The year of the Snake – 2013 returns in fixed income markets

2013 has offered another injection of both adrenaline and performance to fixed income investors. A rapid sell-off shook emerging markets just before the summer while the Fed was conducting a “tapering yes/tapering no” ballet that lasted for more than six months. European peripheral countries finally came out of recession, although unemployment levels remain alarmingly high. In parallel, global high yield markets delivered further stellar performance, while Japan started to feel the effects of the unprecedented monetary and fiscal revolution driven by Shinzō Abe.

However, a common theme clearly emerged: the developed economies appear to be finally growing at a reasonable pace. Markets largely normalised as volatility and correlations returned to pre-crisis levels. While central bank intervention (set to continue for some time) has been the mantra in a liquidity driven environment, the world is transitioning back towards a growth based model. The US is well positioned to lead the pack, although high debt levels in Europe may continue to leave governments with limited room to support the recovery via fiscal stimulus. However, the good news here comes from a healing and deleveraging banking system, as well as rock solid support and a clear accommodative stance by the ECB and its leader Super Mario Draghi.

In this context, many fixed income asset classes offered satisfactory returns. Which assets have been top performers? The results are surprising. Who would have said, back in January 2013, that – together with a new Pope from Argentina, China landing on the moon and an economic bailout in Cyprus – Spanish “Bonos” would have offered total returns in excess of 11% YTD, for example? Let’s take a closer look at government bonds, corporate bonds and major currencies compared to the US dollar (all total return YTD figures are measured from 31 December 2012 to 17 December 2013 in local currency).

Government bonds

Risk-free government bonds have been negatively affected by expectations over rising rates and tapering uncertainty. The UK gilts index – with an average duration of over 9 years – has been the most negatively hit, followed by US Treasuries (5+ years duration) and finally by less volatile German bunds (6+ years). It was a different story for some countries in the European periphery, where Greek government bonds offered tremendous total returns above 50%, followed by Spanish and Italian sovereign debt. Following the May debacle, emerging market government bonds in hard currency (measured by the commonly used JPM EMBI Index) took a significant hit and offered a negative return below 6%, despite a decent rebound after the summer, while the local currency index (JPM GBI-EM) looks set to end the year broadly flat (while once translated in USD, it is negative by around 8%)

Following 2012’s fall from grace for linkers, due to both falling inflation expectations and very low inflation in Europe and US, 2013 has continued to see the US, European and EM markets negatively affected while the UK market is about to close in a marginally positive territory thanks partly to the decision to maintain the link to RPI earlier this year (here’s a blog from Ben on the topic).

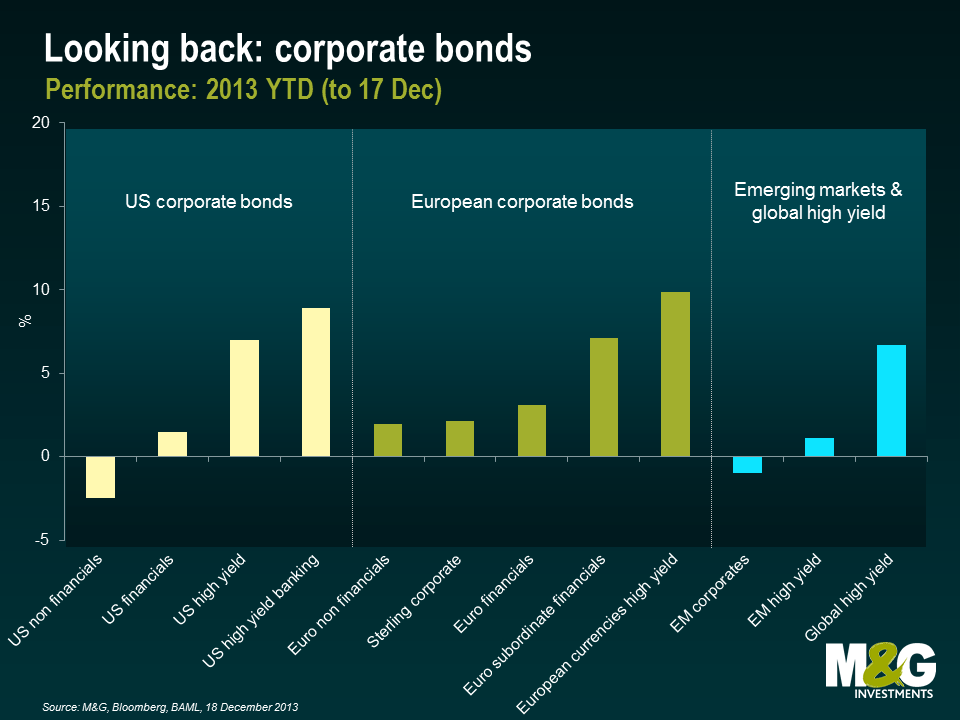

Corporate bonds

A great degree of value over the past year was to be found in corporate bonds. Companies are benefitting from the broad-based economic recovery around the developed world and from the subsequent increase in consumer demand (higher consumption = higher corporate revenues) and public investments. A conservative management of financial resources and balance sheets by bond issuers on average (especially in Europe), improving economic prospects, forward guidance on interest rates and a low inflation environment have all supported the ride of corporate bonds. Names active in the high yield space – especially in the US and Europe – have been amongst the standout performers within credit. Financials have also had a very strong run, especially in the subordinate space, helped by a healthy investor demand for higher yielding and more cyclical paper, as well as a general financial deleveraging process that is going in the right direction to restructure their balance sheets.

Performance highlights include European high yield (+9.9%), European subordinated financials and US high yield banking (+7.1% and +8.9% respectively) and an overall good showing from BBB non-financial corporates in Europe (+4.4%, to compare against -0.8% in the US). Emerging market corporate debt was in negative territory overall (-1.0%), while the high yield portion was marginally positive (+1.1%).

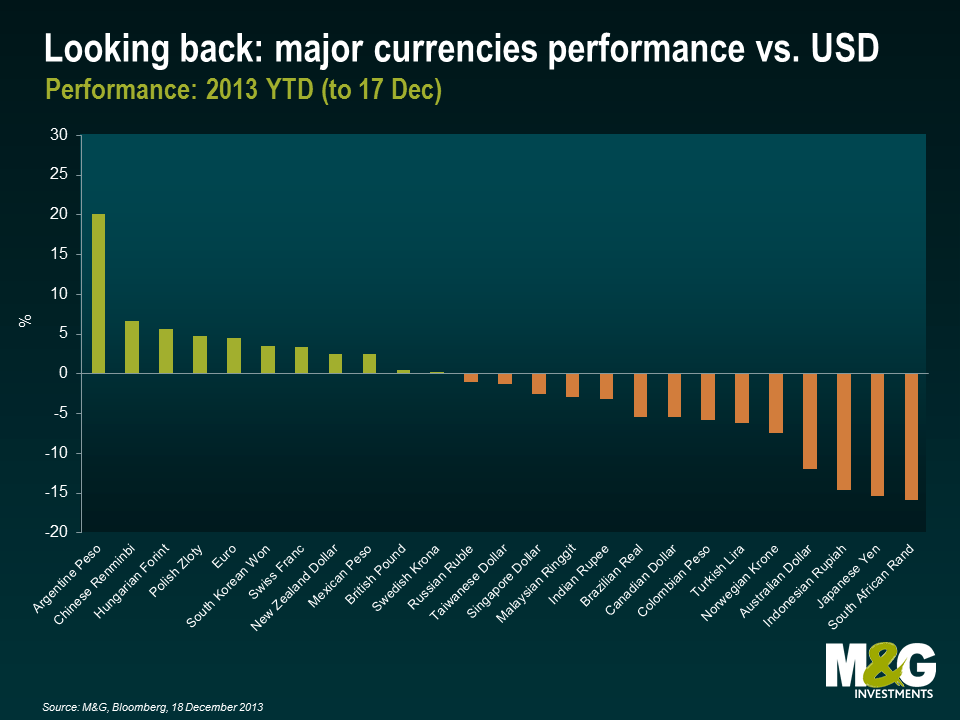

Currencies

The most noticeable development amongst major currencies has been a general lack of excitement around the US dollar from global investors, probably due to the ongoing tapering tantrum together with fears around the US fiscal cliff and the recent government shutdown. The USD index (DXY in Bloomberg) has generated a rather lacklustre performance of +0.4% YTD. We need to make a clear distinction between two separate trends this year: the index generated positive returns for around 6% between January and early July, while it lost ground in the second part of the year (around -5.6%) due to uncertainties around the US government shutdown and Fed’s decision to maintain loose monetary policy. However, today the US economy is growing, its current account deficit is decreasing, the nation is moving towards energy independence, and Fed policy is now clearer following its tapering announcement on 18 December: we strongly believe that US dollar is good value and is set for a strong rebound.

Amongst G10 currencies, the Euro and GBP have gained significant value over the USD in recent months. Thanks to surprisingly strong economic developments in both the UK and the Eurozone, sterling and the euro have been amongst the best performing global currencies between March and December. Stay tuned on the British pound, because the UK’s 5.1% current account deficit in Q3 is the 3rd is the worst in UK history (and worse than Indonesia, India and Brazil). This suggests that there is no sign of the UK economy rebalancing and the UK’s economic recovery in its current form is nowhere near as sustainable as the US recovery.

The Japanese Yen has lost significant value (-15.4%) versus the US dollar due to the fresh efforts of the Bank of Japan to create inflation (and nominal growth) in the country. Some emerging market currencies offered strong performance, including the Argentine peso, Chinese Renminbi, Hungarian Forint, Polish Zloty, and Mexican peso, but the majority of EMFX has underperformed the US dollar, notably the Brazilian real, Indonesian Rupiah or South African rand, with the latter being the only currency to return less than the Yen at the time of writing.

In conclusion, who would have expected such an interesting ride for fixed income asset classes this year? What is going to happen in 2014? Will next year be a negative or positive one for financial markets, and fixed income specifically? Read our latest Panoramic here and continue to stay tuned to this blog, explore recent posts (here from Ben, here from Mike and here from myself) and read more in the upcoming weeks.

Before saying goodbye, let me ask you something related to the Chinese calendar. The Year of the Snake, which began on 10 February 2013, will be over at the end of January 2014. In the Chinese zodiac, the snake carries the meanings of cattiness and mystery, as well as acumen, divination and new beginnings. Do you see any fit with 2013? The new year of the Horse will start on 31 January 2014. The horse is considered energetic, bright, warm-hearted, intelligent and able. Any hint? Good luck and happy 2014!

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox