Equity multiple expansion to the rescue. A benefit to high yield ?

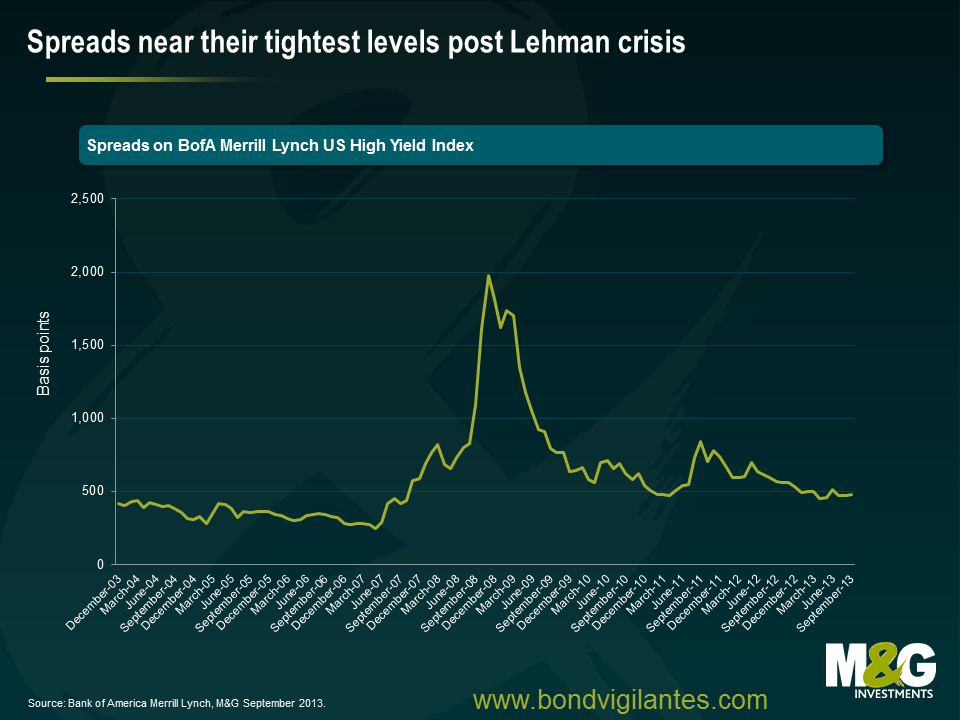

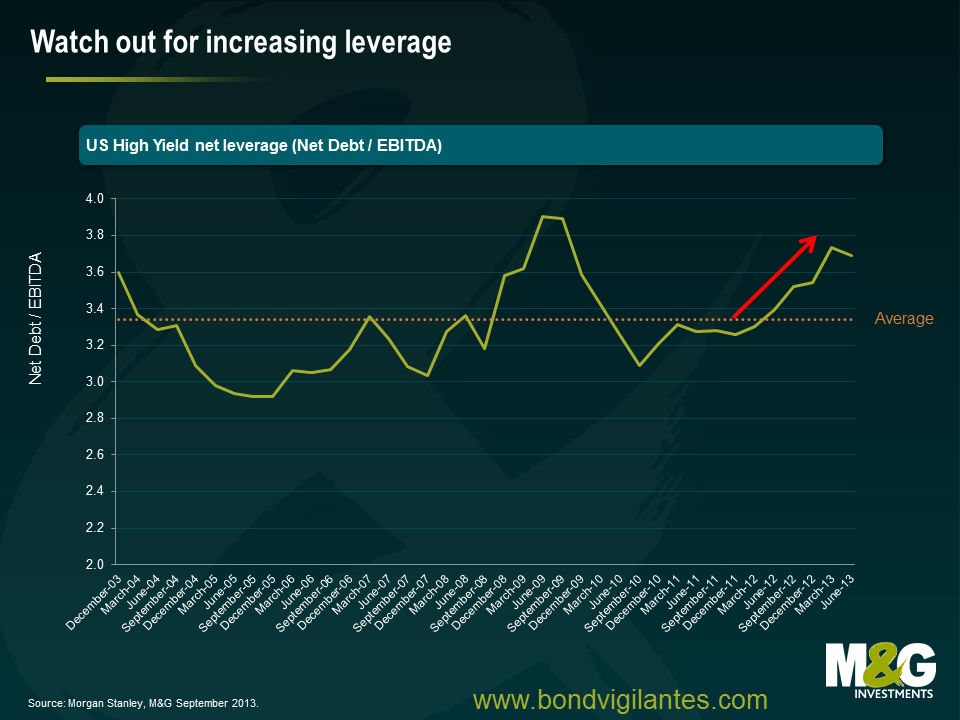

The high yield market rightly pays a good deal of attention to leverage trends (the relationship between debt and earnings). The larger the quantum of debt a business carries relative to its earnings, the greater the risk. Other metrics are arguably as important, though it is the leverage metric that consistently garners the lion’s share of attention. With spreads near the post Lehman tights, it is unquestionably concerning to see a trend of rising leverage as earnings plateau and companies generally take on more debt.

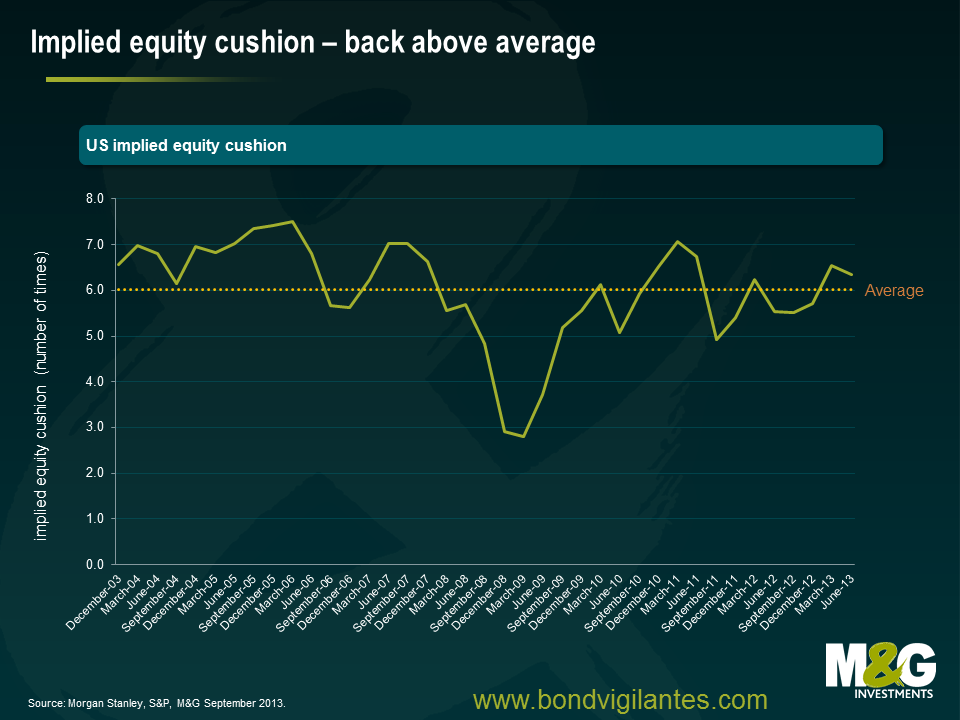

The very same central bank policies that have kept bond yields low and encouraged high yield companies to take on more debt have also helped to support higher equity prices. As money has flooded into the asset class, the market has not surprisingly re-rated upwards. What this has meant for high yield investors is that one measure of the ‘margin of safety’, or an equity cushion has, at least temporarily, been increased. The chart below shows the implied equity cushion by subtracting the average level of US high yield leverage from the S&P Mid Cap trailing 12 month enterprise multiple. The higher the implied cushion the better. So for example with stock markets at the lows in early 2009, the implied equity cushion fell to a mere two turns, but has since recovered to a far more healthy and above average six.

Many will no doubt point out that an implied cushion is exactly that- implied. And the argument is clearly a pro- cyclical one that relies on an imperfect comparison. We’d concur with that and emphasise the fact that there can be no substitute for thorough credit analysis. We will always prefer to invest in appropriate financial leverage, strong interest coverage and free cash flow generation over equity implied multiples. The former gives a business flexibility and exposes it less to market vagaries.

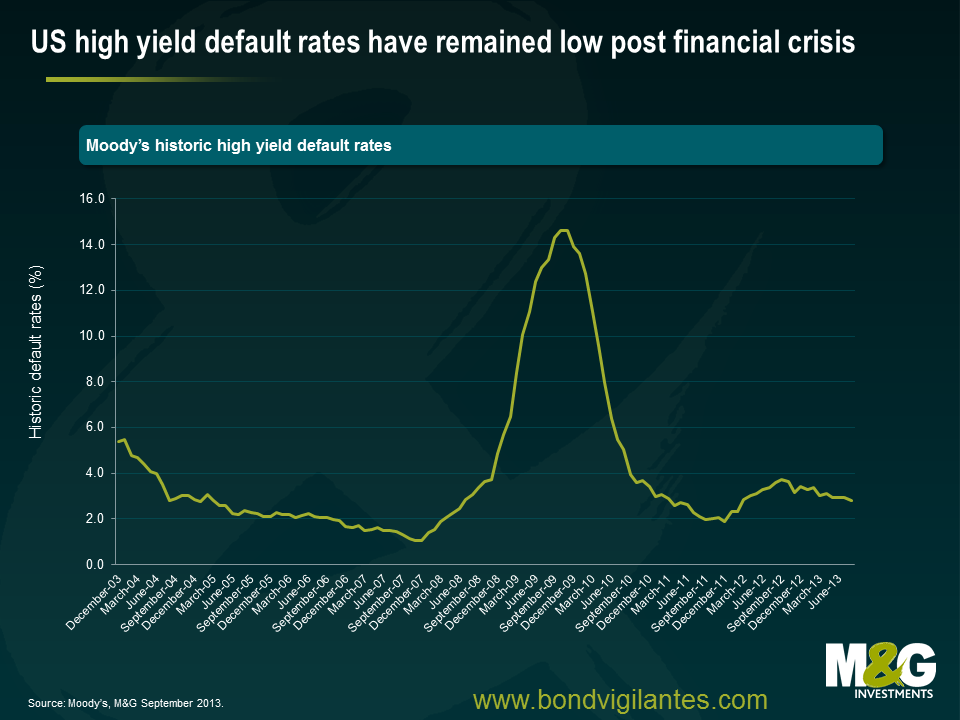

Yet there is no getting away from the fact that central bank policy has, and can still yet, come to the rescue of even some of most levered high yield companies. In hindsight, few of us would have predicted the surprisingly low level of defaults we’ve witnessed through this cycle. And whilst IPOs of high yield companies has been a fairly rare thing over the last few years, higher equity multiples, an on-going return of animal spirits and a desire/need to put money to work may yet alter that trend.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.