Eurozone inflation surprises to the downside. ECB will grudgingly be forced to cut rates.

Last week saw year-on-year core inflation in the euro area fall from just over 1% in September to a two year low of 0.7% in October (see chart). Such a level is entirely inconsistent with the ECB’s definition of price stability as inflation “below but close to 2%”, and will likely be met with a downward revision to medium term inflation prospects and with it an ECB rate cut later this year.

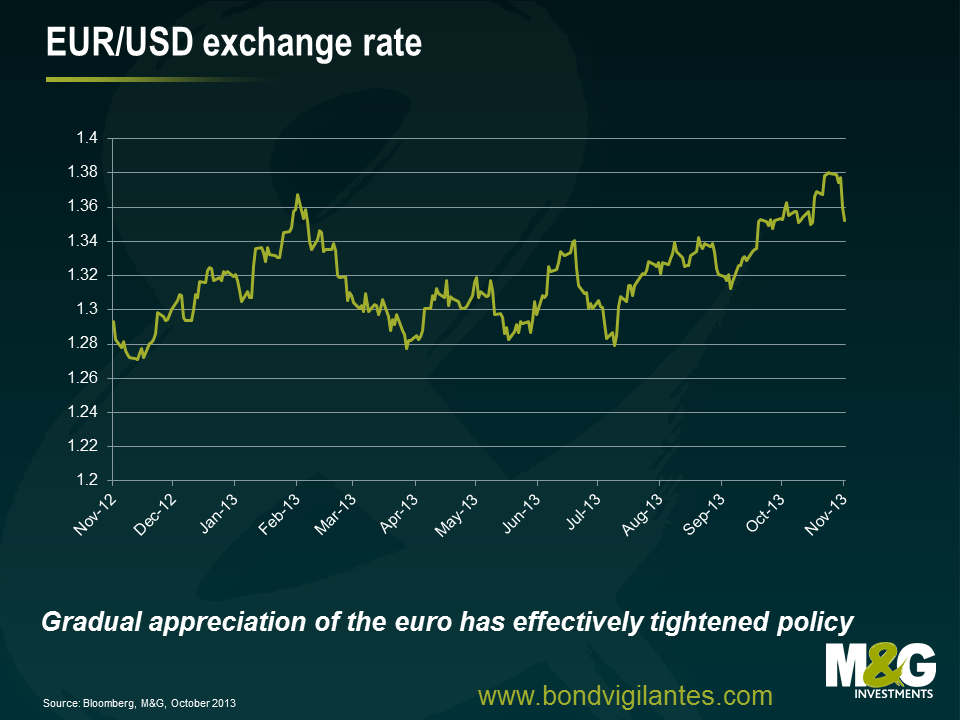

The ECB will no doubt have monitored the recent steady appreciation of the euro (see chart), which has effectively acted as a tightening of policy and will likely have a disproportionately negative effect on the periphery. Coupled with the latest inflation data, the strengthening of the euro will no doubt increase calls from the doves on the Governing Council (who should be acutely aware of the rising risks of a Japanese-style deflationary trap) to run a more stimulative policy.

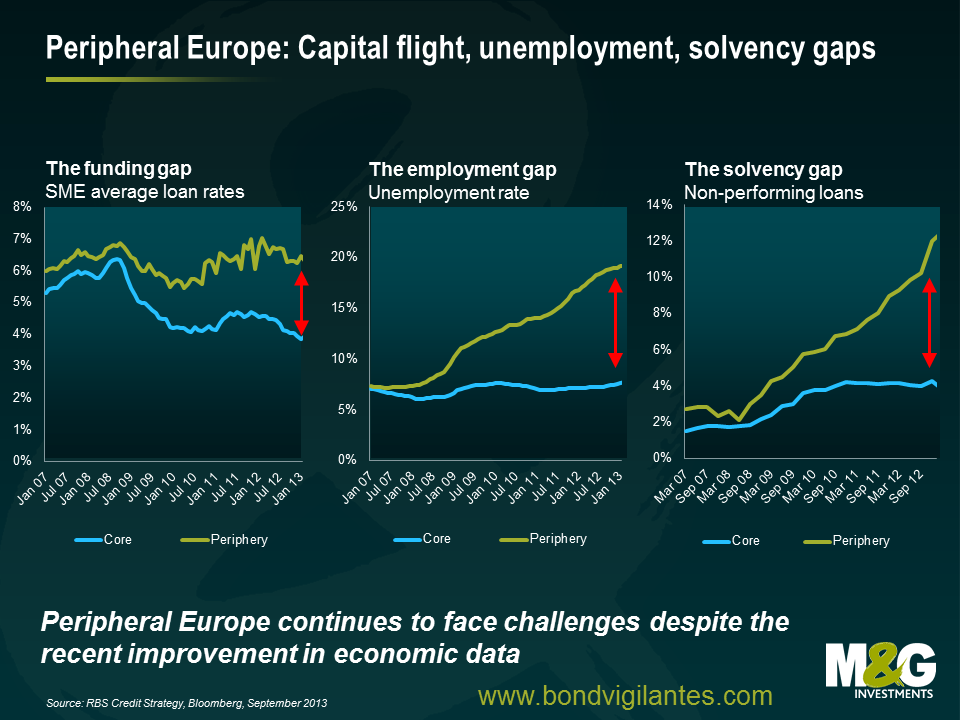

With little evidence of upward pressure on German wages, the internal devaluation required within the eurozone to facilitate a more competitive and balanced economic area has also been dealt a blow. Richard recently noted an improvement in euro area funding costs, and with it a stabilisation of broader economic data. However, this is from a very low base and the challenges that Europe continues to face should not be underestimated. Both unemployment and SME funding costs remain stubbornly high in the periphery and non-performing loans continue to move in the wrong direction (see chart). The ECB understandably wants to maintain pressure on politicians to deliver on structural reforms, and no doubt some harbour fears of leaving fewer policy tools at their disposal once they cut rates towards zero, but the risks of medium term inflation expectations becoming unanchored to the downside should be a wakeup call and a call to action!

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.