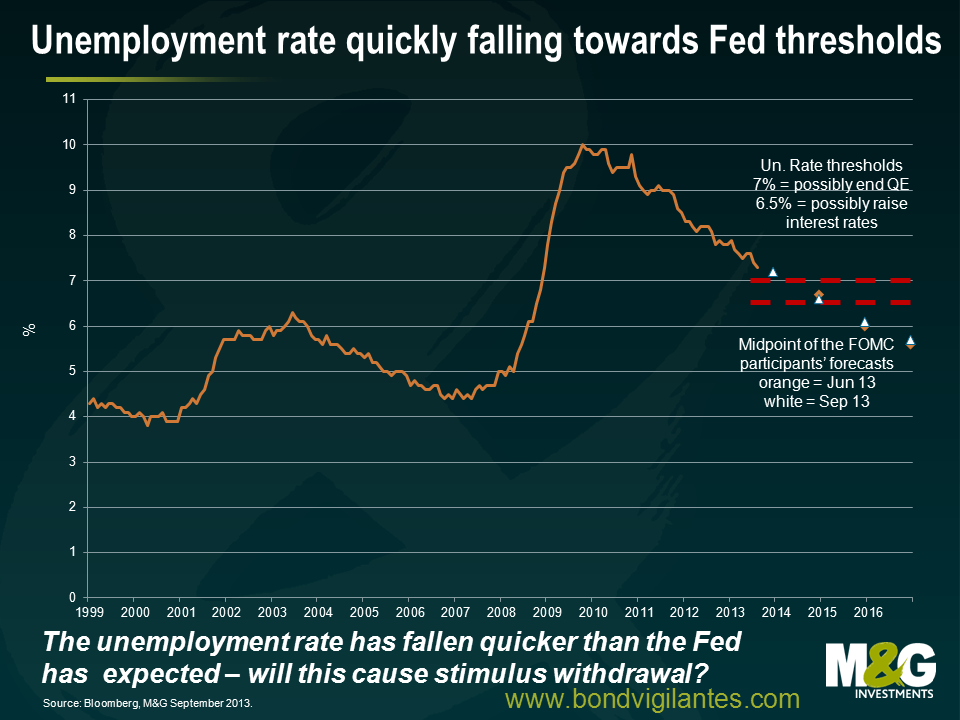

Fed concern number 2: the labour market

The latest payroll report was weaker than market economists had become used to, with payroll growth averaging around 148,000 over the past three months. This is some way off the 200,000+ numbers that the consensus was expecting earlier in the year and confirms a deceleration in the trend in nonfarm payroll growth. Yes, the unemployment rate fell to 7.3%, but this was largely the result of the labour force shrinking and a decline in the participation rate in August. The labour market is not as strong as the headline number suggests.

Arguably, the fall in the unemployment rate has surprised most Fed members. Nonetheless, unemployment is not expected to fall to the 6.5% “think about raising interest rates” level until late 2014. It would have been a confusing message to start to implement tapering given the lower trend in job creation. The Fed reiterated that the economy and labour market have to be strong enough before in contemplates reducing asset purchases going forward. This helps to explain why the FOMC sat on its hands in September.

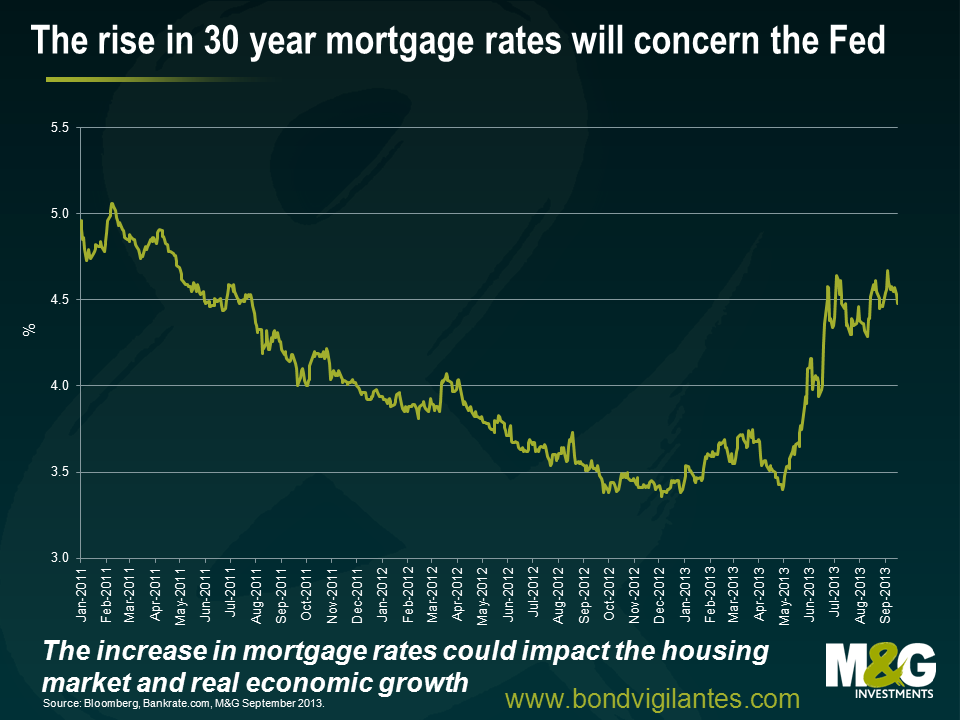

Fed concern number 3: the increase in mortgage rates

Following the moves in markets over the summer, the average rate for a 30-year fixed mortgage has now increased to around 4.5% from 3.4% in May. Essentially, the market has already tightened for the Fed. The housing market is a vital component of US economic growth, and this increase will cut into housing affordability. It could also force potential homebuyers out of the market. A slowing housing market means fewer jobs, less consumption, and lower growth. The increase in yields in the government bond market has been brutal, and does pose some risks to interest-sensitive sectors.

Given the above, it appears that the Fed refused to be bullied into tapering today by the bond markets, though tapering speculation may have reduced the “froth” that had developed in risk assets over the first half of 2013. It is likely that low inflation, a recovering labour market, and a slowing housing market will ensure that interest rate policy remains accommodative for the foreseeable future. The “Fed fake” suggests that tapering is truly data dependent and not predetermined. Macro matters.

As the market begins to refocus on the economic data, it is likely that government bonds may find some support. Additionally, the FOMC may reduce bond purchases slower than anyone currently expects. We expect that market concerns over the impact of tapering decisions will likely diminish over time as the Fed slowly and gradually moves towards a neutral balance sheet policy next year.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox