Bundesbank: no deflation in sight. Really?

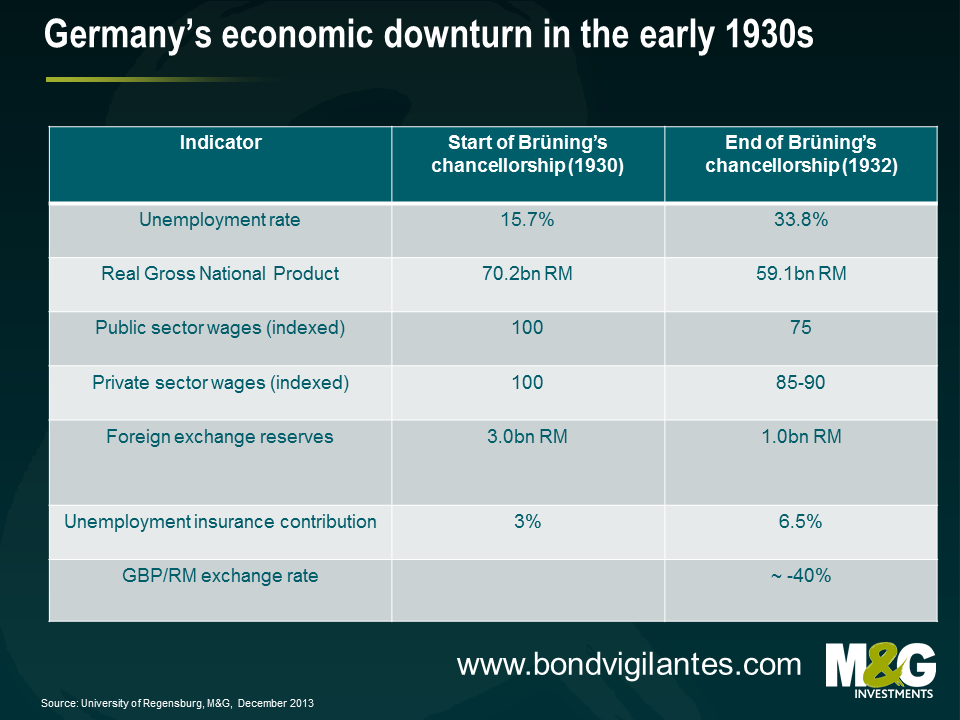

Today I came across an article in which the Bundesbank took the festive season as an opportunity to discuss if all the Christmas sales discounts are going to turn into a permanent phenomenon for the Eurozone. “No deflation in sight” (in German) concludes that the Eurozone is unlikely to experience continuously falling prices, ie deflation. The Bundesbank does however identify some parallels between today and the 1930s – the last period of deflation in Germany. The Bundesbank attributes the current disinflationary trend in the Eurozone to the austerity imposed on the peripheral economies. It is striking that this line of argument offers the opportunity to draw some historical parallels. In the early 1930s, chancellor Brüning’s retrenchment policies (in form of emergency decrees) in response to the global economic crisis and the perceived lack of German competitiveness included severe wage cuts for civil servants, public sector job cuts, reduction of pension payments and entitlements as well as higher income taxes. These policies marked a period of severe economic downturn and deflation with major historical consequences.

However, the Bundesbank seems to take some comfort out of the fact that the deflationary experiences in the periphery have not been as severe as in Germany in the 1930s and not sufficient to drag the entire Eurozone into a deflationary spiral so far. The German central bank anticipates that the austerity measures will show their positive effects on the peripheral economic competitiveness soon which should pay off in form of a return to modest economic growth in 2014 and 2015. While the high unemployment rates in the Eurozone, and in the periphery in particular, will continue to ease any inflationary pressure, the paper concludes that the pickup in economic activity will provide an anchor to the downside. In other words, the worst is over, and that’s why there is no deflation in sight. SocGen’s Sebastien Galy critically points out that the Bundesbank bases much of its analysis on the assumption of a strong positive correlation between growth and inflation which historically has not always been evident and doesn’t seem to be consistent with the trend of disinfloyment that the US is currently experiencing.

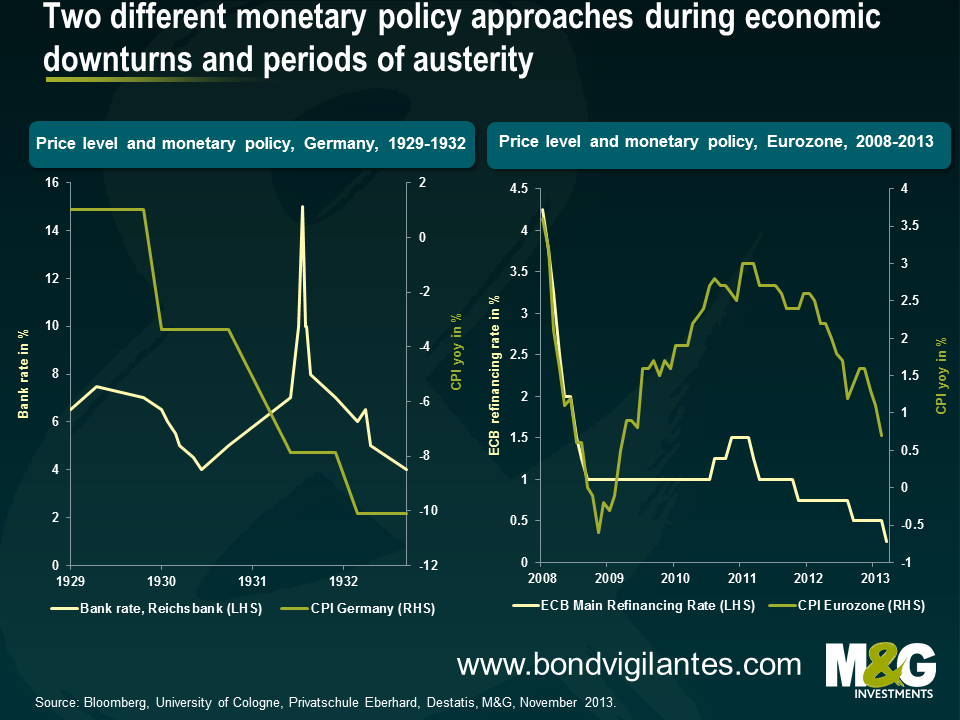

The Bundesbank also sees the deflation risk contained in the Eurozone as the ECB’s monetary policy response is very different to the 1930s. Back then, the economic downturn was aggravated through the monetary policy response of the Reichsbank. As the chart above shows, the central bank kept interest rates at a very high level which led to unbearable financing costs in the real economy and suppressed credit growth further. The reasons for this policy approach were certainly very complex, but, without delving too deep into any academic debate, it seems that the German room to manoeuvre might have been restricted by the Young Plan and that the shock of hyperinflation in the 1920s built a psychological barrier to loose monetary policy. The Bundesbank article points out that today’s monetary response by the ECB is very different. Today’s historically low ECB refinancing rate of just 0.25% is a reflection of the ECB’s very expansive monetary policy approach in response to the Eurozone crisis and is, therefore, providing another anchor of price stability, i.e. reducing the downside risk of deflation.

However, the psychology of deflation doesn’t get sufficient focus by the Bundesbank in this particular article in my view. The authors touch upon the concept of inflation expectations and their impact on consumption behaviour (if you expect prices to go down, then you delay purchases which puts further downward pressure on prices), but don’t go into much detail. As the latest M&G YouGov Inflation Expectations Survey showed, expectations were still well-anchored in November, but on a declining trend across Europe, and it will be interesting to see how inflation expectations have adjusted considering that recent data showed that not only did the periphery experience real wage declines in the third quarter, but German workers also saw real wage declines for the first time since 2009. This is certainly a surprising, if not worrying trend with regard to both disinflation and the Eurozone rebalancing efforts.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox