A quick look at Asia: corporate fundamentals and credit tightening

As Mike just reported, we remain concerned with a number of internal issues as well as external vulnerabilities facing emerging markets. With economic growth fuelled by excessive credit growth, deteriorating current account balances and potential contagion risk if the Fed tightens monetary policy (leading to capital flows back to the US and Europe), another big sell-off can certainly not be ruled out. Combining the above with what are now fairly unattractive valuations, the overall macro EM story continues to be a none too compelling one for us.

However, what do we think of the situation at the company level? As a counter-argument to our cautious macro-economic outlook, a number of EM companies possess solid balance sheets despite their home country’s economies often being stuck in quicksand. Why not invest in solid EM-based multinationals if they have strong balance sheets, solid cash flows, sizeable global market share in their segment and an ability to diversify their revenues internationally? Let’s take a closer look.

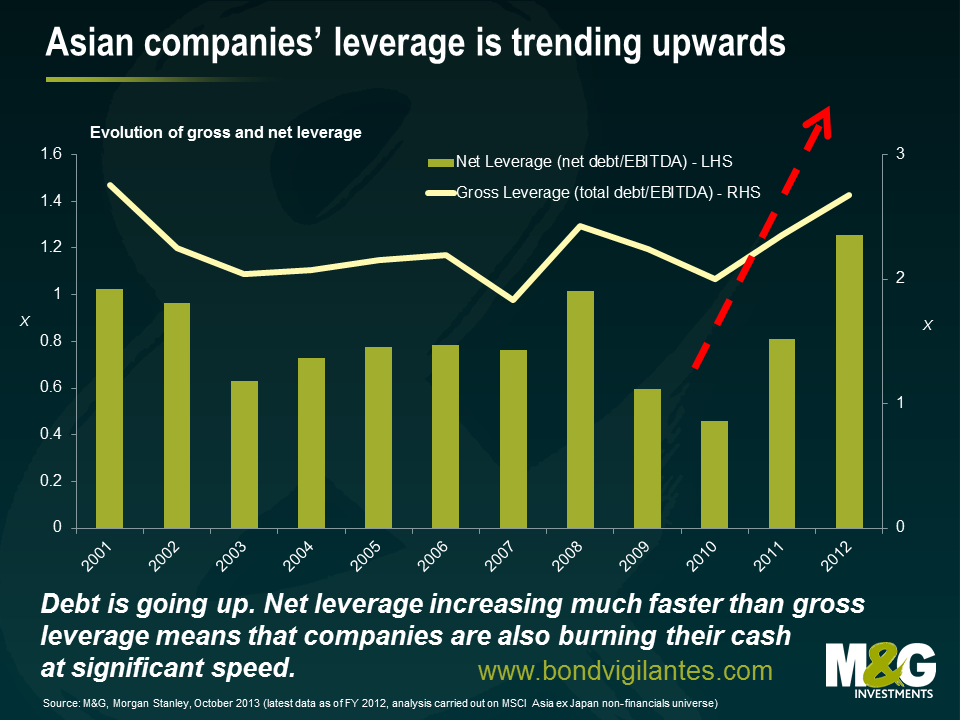

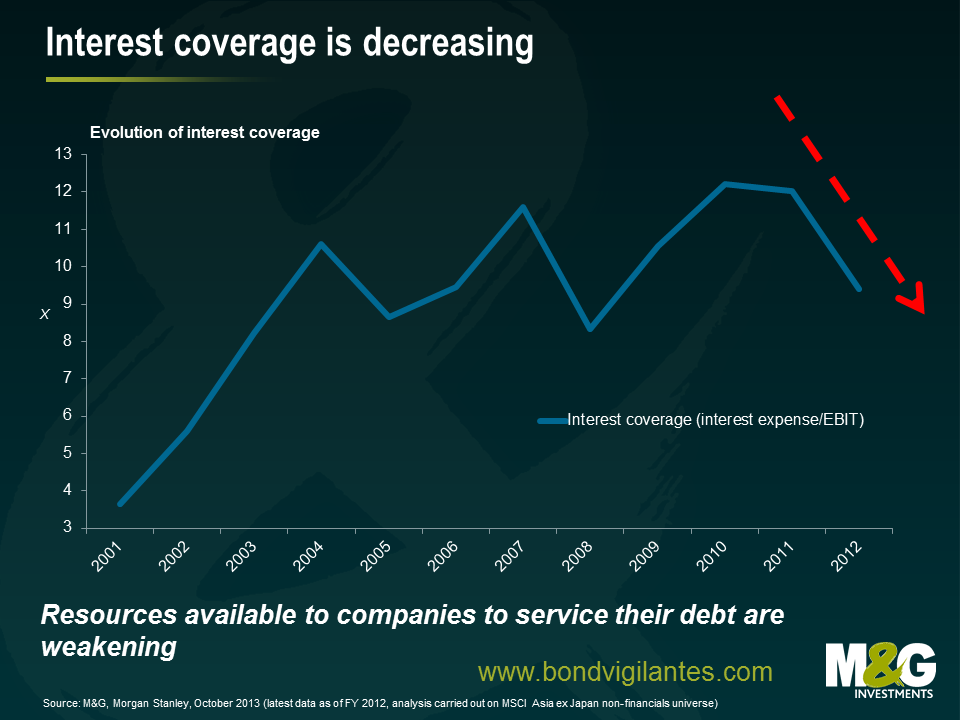

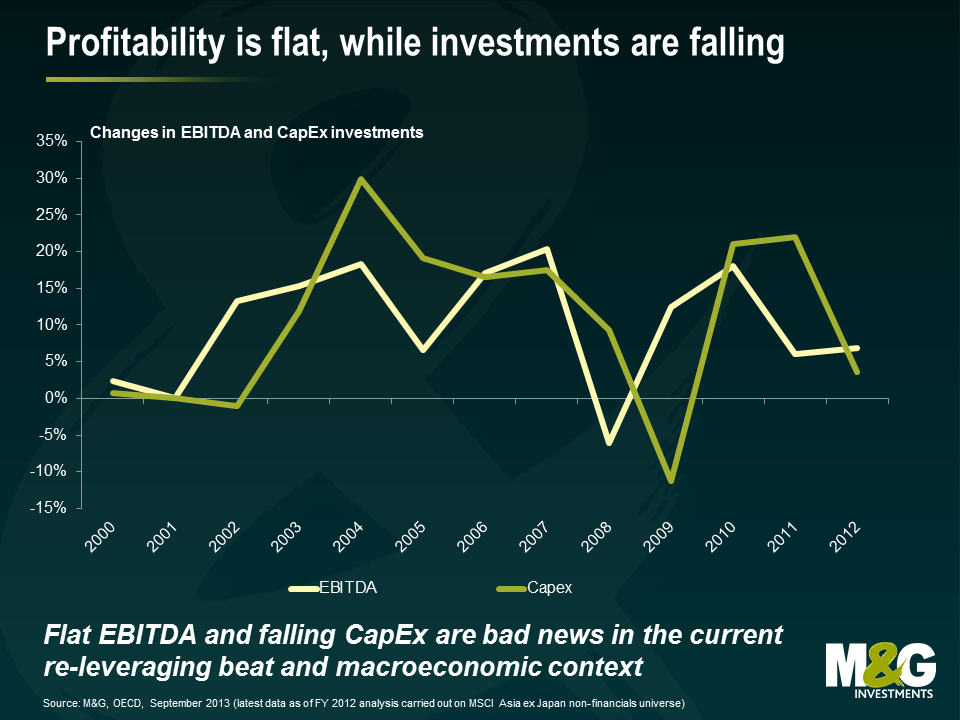

Focusing on the Asian corporate world specifically, this last “stronghold” seems to be collapsing as corporate fundamentals have sharply deteriorated. A worsening economic outlook, slower growth and tighter credit availability from the banking system will create challenges. Leverage has picked up as companies have both taken on more debt and burnt cash (a trend most evident in high yield issuers compared to investment grade). A number of Asian corporates have leveraged up in foreign currencies (mainly USD) while having revenues in local EM currencies, thus becoming increasingly vulnerable (where FX is not hedged) to a potential strengthening of the US Dollar. Operating margins (EBITDA) are flat, and capex has sharply decreased. While reduced capex may be good news for creditors in the short term (other things being equal) as more resources become available to pay back debt, it is not a great foundation to build a company’s future: how do you sustain a business over the long term if you don’t invest? On the other side of the coin, this trend of reduced capex does at least provide some evidence of emerging balance sheet discipline after years of easy credit.

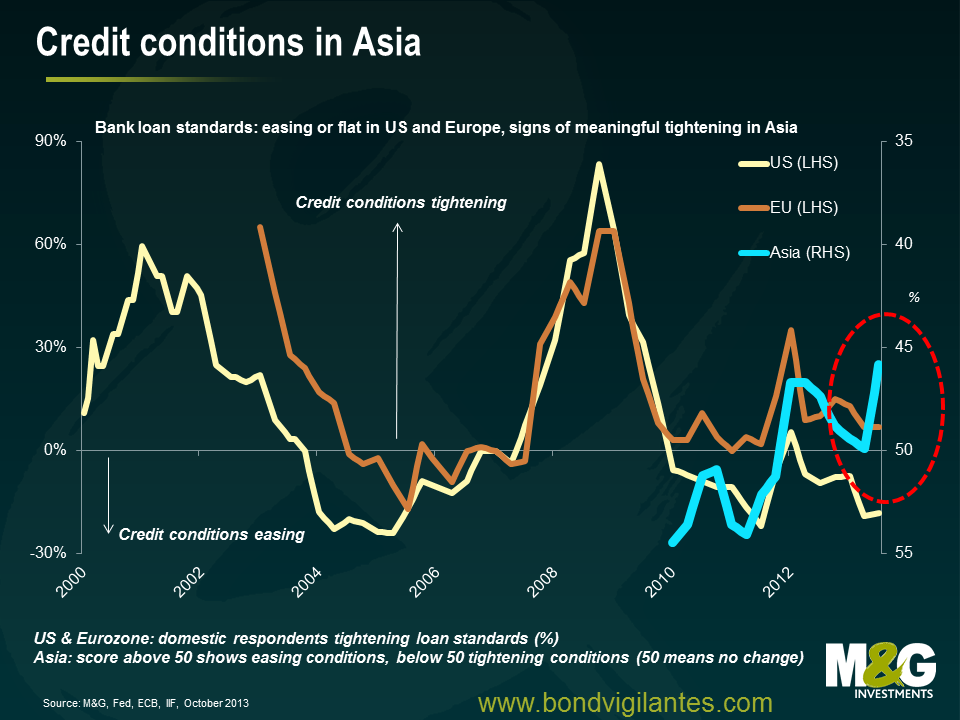

Across EM as a whole, bank loan growth has been broadly unaffected by the crisis in the summer. It was running at a pace of USD 160bn per month in July and August (according to JP Morgan data), the same rate as earlier in the year. However, looking at Asia specifically this is not the case. Despite financial conditions still being in accommodative territory (apart from India and Indonesia, no other Asian EM has hiked rates since mid-2011) a problem of over-leverage – driven by China – is pushing a number of Asian banks to close their wallets. Credit availability via official bank loans (and importantly the shadow banking system in China as well) has not been an issue so far, but corporates will have to rely on bond markets to a greater extent going forward. However, will domestic and international bond investors support deteriorating balance sheets in weakening economies? If not, we should expect to see more defaults next year, bearing in mind that Asian high yield defaults have already increased from an annual rate of 0.8% in early 2013 to 1.8% recently.

Is it only bad news then? Not entirely. Some EM companies will benefit from a stronger USD (exporters specifically) as they will gain competitiveness through being able to offer cheaper goods to the US and Europe, which are expected to grow in the coming years. Also, company specific factors including improving liquidity, stronger cash flows and stabilising balance sheets, especially in the investment grade space, may mitigate some of these concerns. And at the end of the day everything has a price in the market. We think many of the concerns we have highlighted here have been priced in to a certain degree, and while EM corporate spreads have compressed back toward US and EUR corporate spreads since the end of August, they remain well off the pre-May levels. Stock-picking and a clear differentiation between good EM and bad EM, good companies and bad companies, will be the main determinant of performance next year.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox