A Fed taper is on the table

The FOMC took markets and economists by surprise in September this year when the committee members decided to hold off from tapering and maintain its bond-buying programme at $85bn per month. Three months down the road and the consensus for the December meeting outcome is that the Fed will not reduce the pace of MBS or treasury purchases. Consensus has been wrong before; will it be wrong again tomorrow? We think it will be a closer call than many expect.

In our opinion, there are several good reasons for the Fed to taper very slowly. Firstly, inflation is a non-issue, below target and close to lows not seen for decades. Secondly, the 30 year mortgage rate has risen from 3.5% in May to around 4.5% today, impacting US housing affordability and already tightening policy for the Fed. Thirdly, there is continued concern that 2014 may bring a return of the political brinkmanship that characterised late September, with the US Treasury signalling that the debt limit will have to be raised by February or early March to avoid default. Ultimately, the Fed is nowhere near hiking the FOMC funds rate.

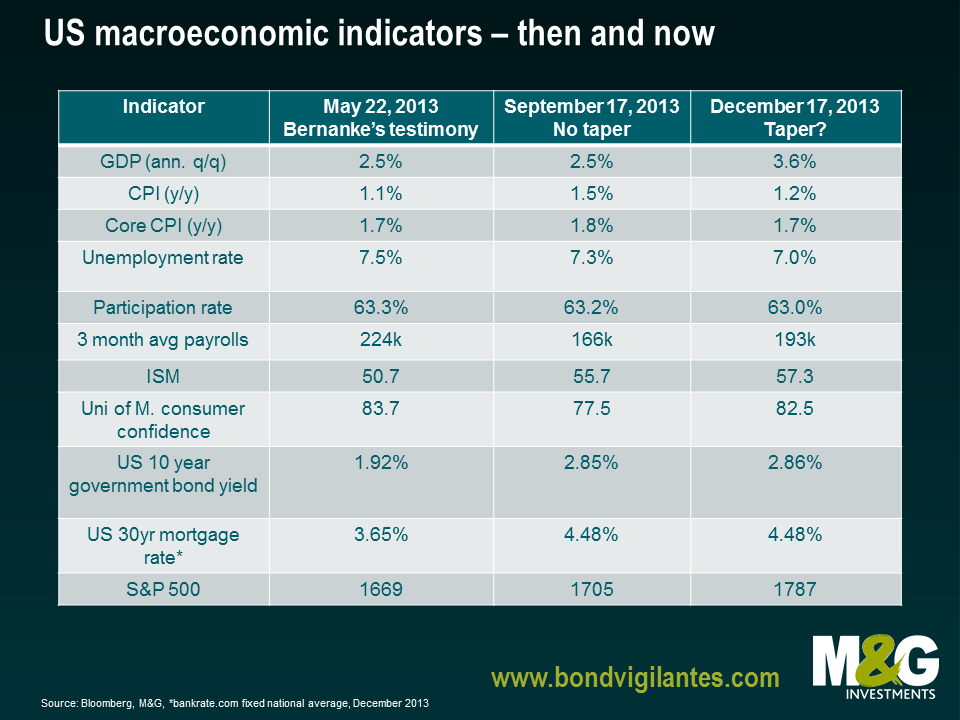

There is no doubt after the September decision that tapering is truly data dependent and in this sense, macro matters. Fortunately, Ben Bernanke has told us what economic variables he and the FOMC will be looking at a press conference in June. The Fed wants to see a broad based improvement in three economic variables – employment, growth and inflation – before reducing the scale of bond buying.

The table below shows that the data has improved across the board. Annualised GDP is stronger, the unemployment rate is lower and the CPI is only 1.2%. Other key leading economic indicators like the ISM and consumer confidence are higher while markets are in a remarkably similar place to where they were three months ago with the 10 year yield at 2.86%.

After the surprise of September’s announcement, we believe that every FOMC meeting from here on out is “live” – that is, there is a good chance that the Fed may act to reduce its bond-buying programme in some way until it reaches balance sheet neutrality. A reduction in bond purchases is not a tightening of policy, we view it as a positive sign that policymakers believe that the US economy is finally healing after the destruction of the financial crisis. As I wrote in September, interest rate policy is set to remain very accommodative for a long time, even after balance sheet neutrality has been achieved.

Given the positive developments in the US economy over the past three months, the December FOMC announcement could announce a) a small reduction in bond buying and b) an adjustment of the unemployment rate threshold or a lower bound on inflation. Whatever the case, quantitative easing is getting closer to making its swansong.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox